Singapore Airlines 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

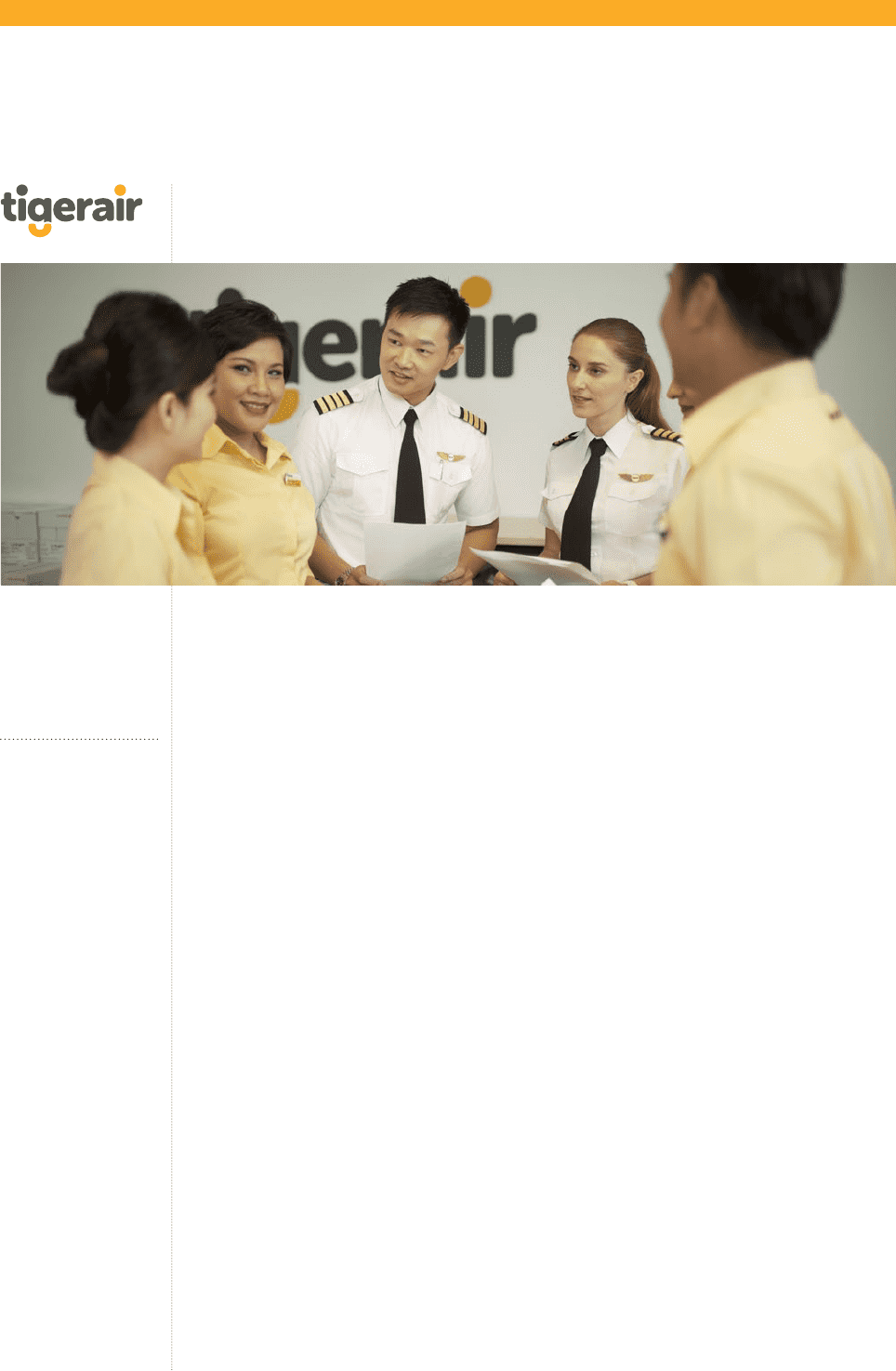

Tigerair

The year under review was a diicult one for

Tigerair, as it was impacted by overcapacity in

the region, which resulted in pressure on yields.

In the face of the challenging environment,

Tigerair went through a series of diicult but

necessary decisions to turn around its financial

performance. These included stemming of

further losses from overseas ventures, shedding

of surplus aircra, capacity management for the

Singapore operations, and strengthening of its

balance sheet.

The execution of the turnaround plan delivered

encouraging results as the business recorded an

improved operating performance in the second

half of the year, where the recovery came mainly

from stronger yields and load factors, aided by

lower fuel prices.

Tigerair Mandala ceased operations in July

2014, while Tigerair Australia was fully divested

to Virgin Australia in February 2015. Tigerair

Philippines had already been divested to Cebu

Pacific at the end of the last financial year. Tigerair

was then burdened with surplus aircra that

were previously operated in Indonesia and the

Philippines.

Tigerair subleased 12 aircra to InterGlobe

Aviation Limited. This was in addition to one

aircra subleased to Tigerair Taiwan during the

year. Tigerair plans to sublease one more aircra

to Tigerair Taiwan and sell two owned aircra in

the new financial year.

The subleasing and sale of surplus aircra enables

Tigerair to focus on improving yield and load factor,

with its operating fleet of 24 aircra as at 31 March

2015, and a further adjustment to 23 aircra at the

end of the new financial year. Capacity management

involved removal of weak routes, while frequencies

were increased to other points. New destinations

were also added to the network, the latest addition

being Ipoh where services began in May 2015.

The strengthening of Tigerair’s balance sheet

through the rights issue completed in January

2015 placed the airline on a firmer footing

to execute its turnaround plan. The rights

issue exercise garnered strong support from

shareholders. Net proceeds of the rights issue

amounted to approximately $227.4 million.

Following the conversion of perpetual convertible

capital securities to ordinary shares and the

completion of the rights issue, SIA’s stake in

Tigerair was raised from 40 per cent to 55.8 per

cent. Tigerair became a subsidiary of SIA during

the third quarter of the financial year. At the same

time, the Competition Commission of Singapore

gave approval for merger control, which eectively

allows all forms of collaboration between Tigerair

and the SIA Group. Tigerair and Scoot had already

engaged in deep co-operation since August 2014,

and this is now extended to the rest of the SIA Group,

an example of which is Tigerair’s participation in

SIA’s KrisFlyer frequent-flyer programme.

Going forward, there continues to be surplus

capacity in the industry which would place

downward pressure on yields. Nonetheless,

Tigerair expects to continue making headway

in its turnaround eort.

37

DESTINATIONS

across 12 countries

FLEET OF

24

A320-200s

In the face of

the challenging

environment,

Tigerair went

through a series

of diicult

but necessary

decisions to

turn around

its financial

performance.

Singapore Airlines | Annual Report FY2014/15 | 43