Singapore Airlines 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

SINGAPORE AIRLINES

132

notes to the financial statements

31 march 2010

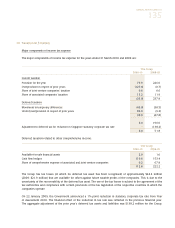

5 Staff Costs (in $ million) (continued)

Share-based compensation expense (continued)

Share-based incentive plans (continued)

Fair values of share awards granted

The fair value of services received in return for shares awarded is measured by reference to the fair value of shares

granted each year under the RSP and PSP. The estimate of the fair value of the services received is measured based on a

Monte Carlo simulation model, which involves projection of future outcomes using statistical distributions of key random

variables including share price and volatility of returns.

The following table lists the key inputs to the model used for the July 2009 and July 2008 awards:

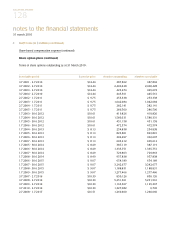

July 2009 Award July 2008 Award

RSP PSP RSP PSP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 27.32 – 33.60 29.50 20.20 – 22.15 21.08

Risk-free interest rate (%) 0.50 – 1.00 0.61 1.30 – 2.35 1.76

Expected term (years) 1.9 – 3.9 2.9 2.0 – 4.0 3.0

Share price at date of grant ($) 13.34 13.34 14.60 14.60

For non-market conditions, achievement factors are determined based on inputs from the Board Compensation &

Industrial Relations Committee for the purpose of accrual for the RSP until the achievement of the targets can be

accurately ascertained.

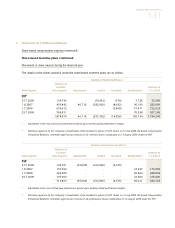

Based on the Monte Carlo simulation model, the estimated fair value at date of grant for each share granted under the

RSP ranges from $11.99 to $12.62 (2008-09: $11.21 to $12.72) and the estimated fair value at date of grant for each

share granted under the PSP is $14.29 (2008-09: $9.62).

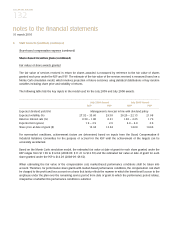

When estimating the fair value of the compensation cost, market-based performance conditions shall be taken into

account. Therefore, for performance share grants with market-based performance conditions, the compensation cost shall

be charged to the profit and loss account on a basis that fairly reflects the manner in which the benefits will accrue to the

employee under the plan over the remaining service period from date of grant to which the performance period relates,

irrespective of whether this performance condition is satisfied.