Singapore Airlines 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2009/10

93

2 Summary of Significant Accounting Policies (continued)

(b) New and revised standards (continued)

• Amendments to FRS 102 Share-based Payment – Vesting Conditions and Cancellations

• Amendments to FRS 107 Financial Instruments: Disclosures

• FRS 108 Operating Segments

• Improvements to FRSs issued in 2008

• INT FRS 113 Customer Loyalty Programmes

• INT FRS 116 Hedges of a Net Investment in a Foreign Operation

• Amendments to INT FRS 109 Reassessment of Embedded Derivatives and FRS 39 Financial Instruments:

Recognition and Measurement – Embedded Derivatives

• INT FRS 118 Transfers of Assets from Customers

Adoption of these standards and interpretations did not have any effect on the financial performance or position of

the Group. They did however give rise to additional disclosures.

The principal effects of these changes are as follows:

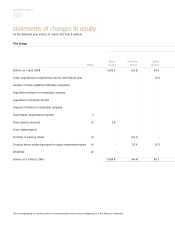

FRS 1: Presentation of Financial Statements

The revised FRS 1 separates owner and non-owner changes in equity. The statement of changes in equity includes

only details of transactions with owners, with all non-owner changes in equity presented in the statement of other

comprehensive income. In addition, the revised standard introduces the statement of comprehensive income which

presents income and expense recognised in the period. This statement may be presented in one single statement,

or two linked statements. The Group has elected to present this statement as two linked statements.

Amendments to FRS 107: Improving Disclosures about Financial Instruments

The amendments to FRS 107 require additional disclosure about fair value measurement and liquidity risk.

Fair value measurements are to be disclosed by source of inputs using a three level hierarchy for each class of

financial instrument. In addition, reconciliation between the beginning and ending balance for Level 3 fair value

measurements is now required, as well as significant transfers between Level 1 and Level 2 fair value measurements.

The amendments also clarify the requirements for liquidity risk disclosures. The fair value measurement disclosures

and liquidity risk disclosures are presented in Note 37(b) and Note 38(e) to the financial statements respectively.

FRS 108: Operating Segments

FRS 108 requires disclosure of information about the Group’s operating segments and replaces the requirement

to determine primary and secondary reporting segments of the Group. As a result of the adoption of FRS 108, the

identification of the Group’s reportable segments has changed. On top of the existing business segments previously

identified under FRS 14: Segment Reporting, an additional segment has been identified. Additional disclosures about

each of the segments are shown in Note 4, including revised comparative information.