ADT 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL NUMBER TWO

PROPOSAL NUMBER TWO—RATIFICATION OF

THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee is directly responsible for the appointment, compensation, oversight and evaluation of performance of the work of our

independent registered public accounting firm. On January 8, 2015, the Audit Committee appointed the firm of Deloitte & Touche LLP (“D&T”),

as the Company’s independent registered public accounting firm to audit ADT’s financial statements for the fiscal year ending September 25,

2015. The Audit Committee and the Board of Directors recommend that stockholders ratify the appointment of D&T as the Company’s

independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending September 25, 2015.

Stockholder approval of the appointment of D&T is not required, but the Audit Committee and the Board of Directors are submitting the selection

of D&T for ratification to obtain our stockholders’ views. In the event the stockholders do not ratify the appointment of D&T as the independent

auditors to audit our financial statements for fiscal year 2015, the Audit Committee and the Board of Directors will consider the voting results and

evaluate whether to select a different independent auditor.

Representatives of D&T will attend the Annual Meeting and will be available to respond to appropriate questions. Although D&T has indicated that

no statement will be made, an opportunity for a statement will be provided.

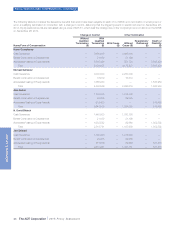

Set forth below are the aggregate audit and non-audit fees billed to the Company by D&T for fiscal years 2013 and 2014:

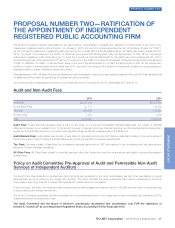

Audit and Non-Audit Fees

2013 2014

Audit Fees $2,837,000 $2,687,850

Audit-Related Fees 121,778 40,800

Tax Fees 499,545 128,945

All Other Fees 2,200 2,000

Total: 3,460,523 2,859,595

Audit Fees: These amounts represent fees of D&T for the audit of our annual consolidated financial statements, the review of financial

statements included in our quarterly Form 10-Q reports, the audit of internal control over financial reporting, and the services that an independent

auditor would customarily provide in connection with regulatory filings and similar engagements for the fiscal year.

Audit-Related Fees: Audit-related fees consist of fees billed for services performed by D&T that are reasonably related to the performance of

the audit or review of the Company’s financial statements, including the audits of employee benefit plans.

Tax Fees: Tax fees consist of fees billed for professional services performed by D&T with respect to tax compliance and tax planning and

advice for US and Canadian operations.

All Other Fees: All Other Fees consist of permitted services other than those that meet the criteria above and relate to accounting research

subscriptions.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit

Services of Independent Auditors

The Audit Committee adopted a pre-approval policy that provides guidelines for the audit, audit-related, tax and other permissible non-audit

services that may be provided by the independent auditors. The policy identifies the guiding principles that must be considered by the Audit

Committee in approving services to ensure that the auditors’ independence is not impaired.

Under the policy, the Audit Committee annually pre-approves the audit engagement fees and terms of all audit and permitted non-audit services

to be provided by the independent auditor.

The Audit Committee considered whether providing the non-audit services shown in the table above was compatible with maintaining D&T’s

independence and concluded that it was.

The Audit Committee and the Board of Directors unanimously recommend that stockholders vote FOR the ratification of

Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for fiscal year 2015.

The ADT Corporation 2015 Proxy Statement 47

PROXY STATEMENT