Singapore Airlines 2015 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2015

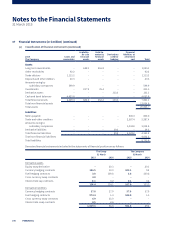

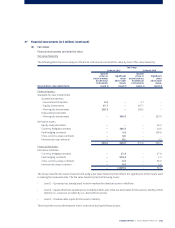

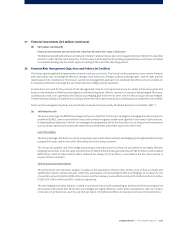

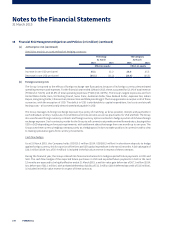

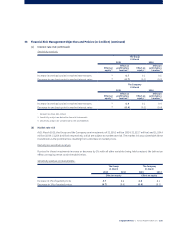

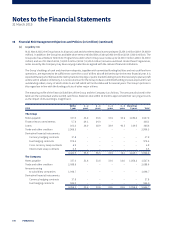

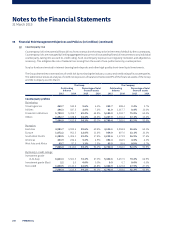

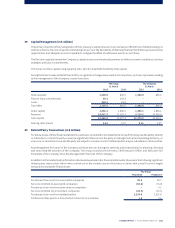

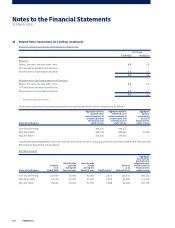

37 Financial Instruments (in $ million) (continued)

(b) Fair values (continued)

Financial instruments carried at fair value (continued)

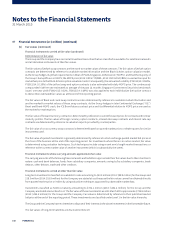

Determination of fair value

The Group and the Company have carried all investment securities that are classified as available-for-sale financial assets

and all derivative instruments at their fair values.

The fair values of jet fuel swap contracts are the mark-to-market values of these contracts. The fair values of jet fuel option

contracts are determined by reference to available market information and the Black-Scholes option valuation model.

As the Group hedges its jet fuel requirements in Mean of Platts Singapore Jet Kerosene (“MOPS”) and that the majority of

the Group’s fuel uplis are in MOPS, the MOPS price (2015: USD 67.99/BBL, 2014: USD 120.20/BBL) is used as the input for

market fuel price to the Black-Scholes option valuation model. Consequently, the annualised volatility (FY2014/15: 34.84%,

FY2013/14: 10.29%) of the jet fuel swap and option contracts is also estimated with daily MOPS price. The continuously

compounded risk-free rate estimated as average of the past 12 months Singapore Government Securities benchmark

issues’ one-year yield (FY2014/15: 0.52%, FY2013/14: 0.29%) was also applied to each individual jet fuel option contract

to derive their estimated fair values as at the end of the reporting period.

The fair values of Brent and crack swap contracts are also determined by reference to available market information and

are the marked-to-market values of these swap contracts. As the Group hedges in InterContinental Exchange (“ICE”)

Brent and Brent-MOPS crack, the ICE Brent futures contract price and its dierential relative to MOPS price are used as

the marked-to-market prices.

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with similar

maturity profiles. The fair values of foreign currency option contracts, interest rate swap contracts and interest rate cap

contracts are determined by reference to valuation reports provided by counterparties.

The fair value of cross currency swap contracts is determined based on quoted market prices or dealer quotes for similar

instruments used.

The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid prices at

the close of the business at the end of the reporting period. For investments where there is no active market, fair value

is determined using valuation techniques. Such techniques include using recent arm’s length market transactions or

reference to the current market value of another instrument (which is substantially the same).

Financial instruments whose carrying amounts approximate fair value

The carrying amounts of the following financial assets and liabilities approximate their fair values due to their short-term

nature: cash and bank balances, funds from subsidiary companies, amounts owing to/by subsidiary companies, trade

debtors, other debtors, trade and other creditors.

Financial instruments carried at other than fair value

Long-term investments classified as available-for-sale amounting to $43.3 million (2014: $98.9 million) for the Group and

$18.5 million (2014: $18.8 million) for the Company are stated at cost because the fair values cannot be obtained directly

from quoted market price or indirectly using valuation techniques supported by observable market data.

Investments classified as held-to-maturity amounting to $782.1 million (2014: $452.2 million) for the Group and the

Company are stated at amortised cost. The fair value of these investments as at 31 March 2015 approximate $782.8 million

(2014: $452.2 million) for the Group and the Company. Fair value is determined by reference to their published market

bid price at the end of the reporting period. These investments are classified under Level 1 in the fair value hierarchy.

The Group and the Company have no intention to dispose of their interests in the above investments in the foreseeable future.

The fair values of long-term liabilities are disclosed in Note 19.

192 FINANCIAL