Singapore Airlines 2015 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2015

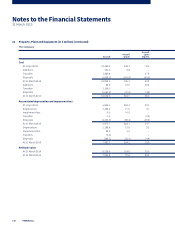

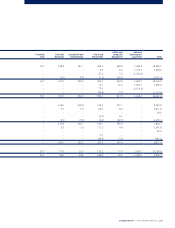

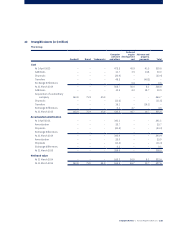

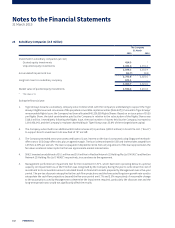

23 Subsidiary Companies (in $ million) (continued)

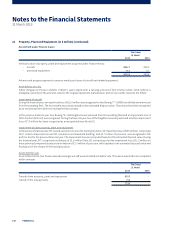

(f) Acquisition of a subsidiary company

On 17 October 2014 (the “acquisition date”), the Company announced an irrevocable undertaking to Tiger Airways’

Rights Issue, to subscribe and pay in full for up to such number of excess Tiger Airways Rights Shares which are not validly

subscribed for by the other Tiger Airways Shareholders, not exceeding a maximum aggregate amount of $140 million. The

Company also announced to convert all its 189,390,367 non-voting perpetual convertible capital securities into new Tiger

Airways’ shares. Following the announcements, Tiger Airways became a subsidiary of the Group.

The acquisition is in line with the Company’s support of Tiger Airways. The Company’s portfolio approach ensures that

all segments of the airline business are well covered, through both full-service and low-cost operations. As a regional

low-cost airline, Tiger Airways is an important part of the Company’s portfolio given that it complements the operations of

Scoot, which operates widebody aircra on medium-haul routes. The Company is therefore committed to the long-term

growth of Tiger Airways.

A goodwill of $163.8 million was recognised on the acquisition based on the dierence between the consideration and the

fair value of the identifiable assets and liabilities at the date of the acquisition. The goodwill arising from the acquisition

comprises the value of strengthening the Group’s portfolio approach and synergies within the Group expected to arise

from the acquisition.

The Group has elected to measure the non-controlling interest at the non-controlling interest’s proportionate share of

Tiger Airway’s net identifiable assets.

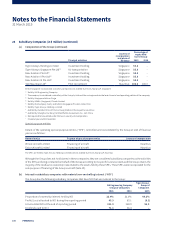

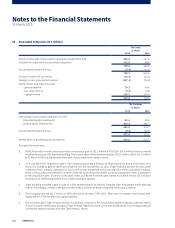

The fair value of the identifiable assets and liabilities of Tiger Airways as at the acquisition date were:

Fair value

recognised

on acquisition

Tigerair brand and trademarks 100.9

Tangible assets 553.1

Pre-existing intangible assets 0.1

Deferred tax assets 12.1

Other receivables 10.6

Long-term investments 8.3

Cash and cash equivalents 135.6

Assets held for sale 20.7

Other current assets 56.8

898.2

Borrowings (345.2)

Provisions (156.8)

Deferred tax liabilities (21.3)

Derivative liabilities (9.4)

Liabilities held for sale (10.4)

Other current liabilities (252.4)

(795.5)

Total identifiable net assets at fair value 102.7

Non-controlling interest measured at the non-controlling interest’s

proportionate share of Tiger Airways’ net identifiable assets (49.3)

Goodwill arising from acquisition 163.8

217.2

Consideration transferred for the acquisition of Tiger Airways

Fair value of equity interest in Tiger Airways held by the Group immediately before the acquisition 217.2

166 FINANCIAL