ADT 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

correspond to a number of funds in the Company’s 401(k) plans and the account balance fluctuates with the

investment returns on those funds. Following the Separation, the Company maintains its own standalone SSRP

for eligible employees. Deferred compensation liabilities were $17 million and $16 million as of September 26,

2014 and September 27, 2013, respectively. Deferred compensation expense was not material for fiscal years

2014, 2013 and 2012.

9. Share Plans

Incentive Equity Awards Converted from Tyco Awards

Prior to the Separation, all employee incentive equity awards were granted by Tyco. On September 28,

2012, substantially all of Tyco’s outstanding awards were converted into like-kind awards of ADT, Tyco and

Pentair. The conversion of existing Tyco equity awards into ADT equity awards was considered a modification

of an award (“2012 Award Modification”) in accordance with the authoritative guidance for share-based

payments and affected all holders of Tyco incentive equity awards. As a result, the Company compared the fair

value of the awards immediately prior to the Separation to the fair value immediately after the Separation to

measure incremental compensation cost. Fair value immediately before the modification was measured based on

the assumptions of Tyco whereas the fair value of ADT options immediately after the modification, and from

there on, was representative of ADT as a standalone company. The conversion resulted in an increase in the fair

value of the awards and, accordingly, the Company recorded non-cash compensation expense, the amount of

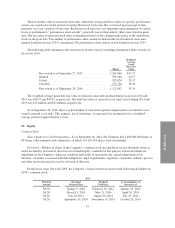

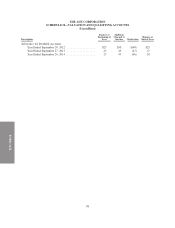

which was immaterial. The following table provides details on the ADT incentive equity awards issued in

conjunction with the 2012 Award Modification:

Shares

Weighted-Average

Grant-Date

Fair Value

Stock options ............................. 7,837,941 $ 7.78

Restricted stock units ....................... 3,169,241 20.86

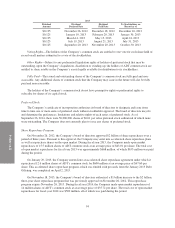

The assumptions used in the Black-Scholes pricing model to calculate the fair value of the options converted

on September 28, 2012 were as follows:

2012

Risk-free interest rate ............................ 1.01 –1.21%

Expected life of options (years) .................... 5.50 – 6.50

Expected annual dividend yield .................... 1.42%

Expected stock price volatility ..................... 33%

Stock Compensation Plans

Prior to the Separation, the Company adopted The ADT Corporation 2012 Stock Incentive Plan (the

“Plan”). The Plan provides for the award of stock options, stock appreciation rights, annual performance bonuses,

long-term performance awards, restricted units, restricted stock, deferred stock units, promissory stock and other

stock-based awards (collectively, “Awards”). In addition to the incentive equity awards converted from Tyco

awards, the Plan provides for a maximum of 8 million common shares to be issued as Awards, subject to

adjustment as provided under the terms of the Plan.

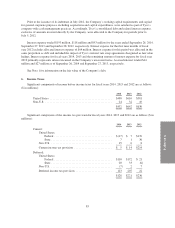

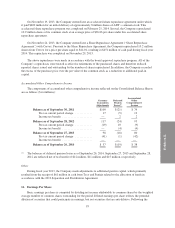

Stock-based compensation expense is included in selling, general and administrative expenses in the

Consolidated and Combined Statements of Operations. The stock-based compensation expense recognized and

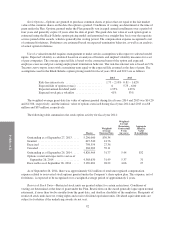

the associated tax benefit for fiscal years 2014, 2013 and 2012 are as follows:

2014 2013 2012

Stock-based compensation expense recognized .................. $20 $19 $7

Tax benefit associated with stock-based compensation ............. 8 7 3

91