Singapore Airlines 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

036

corporate governance report

For the period 1 April 2009 to 31 March 2010

The SIA Performance Share Plan (PSP)

The PSP is targeted at a select group of key senior management who shoulder the responsibility for the Company’s performance

and who are able to drive the growth of the Company through innovation, creativity and superior performance. Awards

under the PSP are performance-based, with stretched performance targets based on criteria such as absolute and relative total

shareholders’ return to be achieved over a three-year performance period.

The SIA Restricted Share Plan (RSP)

The RSP is targeted at a broader base of senior executives and enhances the Company’s ability to recruit and retain talented senior

executives as well as to reward for Company and individual performance. Consistent with the Company’s philosophy on adopting

a pay-for-performance principle, awards under the RSP are contingent on the achievement of performance targets like EBITDAR

margin and staff productivity over a two-year performance period. To encourage participants to continue serving the Company

beyond the performance period, an extended vesting period is imposed beyond the performance target completion date.

The total number of ordinary shares which may be issued pursuant to awards granted under the RSP and PSP, when added to

the number of new shares issued and issuable in respect of all awards granted under the RSP and PSP, and all options under

the ESOP, shall not exceed 13% of the issued ordinary share capital of the Company. In addition the maximum number of

new Shares that can be issued pursuant to awards granted under the RSP and PSP in the period between the current Annual

General Meeting (AGM) to the next AGM shall not exceed 1.5% of the total number of issued ordinary shares in the capital of

the Company.

Details of the Company’s PSP, RSP and ESOP can be found on pages 72 to 75 of the Report by the Board of Directors.

Directors’ Fees

The Directors’ fees paid in financial year 2009-10 amounted to S$1,207,000 [financial year 2008-09: S$1,500,000] and

were based on the following rates:

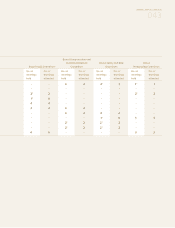

Rates (S$)

Board Retainers Board Member 80,000

Chairman 160,000

Committee Retainers Chairman of Executive Committee and Audit Committee 50,000

Chairman of other Board Committees, 35,000

Member of Executive Committee and Audit Committee

Member of other Board Committees 20,000

Attendance Fees Home – City 5,000

In – Region 10,000

Out – Region 20,000

Teleconference – normal hours 1,000

Teleconference – odd hours 2,000

In response to the potential effects of the global financial crisis, Directors had accepted a 20% reduction in Directors’ fees

for financial year 2009-10 in tandem with the CEO’s pay cut of 20%, with effect from July 2009. The table above sets out

the rates prior to the 20% reduction.