Singapore Airlines 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2015

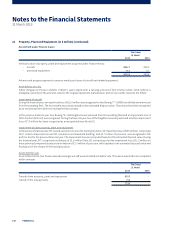

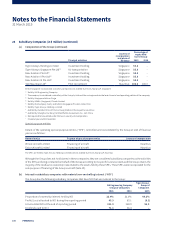

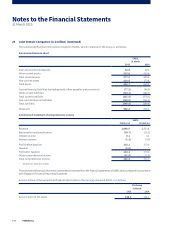

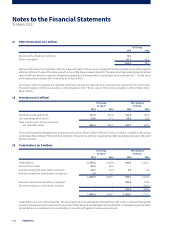

24 Associated Companies (in $ million)

The Group

31 March

2015 2014

Share of net assets of associated companies at acquisition date 638.4 567.8

Goodwill on acquisition of associated companies 131.5 98.8

769.9 666.6

Accumulated impairment loss (9.4) (15.0)

760.5 651.6

Goodwill written off to reserves (23.1) (23.1)

Foreign currency translation reserve (107.1) (96.0)

Share of post-acquisition reserves

– general reserve 76.3 64.0

– fair value reserve (9.6) (0.4)

– capital reserve 225.2 133.3

922.2 729.4

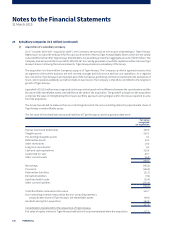

The Company

31 March

2015 2014

Investment in associated companies (at cost)

Unquoted equity investments 61.6 36.0

Quoted equity investments 420.2 340.7

481.8 376.7

Accumulated impairment loss (9.4) (63.2)

472.4 313.5

Market value of quoted equity investments 433.0 270.7

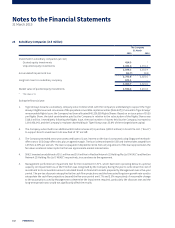

During the financial year:

1. RCMS Properties Private Limited recorded a revaluation gain of $53.1 million (FY2013/14: $65.6 million) from its annual

revaluation exercise of its land and building. The Group’s share of the revaluation gain of $10.6 million (2014: $13.1 million)

at 31 March 2015 is included under the share of post-acquisition capital reserve.

2. On 4 July 2014 (the “acquisition date”), the Company appointed a Director to Virgin Australia’s Board of Directors. As a

result, the Company gained significant influence over the investment, as such, Virgin Australia became an associated

company of the Company. A goodwill of $116.3 million was recognised in the carrying value of the associated company,

which is the purchase consideration in excess of the fair value of net identifiable assets as at acquisition date. Subsequent

to the acquisition date, a further 0.23% interest was purchased from the open market for AUD6.4 million ($7.5 million)

resulting in an additional goodwill of $2.1 million being recognised.

3. Virgin Australia recorded a gain on sale of a 35% shareholding in its Velocity Frequent Flyer Programme while retaining

control. Accordingly, a share of the gain on sale of $81.3 million has been recognised in the capital reserve.

4. The Company injected $25.7 million in TATA SIA Airlines Limited (“TATA-SIA”). There was no change in the Group’s 49%

equity stake in TATA-SIA aer the capital injection.

5. Since October 2014, Tiger Airways became a subsidiary company of the Group following the Company’s announcement

of an irrevocable undertaking to support Tiger Airways’ Rights Issue and convert all its 189,390,367 non-voting perpetual

convertible capital securities into new Tiger Airways’ shares.

168 FINANCIAL