Singapore Airlines 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SINGAPORE AIRLINES

038

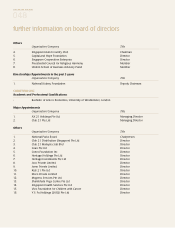

corporate governance report

For the period 1 April 2009 to 31 March 2010

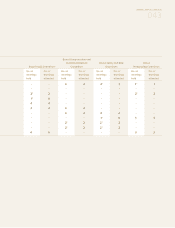

No employee of the Group who is an immediate family member of a Director was paid a remuneration that exceeded

S$150,000 during the financial year ended 31 March 2010.

Performance and

Restricted Shares

granted during

Bonus the year2

Fee Salary Fixed Variable1 Benefits Total Number

Senior Management % % % % % %

Between $1,000,000 to $1,250,000

Bey Soo Khiang - 40 5 48 7 100 24,640 PSP

22,400 RSP

Between $750,000 to $1,000,000

Huang Cheng Eng - 43 4 45 8 100 16,800 PSP

19,040 RSP

Mak Swee Wah - 43 4 41 12 100 16,800 PSP

19,040 RSP

Between $250,000 to $500,000

Ng Chin Hwee - 69 7 8 16 100 16,800 PSP

19,040 RSP

Less than $250,000

Goh Choon Phong3 - 78 - 8 14 100 8,960 PSP

14,560 RSP

1 Includes Economic Value Added (EVA)-based incentive plan (EBIP) payment and profit-sharing bonus. The amount paid in the reporting year

under EBIP is for the executive’s performance in respect of the financial year ended 31 March 2009 because the performance rating was finalized

and payment was made during the financial year ended 31 March 2010. See below for additional information on the EBIP.

2 Shares awarded under the PSP and RSP are subject to performance targets and other terms and conditions being met under the respective share plans.

3 Mr Goh Choon Phong was appointed as an Executive Vice-President on 1 March 2010 and, other than the PSP/RSP awards, the data here on his

remuneration is for only the month of March 2010.

Additional information on Economic Value Added (EVA)-based incentive plan (EBIP):

A portion of the annual performance-related bonus of senior management is tied to the EVA produced by the Group in

the year. Under the plan, one-third of the accumulated EBIP bonus, comprising the EBIP bonus declared in the financial

year and the balance of such bonus brought forward from preceding years, is paid out in cash each year. The remaining

two-thirds are carried forward in the individual executive’s EBIP account. Amounts in the EBIP account are at risk because

negative EVA will result in a retraction of EBIP bonus earned in preceding years. This mechanism encourages Management

to work for sustainable profitability and to adopt strategies that are aligned with the long-term interests of the Company.

The rules of the EBIP are subject to review by the Board Compensation and Industrial Relations Committee, which has the

discretion, under authority of the Board, to amend the rules where appropriate and relevant to the business conditions.