Singapore Airlines 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2009/10

159

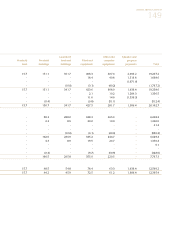

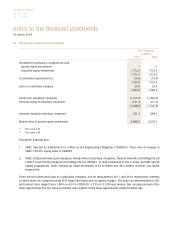

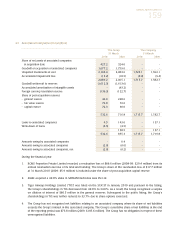

23 Associated Companies (in $ million)

The Group The Company

31 March 31 March

2010 2009 2010 2009

Share of net assets of associated companies

at acquisition date 427.2 324.0 - -

Goodwill on acquisition of associated companies 1,677.2 1,759.6 - -

Unquoted investments at cost 2,104.4 2,083.6 1,725.1 1,592.1

Accumulated impairment loss (15.2) (18.5) (9.4) (9.4)

2,089.2 2,065.1 1,715.7 1,582.7

Goodwill written-off to reserves (1,612.3) (1,613.0) - -

Accumulated amortisation of intangible assets - (43.2) - -

Foreign currency translation reserve (136.3) (122.7) - -

Share of post-acquisition reserves

- general reserve 46.9 268.6 - -

- fair value reserve 72.8 72.0 - -

- capital reserve 72.3 90.0 - -

532.6 716.8 1,715.7 1,582.7

Loans to associated companies 4.5 143.0 - 137.1

Write-down of loans (4.5) (4.5) - -

- 138.5 - 137.1

532.6 855.3 1,715.7 1,719.8

Amounts owing by associated companies - 0.4 - -

Amounts owing to associated companies (2.0) (0.6) - -

Amounts owing to associated companies, net (2.0) (0.2) - -

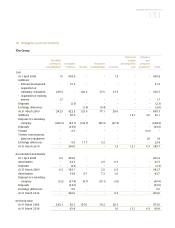

During the financial year:

1. RCMS Properties Private Limited recorded a revaluation loss of $88.6 million (2008-09: $29.4 million) from its

annual revaluation exercise of its land and building. The Group’s share of the revaluation loss of $17.7 million

at 31 March 2010 (2009: $5.9 million) is included under the share of post-acquisition capital reserve.

2. SIAEC acquired a 49.0% stake in SAFRAN Electronics Asia Pte Ltd.

3. Tiger Airways Holdings Limited (“TIG”) was listed on the SGX-ST in January 2010 and pursuant to the listing,

the Group’s shareholdings in TIG decreased from 49.0% to 34.0%. As a result, the Group recognised a surplus

on dilution of interest of $80.5 million in the general reserves. Subsequent to the public listing, the Group’s

shareholdings in TIG was further reduced to 33.7% due to share options exercised.

4. The Group has not recognised net liabilities relating to an associated company where its share of net liabilities

exceeds the Group’s interest in this associated company. The Group’s cumulative share of net liabilities at the end

of the reporting period was $73.8 million (2009: $185.6 million). The Group has no obligation in respect of these

unrecognised liabilities.