Singapore Airlines 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

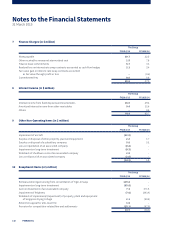

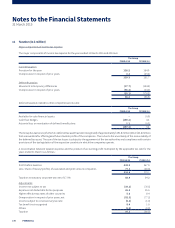

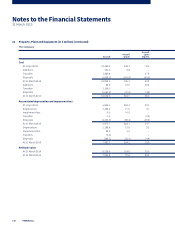

Notes to the Financial Statements

31 March 2015

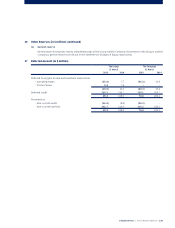

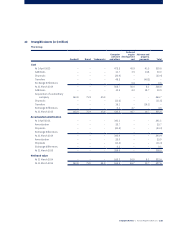

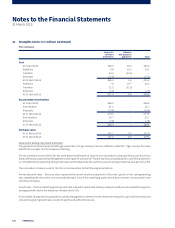

19 Long-Term Liabilities (in $ million) (continued)

Loans

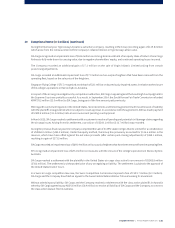

A short-term loan of $9.3 million is a revolving credit facility denominated in USD taken by a subsidiary company. The loan

is unsecured and bears a fixed interest at 2.75% (FY2013/14: 2.50%) per annum. The current revolving credit facility shall be

repayable within 12-months aer the reporting date.

The other short-term loans of $83.7 million are European Export Credit Agency (“ECA”) aircra financing loans denominated in

SGD taken by a subsidiary company. These are in the form of credit support, where a bank or other financial institution lends

money to the borrower with the loan guaranteed by the ECA. The secured bank loans are secured via assignment of the aircra

purchase agreement, assignment of engine warranty and credit agreement as well as mortgage of the aircra. The interest rates

range from 0.90% to 4.11% per annum and the loans shall be repayable within 12-months aer the reporting date.

A long-term loan of $23.9 million denominated in USD is taken by a subsidiary company is unsecured and bears an average

floating rate of 1.47% (FY2013/14: 1.47%) per annum, re-priced quarterly. This loan is repayable by 29 April 2022.

The other long-term loans of $223.3 million are ECA aircra financing loans denominated in SGD taken by a subsidiary company.

The interest rates range from 0.90% to 4.11% per annum and the loans shall be repayable by 21 April 2023.

As part of the ECA financing arrangements with banks, special purpose entities (“SPE”) (Note 23) were incorporated. As at 31 March

2015, there were ECA financing arrangements with banks to finance 11 aircra (2014: 11). Pursuant to the ECA financing, the legal

ownership of the aircra is vested in the SPEs. The subsidiary companies leased the aircra using finance lease arrangement with

Falcon Aircra Limited and Winnie Aircra Limited. The subsidiary companies have purchase options to acquire legal ownership

of the aircra from the SPEs at the end of the lease term at a bargain purchase option price.

The fair value of the loans amounted to $336.3 million as at 31 March 2015 (2014: $22.8 million).

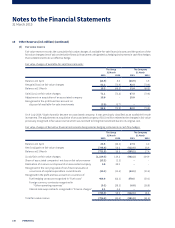

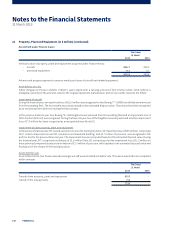

Finance lease commitments and purchase option price payable

SIA Cargo holds four B747-400 freighters under finance leases, which mature between 2015 and 2018, without any options for

renewal. Three leases have options for SIA Cargo to purchase the aircra at the end of the lease period of 12 years. The fourth

lease has an option for SIA Cargo to purchase the aircra at the end of the 15th year of the lease period. Sub-leasing is allowed

under the lease agreements.

Interest on three of SIA Cargo’s finance lease commitments are charged at a margin above the London Interbank Oered Rate

(“LIBOR”). These ranged from 0.26% to 0.99% (FY2013/14: 0.27% to 1.12%) per annum. The interest rate on the fourth finance

lease commitment is fixed at 5.81% (FY2013/14: 5.81%) per annum.

The net carrying amounts approximate the fair value as the interest rate approximates the market rate.

SIA Cargo continues to remain the primary obligor under the lease agreements, and as such, there are unpaid lease commitments

of $86.3 million (2014: $79.1 million) as at 31 March 2015. In 2013, $66.4 million was covered by funds placed with financial

institutions under defeasance to provide for payments due at time of exercise of purchase option at the end of the 15th year of the

lease period. The funds placed with financial institutions are expected to generate interest in order to meet the obligation at time

of maturity. These arrangements have not been included in the financial statements for 2013. During the year, this arrangement

has been terminated and the deposit, amounting to $76.6 million has been transferred to the SIA Cargo (Note 27). This amount

has been designated by SIA Cargo to meet the obligation at maturity in December 2017. The fair value of the purchase option

price payable amounted to $85.3 million as at 31 March 2015.

152 FINANCIAL