Singapore Airlines 2010 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2009/10

181

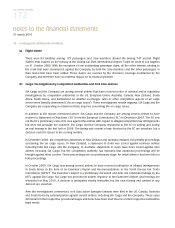

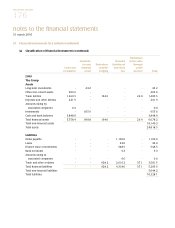

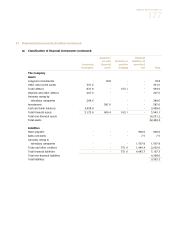

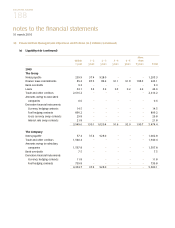

37 Financial Instruments (in $ million) (continued)

(b) Fair values (continued)

Financial instruments carried at other than fair value (continued)

Net carrying amounts of long-term liabilities approximate the fair value as the interest rates implicit in the long-

term liabilities approximate the market interest rates.

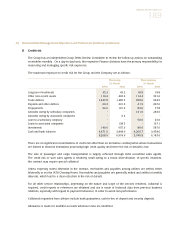

38 Financial Risk Management Objectives and Policies (in $ million)

The Group operates globally and generates revenue in various currencies. The Group’s airline operations carry certain

financial and commodity risks, including the effects of changes in jet fuel prices, foreign currency exchange rates,

interest rates and the market value of its investments. The Group’s overall risk management approach is to moderate the

effects of such volatility on its financial performance. The Group’s policy is to use derivatives to hedge specific exposures.

As derivatives are used for the purpose of risk management, they do not expose the Group to market risk because

gains and losses on the derivatives offset losses and gains on the matching asset, liability, revenues or costs being

hedged. Moreover, counterparty credit risk is generally restricted to any hedging gain from time to time, and not the

principal amount hedged. Therefore the possibility of a material loss arising in the event of non-performance by a

counterparty is considered to be unlikely.

Financial risk management policies are periodically reviewed and approved by the Board Executive Committee (“BEC”).

(a) Jet fuel price risk

The Group’s earnings are affected by changes in the price of jet fuel. The Group’s strategy for managing the risk on

fuel price, as defined by BEC, aims to provide the Group with protection against sudden and significant increases

in jet fuel prices. In meeting these objectives, the fuel risk management programme allows for the judicious use of

approved instruments such as swaps and options with approved counterparties and within approved credit limits.

Cash flow hedges

The Group manages this fuel price risk by using swap and option contracts and hedging up to 15 months forward

using jet fuel swap and option contracts. The Group will no longer enter into new gasoil hedges. Existing gasoil swap

contracts will all be rolled up into jet fuel equivalents by hedging in the gasoil-jet fuel regrade closer to maturity.

The Group has applied cash flow hedge accounting to these derivatives as they are considered to be highly

effective hedging instruments. A net fair value loss before tax of $458.9 million (2009: $1,249.6 million), with

a related deferred tax credit of $116.9 million (2009: $251.3 million), is included in the fair value reserve in

respect of these contracts.

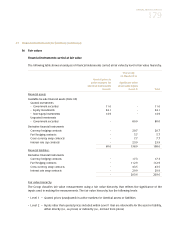

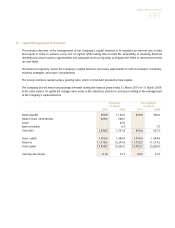

Jet fuel price sensitivity analysis

The jet fuel price risk sensitivity analysis is based on the assumption that all other factors, such as fuel surcharge

and uplifted fuel volume, remain constant. Under this assumption, and excluding the effects of hedging, an

increase in price of one USD per barrel of jet fuel affects the Group’s and the Company’s annual fuel costs by

$44.9 million and $38.1 million (2008-09: $54.4 million and $45.7 million) respectively.