Singapore Airlines 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2015

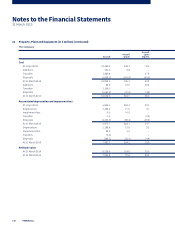

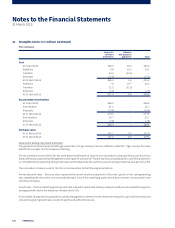

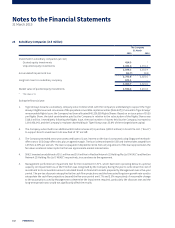

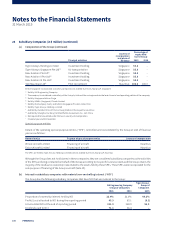

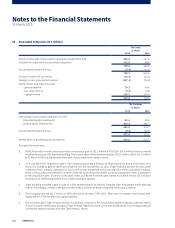

23 Subsidiary Companies (in $ million)

The Company

31 March

2015 2014

Investment in subsidiary companies (at cost)

Quoted equity investments 414.9 #

Unquoted equity investments 2,431.4 2,031.4

2,846.3 2,031.4

Accumulated impairment loss (52.7) (9.8)

2,793.6 2,021.6

Long term loan to a subsidiary company 571.1 –

3,364.7 2,021.6

Market value of quoted equity investments 3,934.6 4,210.8

# The value is $1.

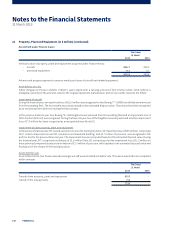

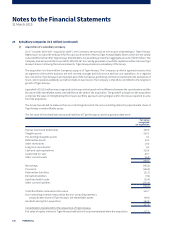

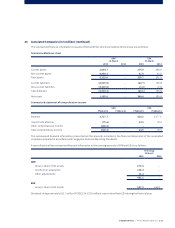

During the financial year:

1. Tiger Airways became a subsidiary company since October 2014 with the Company’s undertaking to support the Tiger

Airways’ Rights Issue and conversion of the perpetual convertible capital securities [Note 23(f)]. Pursuant to Tiger Airways’

renounceable Rights Issue, the Company had been allocated 640,236,559 Rights Shares. Based on an issue price of $0.20

per Rights Share, the total consideration paid by the Company in relation to the subscription of the Rights Shares was

$128.0 million. Immediately following the Rights Issue, the total number of shares held by the Company increased to

1,393,456,041, and the Company’s resultant shareholding in Tiger Airways was 55.8% of the enlarged share capital.

2. The Company subscribed to an additional 400 million shares at $1 per share ($400.0 million) in Scoot Pte. Ltd. (“Scoot”)

to support Scoot’s investment in its new fleet of 787 aircra.

3. The Company extended a two-year unsecured loan to Scoot. Interest on the loan is computed using Singapore Interbank-

oer rates or SGD Swap-oer rates, plus an agreed margin. The loan is denominated in SGD and interest rates ranged from

1.45% to 2.30% per annum. The loan is repayable in September 2016. Net carrying amount of the loan approximates the

fair value as interest rates implicit in the loan approximate market interest rates.

4. SIAEC invested an additional of $0.1 million and $0.6 million in NexGen Network (1) Holding Pte Ltd (“NGN1”) and NexGen

Network (2) Holding Pte Ltd (“NGN2”) respectively, in accordance to the agreement.

5. Management performed an impairment test for the investment in SFC, which had been operating below its optimal

capacity. An impairment loss of $42.9 million was recognised by the Company during the year to write down the cost of

investment to its recoverable amount calculated based on financial forecasts prepared by Management over a five-year

period. The pre-tax discount rate applied to the cash flow projections and the forecasted long-term growth rate used to

extrapolate the cash flow projections beyond the five-year period are 6.7% and 2.5% respectively. A reasonable change

to the assumptions used by Management to determine the impairment required, particularly the discount rate and the

long-term growth rate, would not significantly aect the results.

162 FINANCIAL