Singapore Airlines 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SINGAPORE AIRLINES

100

notes to the financial statements

31 march 2010

2 Summary of Significant Accounting Policies (continued)

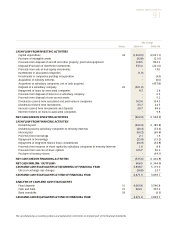

(h) Depreciation of property, plant and equipment

Property, plant and equipment are depreciated on a straight-line basis at rates which are calculated to write-down

their cost to their estimated residual values at the end of their operational lives. Operational lives, residual values and

depreciation method are reviewed annually in the light of experience and changing circumstances, and adjusted as

appropriate at the end of each reporting period.

Freehold land, advance and progress payments are not depreciated.

Fully depreciated assets are retained in the financial statements until they are no longer in use. No depreciation is

charged after assets are depreciated to their residual values.

(i) Aircraft, spares and spare engines

The Group depreciates its new passenger aircraft, spares and spare engines over 15 years to 10% residual

values. For used passenger aircraft, the Group depreciates them over the remaining life (15 years less age of

aircraft) to 10% residual values.

The Group depreciates its new freighter aircraft over 15 years to 20% residual values. For used freighter aircraft,

the Group depreciates them over the remaining life (15 years less age of aircraft) to 20% residual value.

Major inspection costs relating to landing gear overhauls, heavy maintenance visits and engine overhauls

(including inspection costs provided under power-by-hour maintenance agreements) are capitalised and

depreciated over the average expected life between major overhauls, estimated to be 4 to 10 years.

Flight simulators and training aircraft are depreciated over 10 years to nil residual values, and 5 years to 20%

residual values respectively.

(ii) Land and buildings

Freehold buildings, leasehold land and buildings are depreciated to nil residual values as follows:

Company owned office premises – according to lease period or 30 years, whichever is the shorter.

Company owned household premises – according to lease period or 10 years, whichever is the shorter.

Other premises – according to lease period or 5 years, whichever is the shorter.

(iii) Others

Plant and equipment, office and computer equipment are depreciated over 1 to 12 years to nil residual values.

(i) Investment properties

Investment properties are initially recorded at cost. Subsequent to recognition, investment properties are stated at

cost less accumulated depreciation and accumulated impairment losses, if any.

Depreciation is provided on a straight-line basis so as to write off the cost of the leasehold investment properties over

its estimated useful lives according to the lease period or 30 years whichever is shorter.