Singapore Airlines 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

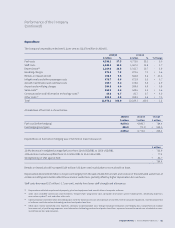

SIA Cargo’s revenue declined by $13 million (-0.6 per cent)

against last year to $2,241 million, notwithstanding a higher

load factor (+0.8 percentage point) and yield (+0.3 per cent),

largely due to a 2.4 per cent reduction in capacity. Expenditure

decreased $91 million (-3.9 per cent) arising from the reduction

in fuel cost and depreciation with the removal of four freighters

from the operating fleet. This translated to an operating loss

of $22 million for 2014/15, an improvement of $78 million as

compared to a year ago.

In 2014/15, cargo capacity (in capacity tonne kilometers)

dropped 2.4 per cent as a result of rationalisation eorts in

response to excess capacity in the air cargo market, while

overall cargo traic (in load tonne kilometers) dropped by

1.1 per cent, resulting in an improvement in cargo load factor

by 0.8 percentage point to 63.3 per cent. Cargo breakeven load

factor improved by 1.8 percentage points to 65.2 per cent due to

lower unit cost (-2.3 per cent) and stronger yields (+0.3 per cent).

The exceptional items in 2014/15 pertained mainly to

impairment loss of $64 million on its investment in China

Cargo Airlines, a provision of USD10 million ($14 million)

for settlement with a customer to resolve all pending and

potential civil damage claims regarding the air cargo issues,

and additional impairment loss of $7 million on two surplus

freighters removed from the operating fleet. These were

oset by a partial refund of $1 million from the South Korean

Fair Trade Commission being part of the fine amount paid

previously, following SIA Cargo’s appeal.

As at 31 March 2015, SIA Cargo operated a fleet of eight 747-400

freighters. SIA Cargo’s equity was $751 million (-15.5 per cent).

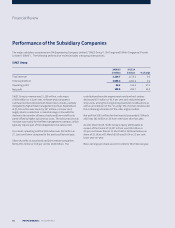

SIA Cargo

2014/15 2013/14

$ million $ million % Change

Total revenue 2,240.8 2,253.7 - 0.6

Total expenditure 2,262.8 2,354.1 - 3.9

Operating loss (22.0) (100.4) + 78.1

Exceptional items (83.3) (380.4) + 78.1

Loss aer taxation (99.7) (418.3) + 76.2

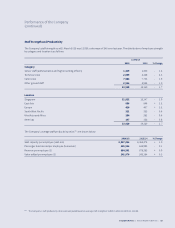

SilkAir’s revenue increased by $46 million (+5.4 per cent)

to $903 million, as passenger revenue was boosted by a

6.3 per cent improvement in passenger carriage and a 1.5 per cent

improvement in passenger yield. The increase in expenditure of

$40 million (+4.8 per cent) was primarily due to higher aircra

standing charges and payroll costs. As a result, the operating

profit increased by $6 million (+18.3 per cent) to $41 million.

Yield increased 1.5 per cent to 13.9 ¢/pkm and unit cost

declined by 1.0 per cent to 9.7 ¢/ask. Consequently, the

breakeven load factor improved by 1.7 percentage points

to 69.8 per cent.

Profit aer taxation improved 44.7 per cent to $54 million.

SilkAir’s route network spanned 48 cities in 12 countries

including Singapore. During the year, SilkAir launched

new services to Kalibo (Philippines), Mandalay (Myanmar),

Hangzhou (China) and Denpasar (Indonesia).

As at 31 March 2015, equity holders’ funds of SilkAir stood at

$829 million (+2.1 per cent).

SilkAir

2014/15 2013/14

$ million $ million % Change

Total revenue 902.5 856.6 + 5.4

Total expenditure 861.7 822.1 + 4.8

Operating profit 40.8 34.5 + 18.3

Profit aer taxation 53.7 37.1 + 44.7

Singapore Airlines | Annual Report FY2014/15 | 59