Singapore Airlines 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

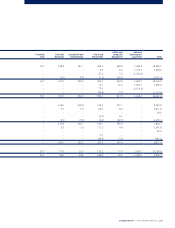

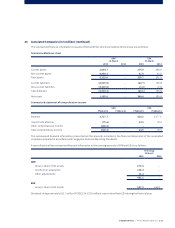

23 Subsidiary Companies (in $ million) (continued)

(f) Acquisition of a subsidiary company (continued)

Fair value

recognised on

acquisition

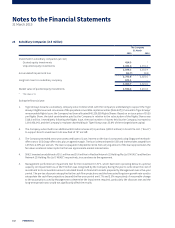

Effect of the acquisition of Tiger Airways on cash flows

Total consideration for the acquisition 217.2

Less: non-cash consideration (217.2)

Consideration settled in cash –

Less: Cash and cash equivalents of subsidiary company acquired (135.6)

Net cash inflow on acquisition 135.6

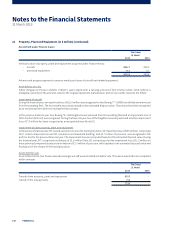

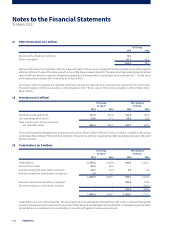

Gain on remeasuring previously held equity interest in Tiger Airways to fair value at acquisition date

The Group recognised a gain of $119.8 million as a result of measuring at fair value its 52.0% equity interest in Tiger Airways

held before the business combination. The gain is included in “Exceptional items” line item in the Group’s profit or loss

for the year ended 31 March 2015.

Goodwill arising from acquisition

The goodwill of $163.8 million comprises the value of strengthening the Group’s portfolio approach and synergies within

the Group expected to arise from the acquisition. Goodwill is allocated entirely to the Tiger Airways’ business. None of

the goodwill recognised is expected to be tax deductible for income tax purposes.

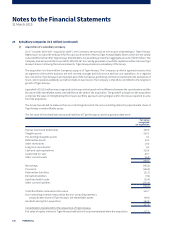

Impact of the acquisition on profit or loss

From the acquisition date, Tiger Airways has contributed $357.0 million of revenue and $9.9 million of loss to the Group’s

profit for the year. If the acquisition had taken place at the beginning of the year, the Group’s revenue would have been

$15,886.1 million and the Group’s net profit attributable to owners of the Parent would remain the same, as there is no

change in the net equity interest.

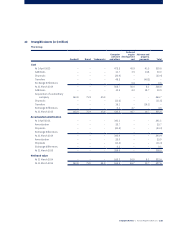

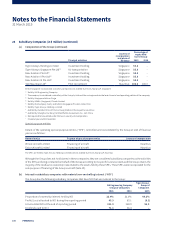

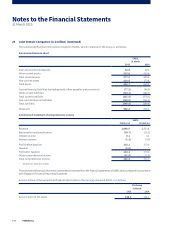

(g) Changes in ownership interests in subsidiary companies

Acquisition of non-controlling interests

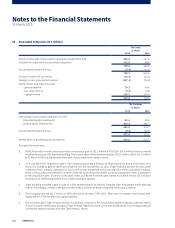

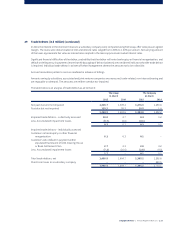

On 16 May 2014, the Group completed the restructuring of one of its subsidiary companies, Singapore Jamco Pte Ltd

(“SJAMCO”). As part of the restructuring, a new company, Singapore Jamco Services Pte Ltd (“SJAMCO Services”) was

incorporated with the same shareholding interest as SJAMCO. SJAMCO then transferred a part of its existing business to

SJAMCO Services. Following the transfer, the Group disposed of 45% of SJAMCO and acquired an additional 15% interest

in SJAMCO Services. Consequently SJAMCO became an associated company upon the disposal of its interest.

On 5 December 2014, the Company converted its 189,390,367 non-voting perpetual convertible capital securities into new

Tiger Airways’ shares, resulting in an increase in equity interest of 3.8%, from 52.0% to 55.8%.

The following summarises the eect of the changes in the Group’s ownership interest in SJAMCO Services and Tiger Airways

on the equity attributable to owners of the Company.

Consideration paid for acquisition of non-controlling interests –

Decrease in equity attributable to non-controlling interests (2.5)

Decrease in equity attributable to owners of the Company (2.5)

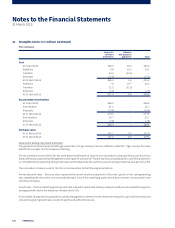

On 7 January 2015, Tiger Airways issued 1,147,102,770 ordinary shares, pursuant to a rights issue, on the basis of 85 Rights

Share for every 100 existing ordinary shares held, at an issue price of $0.20 for each Rights Share with net proceeds of

$227.4 million. Accordingly, rights shares of $100.5 million was allotted to the non-controlling interests of Tiger Airways.

Singapore Airlines | Annual Report FY2014/15 |167