Singapore Airlines 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

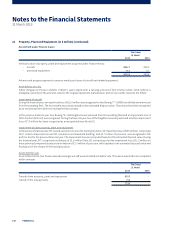

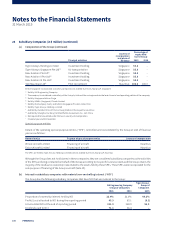

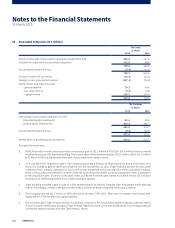

22 Intangible Assets (in $ million) (continued)

Impairment testing of deferred engine development costs

This relates to the Group’s share of engine development payments made in connection with its participation in aircra

engine development projects with other companies. As the intangible asset is not yet available for use, an impairment test

has been performed.

The recoverable amount of the CGU (the aircra engine development project) has been determined based on value-in-use

calculations using cash flow projections from business plan approved by the Management for the next 47 years (2014: 48 years).

The pre-tax discount rate applied to cash flow projections is 7% (2014: 8%).

The calculation of value-in-use for the CGU is most sensitive to the following assumptions:

Pre-tax discount rates – Discount rates represent the current market assessment of the risks specific to the cash-generating

unit, regarding the time value of money and individual risks of the underlying assets which have not been incorporated in the

cash flow estimates.

Number and timing of engine sales – Number and timing of engine sales represent the projected number of aircra engines

expected to be sold each year upon completion of the engine development. Projected engine sale is based on current aircra

orders and expectation of market development.

The recoverable amount is still expected to exceed its carrying amount if the discount rate or growth rate increases by 1.0% or

if engine sales are delayed by 1 year.

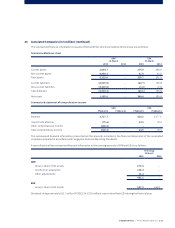

Impairment testing of landing slots

The carrying value of the landing slots classified under “others” is assessed for impairment annually as the landing slots have

indefinite useful life. The recoverable amount of the landing slots has been determined based on value-in-use calculations using

eight-year cash flow projection approved by Management. The pre-tax discount rate applied to cash flow projections is 7%

(2014: 6%) and the forecasted long-term growth rate used to extrapolate the cash flow projections beyond the five-year period

is 2.5% (2014: 2.5%). A reasonable change to the assumptions used by Management to determine the impairment required,

particularly the discount rate and long-term growth rate, would not significantly aect the results.

Singapore Airlines | Annual Report FY2014/15 |161