Singapore Airlines 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

singapore airlines

annual report

2009/2010

Table of contents

-

Page 1

singapore airlines annual report 2009/2010 -

Page 2

..., the Airbus A380, to more destinations, rolling out a cabin renewal programme for selected Boeing 777 aircraft, and opening a new service centre in the heart of Singapore's premier shopping belt. Market conditions gradually improved in the second half of the financial year. Reflecting this, the... -

Page 3

...of directors chairman's letter to shareholders corporate data significant events the year in review network fleet management products and services people development environment supporting our communities subsidiaries list of awards statement on risk management corporate governance report financials... -

Page 4

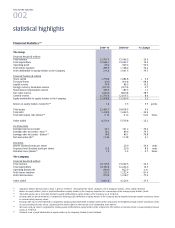

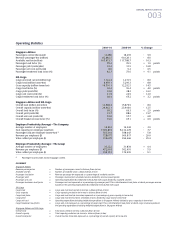

...financial year is from 1 April to 31 March. Throughout this report, all figures are in Singapore Dollars, unless stated otherwise. Return on equity holders' funds is profit attributable to equity holders of the Company expressed as a percentage of the average equity holders' funds. Total debt equity... -

Page 5

... Singapore Airlines and SIA Cargo Overall load Overall capacity Overall load factor Number of passengers carried x distance flown (in km) Number of available seats x distance flown (in km) Revenue passenger-km expressed as a percentage of available seat-km Passenger revenue from scheduled services... -

Page 6

... 23rd Singapore Business Awards in March 2008. Age 63. William Fung Kwok Lun Director Appointed Director on 1 December 2009. Dr Fung is Group Managing Director of Li & Fung Limited, a multinational group of companies headquartered in Hong Kong. Dr Fung held key positions in major trade and business... -

Page 7

... banking, corporate and financial services work. His other directorships include Director of Cerebos Pacific Limited, Director of Hap Seng Plantations Holdings Berhad and Director of Singapore Press Holdings Limited. He is also Chairman of the Maritime and Port Authority of Singapore, a Board member... -

Page 8

... a full-year group net profit attributable to equity holders of S$216 million. How did we manage this, when many other airline groups recorded losses? We have taken many actions to counter the severe downturn, and I will focus on three areas: the dedication of our staff, marketing strategies and our... -

Page 9

... Boeing 777s with our latest product offerings. Our focus on the core airline business is also being strictly adhered to and in line with this we divested our holding in Singapore Airport Terminal Services during the year in review. We meanwhile continue to adapt to the changing market environment... -

Page 10

...) Board Compensation and Industrial Relations Committee Chairman Stephen Lee Ching Yen Members David Michael Gonski James Koh Cher Siang Sir Brian Pitman (until 31 July 2009) Company Secretary Ethel Tan Share Registrar M & C Services Private Limited 138 Robinson Road #17-00 The Corporate Office... -

Page 11

ANNUAL REPORT 2009/10 009 Executive Management Head Office Chew Choon Seng Chief Executive Officer Bey Soo Khiang Senior Executive Vice President Operations and Planning (until 28 February 2010) Gerard Yeap Beng Hock Senior Vice President Flight Operations Christopher Cheng Kian Hai Senior Vice ... -

Page 12

... Singapore and Manila, Philippines is introduced. The new Singapore Airlines Service Centre at ION Orchard opens. The Airline launches an aircraft cabin renewal programme involving selected Boeing 777 aircraft. PPS Connect, a Short Message Service (SMS) contact service for Solitaire PPS Club members... -

Page 13

...the first half of FY 2009-2010. The Airline announces plans to operate twice-daily flights between Singapore and Tokyo Haneda from October 2010. The Airline and Tourism New South Wales ink a joint marketing agreement aimed at boosting visitor numbers to Sydney. February • The Airline partners the... -

Page 14

... from the global recession. The year in review also saw the addition of four new Airbus A380 destinations - Paris, Hong Kong, Melbourne and Zurich. To enable it to focus on its core business, the Airline divested its shares in Singapore Airport Terminal Services (SATS) via a dividend in specie... -

Page 15

ANNUAL REPORT 2009/10 013 -

Page 16

... during the financial year - Paris, Hong Kong, Melbourne and Zurich. There are now seven destinations to which Singapore Airlines operates the A380, including Sydney, London and Tokyo. There are positive signs of a recovery in travel demand. However, operating conditions remain challenging, and... -

Page 17

... aircraft to more destinations. Five Boeing 747-400s left the operating fleet during the year in review. Three were returned to lessors as planned while two were parked. The passenger fleet operated by the Airline, as at 31 March 2010, comprised 108 aircraft, with an average age of six years... -

Page 18

SINGAPORE AIRLINES 016 -

Page 19

... SIA Mobile booking, or during their SIA Mobile check-in, which is anytime between two and 48 hours prior to flight departure. New Singapore Airlines Service Centre opens in ION Orchard The Singapore Airlines Service Centre has moved to ION Orchard, the latest premier address on Singapore's busy... -

Page 20

... on partner airlines with changes such as the introduction of one-way redemption and reduction in the number of zones. In addition, members have even more ways to earn miles with the launch of the American Express Singapore Airlines Solitaire PPS Credit Card in Singapore and the Singapore Airlines... -

Page 21

... REPORT 2009/10 019 People Development At the start of the financial year, the Airline implemented various measures to address excess staffing levels resulting from cuts in flight capacity brought about by the economic downturn. Such measures included a Voluntary No-Pay Leave Scheme for all staff... -

Page 22

SINGAPORE AIRLINES 020 Photograph courtesy of Airbus -

Page 23

... fuel saved resulted in carbon emission savings of 33,769 kg. Singapore Airlines also collaborated with Airbus, BAA and National Air Traffic Services to launch an improved departure procedure for Airbus A380 operations at London Heathrow Airport. A380s now use less power when taking off, saving fuel... -

Page 24

...'s flag high in the sporting arena, Singapore Airlines is proud to be the Official Airline for the inaugural Youth Olympic Games, to be held in Singapore in August 2010. The Airline will provide air tickets and carriage of airfreight, as well as promote the Games via its proprietary media channels. -

Page 25

... major consumer markets in the US and Europe. Market conditions were better in the second half of the financial year with renewal of inventory restocking and some improvement in global economies. SIA Cargo rationalised its freighter network to align capacity more closely to demand in response to the... -

Page 26

... MRO value chain when it entered into an agreement with Pratt & Whitney to participate in the PW1000G RiskRevenue Sharing Programme (RRSP). P&W is developing the PW1000G engine to power Next Generation Single-Aisle aircraft. Amidst the buzz of Singapore Airshow 2010, SIAEC opened its new A380 Hangar... -

Page 27

ANNUAL REPORT 2009/10 025 -

Page 28

...the year in review - an Airbus A320 in December 2009 and an Airbus A319 in March 2010. These latest aircraft feature SilkAir's new cabin design with a warm colour scheme, complete with leatherupholstered Business Class seats and ergonomic Economy Class seats. SilkAir continued to receive recognition... -

Page 29

... Airline • Best Business Class • Best Economy Class • Best Cabin Staff E-Travel Blackboard Readers' Choice Awards (Australia) • Best Airline International • Best Airline First Class • Best Airline Economy Class Asian Wall Street Journal Award • Singapore's Most Admired Company since... -

Page 30

...Admired Companies (Ranked 27th) Asiamoney ( Hong Kong) 2010 Travel Poll • Asia's Best Airline (14th consecutive year) - Best Airline for First Class - Best Airline for Business Class - Best Airline for Economy Class - Best Online Booking Tool - Best Online Check-in Facilities - Best Frequent Flyer... -

Page 31

... to meet the Board's oversight obligations. This review was presented to and discussed by the Board of Directors. Separately, as part of the Framework's governance policy, the risk management processes and activities were independently audited to ensure its effectiveness. The Internal Audit report... -

Page 32

... year, the Annual Risk Review was carried out Group-wide, with key risks surfaced and reviewed by the Company Risk Management Committees, the Group Risk Management Committee and the Board Safety & Risk Committee. 3.2 Testing of Alternate Sites of Control Centers In ensuring that controls/responses... -

Page 33

...2010 The Board and Management are committed to continually enhancing shareholder value by maintaining high standards of corporate governance, professionalism, integrity and commitment at all levels, underpinned by strong internal controls and risk management systems. This Report sets out the Company... -

Page 34

... in the financial year. The Board holds separate Strategy Sessions to assist Management in developing its plans and strategies for the future. The non-executive Directors also set aside time to meet without the presence of Management to review the latter's performance in meeting goals and objectives... -

Page 35

ANNUAL REPORT 2009/10 033 Board Executive Committee (ExCo) The members of the ExCo were Mr Stephen Lee (Chairman), Mr Chew Choon Seng, Ms Euleen Goh and Mr James Koh. The ExCo oversees the execution by Management of the overall strategy, policies, directions and guidelines set by the Board for the... -

Page 36

... Board to review and approve recommendations on remuneration policies and packages for key executives, and administer the Company's EVA-based Incentive Plan, Performance Share Plan and Restricted Share Plan for key senior executives and the Company's Employee Share Option Plan. The award of shares... -

Page 37

... and achieve sustainable growth for the Company in the changing business environment, and to foster a greater ownership culture amongst key senior management and senior executives. These PSP and RSP contemplate the award of fully paid Shares, when and after pre-determined performance and/or service... -

Page 38

SINGAPORE AIRLINES 036 corporate governance report For the period 1 April 2009 to 31 March 2010 The SIA Performance Share Plan (PSP) The PSP is targeted at a select group of key senior management who shoulder the responsibility for the Company's performance and who are able to drive the growth of ... -

Page 39

... the financial year ended 31 March 2010. See below for additional information on the EBIP. Shares awarded under the PSP and RSP are subject to performance targets and other terms and conditions being met under the respective share plans. Mr Chew Choon Seng, being the Chief Executive Officer, does... -

Page 40

SINGAPORE AIRLINES 038 corporate governance report For the period 1 April 2009 to 31 March 2010 No employee of the Group who is an immediate family member of a Director was paid a remuneration that exceeded S$150,000 during the financial year ended 31 March 2010. Performance and Restricted Shares ... -

Page 41

... Reporting The AC reviewed the interim and annual financial statements and financial announcements required by SGXST for recommendation to the Board for approval. The review focused on changes in accounting policies and practices, major judgmental and risk areas, significant adjustments resulting... -

Page 42

.... The Risk Management Report can be found on pages 29 to 30. Communication with Shareholders (Principles 14 and 15) The Company believes in prompt disclosure of pertinent information. It values dialogue with shareholders, and holds analyst and media briefings when announcing half-yearly and year-end... -

Page 43

...' Choice Award in 2000. In addition, the Company was the winner of the Golden Circle Award, an open category award for overall recognition of transparency excellence across all sectors. The Board members always endeavour to attend shareholder meetings where shareholders are given the opportunity to... -

Page 44

... and attendance of singapore airlines limited board of directors and board commitee members For the period 1 April 2009 to 31 March 2010 Board Executive Board No. of meetings Name of Directors held No. of meetings attended No. of meetings held Committee No. of meetings attended Stephen Lee... -

Page 45

ANNUAL REPORT 2009/10 043 Board Compensation and Industrial Relations Board Audit Committee No. of meetings held No. of meetings attended No. of meetings held Committee No. of meetings attended No. of meetings held Board Safety and Risk Committee No. of meetings attended No. of meetings held Board... -

Page 46

...Companies Company 1. SIA Engineering Company Limited Title Chairman Other Major Appointments Organisation/Company 1. 2. 3. Others Organisation/Company 1. 2. 3. 4. 5. Baosteel Group Corporation, China Singapore Labour Foundation Shanghai Commercial Bank Ltd, Hong Kong Chinese Development Assistance... -

Page 47

ANNUAL REPORT 2009/10 045 Others Organisation/Company 1. International Air Transport Association Title Member, Board of Governors Directorships/Appointments in the past 3 years Organisation/Company 1. Singapore Airport Terminal Services Limited Title Deputy Chairman WILLIAM FUNG KWOK LUN ... -

Page 48

SINGAPORE AIRLINES 046 further information on board of directors Current Directorships in Other Listed Companies Company 1. 2. 3. Aviva plc DBS Group Holdings Ltd Singapore Exchange Limited Title Director Director Director Other Major Appointments Organisation/Company 1. 2. 3. Others Organisation... -

Page 49

... Limited UOL Group Limited Title Director Director Director Other Major Appointments Organisation/Company 1. Others Organisation/Company 1. 2. 3. CapitaMall Trust Management Limited Governing Board for the Mechanobiology Research Centre of Excellence Singapore Deposit Insurance Corporation Limited... -

Page 50

SINGAPORE AIRLINES 048 further information on board of directors Others Organisation/Company 4. 5. 6. 7. 8. Singapore Island Country Club CapitaLand Hope Foundation Singapore Cooperation Enterprise Presidential Council for Religious Harmony UniSim School of Business Advisory Panel Title Chairman ... -

Page 51

... Equities Fund (Dubai International Capital LLC) Title Member, Advisory Board LUCIEN WONG YUEN KUAI Academic and Professional Qualifications: Bachelor of Laws (Honours), University of Singapore Current Directorships in Other Listed Companies Company 1. 2. 3. Cerebos Pacific Limited Hap Seng... -

Page 52

...the board of directors auditors' report consolidated profit and loss account consolidated statement of comprehensive income statements of financial position statements of changes in equity consolidated statement of cash flows notes to the financial statements additional information quarterly results... -

Page 53

ANNUAL REPORT 2009/10 51 financial review HIGHLIGHTS OF THE GROUP'S PERFORMANCE • Total revenue $12,707 million (-20.6 per cent) ($ million) 15,996 12,707 8,511 5,953 7,485 6,754 • Operating profit $63 million (-93.0 per cent) ($ million) 904 575 329 63 564 -501 • Profit attributable to ... -

Page 54

... review Performance of the Group Key Financial Highlights 2009-10 2008-09 R1 % Change Earnings For The Year ($ million) Revenue Expenditure Operating profit Profit attributable to equity holders of the Company Per Share Data (cents) Earnings per share - basic Dividends per share Ratios (%) Return... -

Page 55

... at the operating level, with SilkAir registering higher year-on-year profits. In contrast, Singapore Airlines and Singapore Airlines Cargo reported full year operating losses, as the passenger and cargo businesses were severely affected by the economic downturn, especially in the first half. Please... -

Page 56

SINGAPORE AIRLINES 54 financial review Performance of the Group (continued) Financial Position The Group's total assets stood at $22,484 million as at 31 March 2010, down 9.4 per cent from a year ago, mainly as a result of the divestment of SATS Group. Net asset value per share decreased 4.1 per ... -

Page 57

ANNUAL REPORT 2009/10 55 Performance of the Group (continued) Dividends For the financial year ended 31 March 2010, the Board recommends a final dividend of 12 cents per share. This amounts to a payout of approximately $143 million based on the number of issued shares as at 31 March 2010. The ... -

Page 58

SINGAPORE AIRLINES 56 financial review Performance of the Group (continued) Statements of Value Added and its Distribution 2009-10 $ million 2008-09 $ million Total revenue Less: Purchase of goods and services Add: Interest income Surplus on disposal of aircraft, spares and spare engines Dividends... -

Page 59

ANNUAL REPORT 2009/10 57 Performance of the Group (continued) Group Staff Strength and Productivity The Group's staff strength as at 31 March 2010 is as follows: 2009-10 2008-09 % Change Singapore Airlines Singapore Airport Terminal Services Group SIA Engineering Group Singapore Airlines Cargo ... -

Page 60

... AIRLINES 58 financial review Performance of the Group (continued) Proforma Consolidated Profit and Loss Account Proforma R6 2008-09 $ million 2009-10 $ million REVENUE EXPENDITURE Staff costs Fuel costs Depreciation Impairment of property, plant and equipment Amortisation of intangible assets... -

Page 61

ANNUAL REPORT 2009/10 59 Performance of the Company Operating Performance 2009-10 2008-09 % Change Passengers carried (thousand) Available seat-km (million) Revenue passenger-km (million) Passenger load factor (%) Passenger yield (¢/pkm) Passenger unit cost (¢/ask) Passenger breakeven load ... -

Page 62

...) A review of the Company's operating performance by route region is as follows: By Route Region R7 (2009-10 against 2008-09) Revenue Available Passengers Carried Passenger KM Seat KM Change (thousand) % Change % Change East Asia Americas Europe South West Pacific West Asia and Africa Systemwide... -

Page 63

ANNUAL REPORT 2009/10 61 Performance of the Company (continued) Earnings 2009-10 $ million 2008-09 $ million Change % Revenue Expenditure Operating (loss)/profit Finance charges Interest income Surplus on disposal of aircraft, spares and spare engines Dividends from subsidiary and associated ... -

Page 64

... financial review Performance of the Company (continued) Revenue The Company's revenue decreased 22.3 per cent to $10,145 million as follows: 2009-10 $ million 2008-09 $ million Change % Passenger revenue Excess baggage revenue Non-scheduled services Bellyhold revenue from Singapore Airlines Cargo... -

Page 65

... costs mainly comprised crew expenses, company accommodation cost, foreign exchange hedging and revaluation loss, comprehensive aviation insurance cost, airport lounge expenses, non-information technology contract and professional fees, expenses incurred to mount non-scheduled services, aircraft... -

Page 66

... by increase in rates from new aircraft type joining the fleet. Inflight meals and other passenger costs fell $38 million due mainly to decrease in number of passengers uplifted. Airport and overflying charges was $47 million lower, largely due to decrease in number of trips. Sales cost decreased... -

Page 67

...in fuel productivity (passenger aircraft) of 1.0 per cent would impact the Company's annual fuel cost by about $30 million, before accounting for changes in fuel price, USD exchange rate and flying operations. A change in the price of fuel of one USD per barrel affects the Company's annual fuel cost... -

Page 68

SINGAPORE AIRLINES 66 financial review Performance of the Company (continued) Staff Strength and Productivity The Company's staff strength as at 31 March 2010 was 13,382, a decrease of 1,104 over last year. The distribution of employee strength by category and location is as follows: 2009-10 2008... -

Page 69

... at 31 March 2009. Basic earnings per share was 21.9 cents for the financial year ended 31 March 2010, a decrease of 2.3 cents per share over last year. Singapore Airlines Cargo 2009-10 $ million 2008-09 $ million Change % Total revenue Total expenditure Operating loss Loss after taxation 2,296... -

Page 70

... Cargo's operating fleet stood at 11 B747-400 freighters. As at 31 March 2010, Singapore Airlines Cargo's equity attributable to equity holders of the Company was $1,682 million (-4.1 per cent). SilkAir 2009-10 $ million 2008-09 $ million Change % Total revenue Total expenditure Operating profit... -

Page 71

... with the audited financial statements of the Group and of the Company for the financial year ended 31 March 2010. 1 Directors of the Company The names of the directors in office at the date of this report are: Stephen Lee Ching Yen - Chairman Chew Choon Seng - Chief Executive Officer Euleen Goh Yiu... -

Page 72

... performance shares (Note 2) Chew Choon Seng - Base Awards 100,215 18,472 100,800 38,854 - - 134,625 173,483 - - Interest in SIA Engineering Company Limited Ordinary shares Chew Choon Seng Lucien Wong Yuen Kuai 20,000 - 20,000 - - 112,000 Interest in Singapore Airport Terminal Services... -

Page 73

...paid ordinary shares will range from 0% to 200% of the Base Awards and is contingent on the Achievements against Targets over the three-year performance periods relating to the relevant awards. * Singapore Airport Terminal Services Limited ("SATS") ceased to be a related corporation of the Company... -

Page 74

... financial interest. 5 Equity Compensation Plans of the Company The Company has in place, the Singapore Airlines Limited Employee Share Option Plan ("ESOP"), Restricted Share Plan ("RSP") and Performance Share Plan ("PSP"). At the date of this report, the Board Compensation & Industrial Relations... -

Page 75

... financial statements. At the end of the financial year, options to take up 52,411,320 unissued shares in the Company were outstanding: Number of options to subscribe for unissued ordinary shares Date of grant Balance at 1.4.2009 Cancelled Exercised Balance at 31.3.2010 Exercise price* Exercisable... -

Page 76

..., have been increased by 12% to adjust for the drop in value of the share awards. The adjustments have been verified by Ernst & Young LLP, the auditors of the Company, and approved by the Board Compensation & Industrial Relations Committee. No employee has received 5% or more of the total number of... -

Page 77

... financial year Adjustment arising from dividend in specie* Balance as at 31 March 2010 Aggregate ordinary shares released to participant since commencement of RSP to end of financial year under review Chew Choon Seng 18,472 50,840 34,620 4,162 38,854 53,120 3. PSP Base Awards R2 Name... -

Page 78

SINGAPORE AIRLINES 76 report by the board of directors 6 Equity Compensation Plans of Subsidiary Company (i) SIA Engineering Company Limited ("SIAEC") Employee Share Option Plan At the end of the financial year, options to take up 56,666,363 unissued shares in SIAEC were outstanding. Details and ... -

Page 79

... Choon Seng, being two of the directors of Singapore Airlines Limited, do hereby state that in the opinion of the directors: (i) the accompanying statements of financial position, consolidated profit and loss account, consolidated statement of comprehensive income, statements of changes in equity... -

Page 80

...statements of Singapore Airlines Limited (the "Company") and its subsidiaries (collectively, the "Group") set out on pages 80 to 194, which comprise the statements of financial position of the Group and the Company as at 31 March 2010, the statements of changes in equity of the Group and the Company... -

Page 81

... of the Act and Singapore Financial Reporting Standards so as to give a true and fair view of the state of affairs of the Group and of the Company as at 31 March 2010 and the results, changes in equity and cash flows of the Group and the changes in equity of the Company for the year ended on that... -

Page 82

SINGAPORE AIRLINES 80 consolidated profit and loss account for the financial year ended 31 march 2010 (in $ million) The Group Notes 2009-10 2008-09 REVENUE EXPENDITURE Staff costs Fuel costs Depreciation Impairment of property, plant and equipment Amortisation of intangible assets Aircraft ... -

Page 83

ANNUAL REPORT 2009/10 81 consolidated statement of comprehensive income for the financial year ended 31 march 2010 (in $ million) The Group 2009-10 2008-09 PROFIT FOR THE FINANCIAL YEAR OTHER COMPREHENSIVE INCOME: Currency translation differences Available-for-sale financial assets Cash flow ... -

Page 84

SINGAPORE AIRLINES 82 statements of financial position at 31 march 2010 (in $ million) The Group Notes 2010 2009 The Company 2010 2009 EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY Share capital Treasury shares Capital reserve Foreign currency translation reserve Share-based compensation ... -

Page 85

ANNUAL REPORT 2009/10 83 The Group Notes 2010 2009 The Company 2010 2009 Less: CURRENT LIABILITIES Sales in advance of carriage Deferred revenue Current tax payable Trade and other creditors Amounts owing to subsidiary companies Amounts owing to associated companies Finance lease commitments ... -

Page 86

SINGAPORE AIRLINES 84 statements of changes in equity for the financial year ended 31 march 2010 (in $ million) The Group Share Notes capital Treasury shares Capital reserve Balance at 1 April 2009 Total comprehensive (expense)/income for the financial year Issuance of share capital by a ... -

Page 87

ANNUAL REPORT 2009/10 85 Attributable to Equity Holders of the Company Foreign currency translation reserve Share-based compensation reserve Fair value reserve General reserve Total Minority interests Total equity (137.9) (22.7) 23.6 (137.0) 187.3 (3.2) 43.5 (3.4) (3.0) (13.7) (22.2) 185.3 (660... -

Page 88

SINGAPORE AIRLINES 86 statements of changes in equity for the financial year ended 31 march 2010 (in $ million) The Group Share Notes capital Treasury shares Capital reserve Balance at 1 April 2008 Total comprehensive (expense)/income for the financial year Issuance of share capital by ... -

Page 89

ANNUAL REPORT 2009/10 87 Attributable to Equity Holders of the Company Foreign currency translation reserve Share-based compensation reserve Fair value reserve General reserve Total Minority interests Total equity (130.7) (7.2) (137.9) 136.4 (6.4) 68.6 (0.2) (1.1) (10.0) 187.3 443.4 (1,104.2) (... -

Page 90

SINGAPORE AIRLINES 88 statements of changes in equity for the financial year ended 31 march 2010 (in $ million) The Company Notes 2010 Balance at 1 April 2009 Total comprehensive income for the financial year Share-based compensation expense Share options exercised Share options lapsed Treasury ... -

Page 91

ANNUAL REPORT 2009/10 89 Share-based Share capital Treasury shares Capital reserve compensation reserve Fair value reserve General reserve Total 1,684.8 65.8 1,750.6 (44.4) 43.5 (0.9) (3.7) 6.2 2.5 135.0 32.3 (3.4) (2.3) (13.7) 147.9 (496.0) 410.7 (85.3) 11,623.3 1,426.1 2.3 (1,146.3) (236... -

Page 92

...of aircraft, spares and spare engines Surplus on disposal of non-current assets Dividends from long-term investments, gross Other non-operating items Share of profits of joint venture companies Share of profits of associated companies Operating profit before working capital changes Decrease in trade... -

Page 93

... issuance of share capital by subsidiary companies to minority interests Proceeds from exercise of share options Purchase of treasury shares NET CASH USED IN FINANCING ACTIVITIES NET CASH INFLOW/ (OUTFLOW) CASH AND CASH EQUIVALENTS AT BEGINNING OF FINANCIAL YEAR Effect of exchange rate changes CASH... -

Page 94

... office of the Company is at Airline House, 25 Airline Road, Singapore 819829. The principal activities of the Group consist of passenger and cargo air transportation, airport terminal and food operations, engineering services, training of pilots, air charters and tour wholesaling and related... -

Page 95

... one single statement, or two linked statements. The Group has elected to present this statement as two linked statements. Amendments to FRS 107: Improving Disclosures about Financial Instruments The amendments to FRS 107 require additional disclosure about fair value measurement and liquidity risk... -

Page 96

... goods or services upon the redemption of the award credits. The adoption of this interpretation did not result in a change in accounting policy of the Company as the current accounting treatment of the Company's award credits granted under the frequent flyer programme ("KrisFlyer") is closely... -

Page 97

.... Any excess of the cost of the business combination over the Group's share in the net fair value of the acquired subsidiary company's identifiable assets, liabilities and contingent liabilities is recorded as goodwill on the statement of financial position. The accounting policy for goodwill is set... -

Page 98

... in associated companies are accounted for using the equity method. Under the equity method, the investment in associated company is measured in the statement of financial position at cost plus postacquisition changes in the Group's share of net assets of the associated company. Goodwill relating to... -

Page 99

...used are not co-terminous with those of the Group, the share of results is arrived at from the last audited financial statements available and unaudited management financial statements to the end of the accounting period. Where necessary, adjustments are made to bring the accounting policies in line... -

Page 100

... losses. These intangible assets are amortised in the profit and loss account on a straight-line basis over their estimated useful lives as follows: Brands Customer relationships Licences 17 years 5 years 14 years (iv) Deferred engine development cost This relates to the Group's share of engine... -

Page 101

... condition for its intended use. The cost of all aircraft is stated net of manufacturers' credit. Aircraft and related equipment acquired on an exchange basis are stated at amounts paid plus the fair value of the fixed asset traded-in. Expenditure for heavy maintenance visits on aircraft and engine... -

Page 102

...new freighter aircraft over 15 years to 20% residual values. For used freighter aircraft, the Group depreciates them over the remaining life (15 years less age of aircraft) to 20% residual value. Major inspection costs relating to landing gear overhauls, heavy maintenance visits and engine overhauls... -

Page 103

...so as to achieve a constant rate of interest on the remaining balance of the liability. Finance charges are charged directly against the profit and loss account. For sale and finance leaseback, differences between sales proceeds and net book values are taken to the statement of financial position as... -

Page 104

... in profit or loss. All regular way purchases and sales of financial assets are recognised or derecognised on the trade date, i.e., the date that the Group commits to purchase or sell the asset. Regular way purchases or sales are purchases or sales of financial assets that require delivery of assets... -

Page 105

ANNUAL REPORT 2009/10 103 2 Summary of Significant Accounting Policies (continued) (l) Financial assets (continued) (i) Financial assets at fair value through profit and loss There are two sub-categories: financial assets held for trading, and those designated as fair value through profit or loss... -

Page 106

SINGAPORE AIRLINES 104 notes to the financial statements 31 march 2010 2 Summary of Significant Accounting Policies (continued) (o) Investments Short-term investments held by the Group are classified as available-for-sale and are stated at fair values. Fair value is determined in the manner ... -

Page 107

...'s carrying amount and the present value of estimated future cash flows discounted at the current market rate of return for a similar financial asset. Such impairment losses are not reversed in subsequent periods. (iii) Available-for-sale financial assets Significant or prolonged decline in fair... -

Page 108

SINGAPORE AIRLINES 106 notes to the financial statements 31 march 2010 2 Summary of Significant Accounting Policies (continued) (s) Financial liabilities Financial liabilities are recognised on the statement of financial position when, and only when, the Group becomes a party to the contractual ... -

Page 109

... line maintenance) based on past experience of the level of repairs. Provision for return costs to meet contractual return aircraft minimum conditions, at the end of the lease terms for the aircraft under operating leases, are recorded equally over the lease terms. (w) Share capital and share... -

Page 110

... the year when the asset is realised or the liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted at the end of the reporting period Deferred income tax relating to items recognised outside profit or loss is recognised outside profit or loss. Deferred... -

Page 111

... for services rendered. The Group has in place, the Singapore Airlines Limited Employee Share Option Plan and the SIA Engineering Company Limited Employee Share Option Plan for granting of share options to senior executives and all other employees. The exercise price approximates the market value of... -

Page 112

...) Employee benefits (continued) (i) Equity compensation plans (continued) The Group has also implemented the Singapore Airlines Limited Restricted Share Plan and Performance Share Plan and the SIA Engineering Company Limited Restricted Share Plan and Performance Share Plan for awarding of fully paid... -

Page 113

... thirdparty maintenance agreements, a portion of the cost is expensed at a fixed rate per hour during the terms of the agreements. (ae) Training and development costs Training and development costs, including start-up programme costs, are charged to the profit and loss account in the financial year... -

Page 114

...factors used to identify the reportable segments and the measurement basis of segment information. The significant business segments of the Group are airline operations, airport terminal and food operations, engineering services and cargo operations. (ii) Geographical segment The analysis of revenue... -

Page 115

... lives and residual values are reviewed on an annual basis. The carrying amount of the Group's and the Company's aircraft fleet at 31 March 2010 was $12,474.9 million (2009: $12,448.2 million) and $10,347.5 million (2009: $10,212.6 million) respectively. (iii) Passenger revenue recognition Passenger... -

Page 116

... the financial year, the Company revised the estimated breakage rate. The impact of the revision in estimate is an increase of $75.4 million in revenue. (v) Aircraft maintenance and overhaul expenditure under power-by-hour agreements The Group has entered into several power-by-hour ("PBH") engine... -

Page 117

ANNUAL REPORT 2009/10 115 4 Segment Information (in $ million) (continued) (iv) The cargo operations segment is involved in air cargo transportation and related activities. (v) Other services provided by the Group, such as training of pilots, air charters and tour wholesaling, has been aggregated... -

Page 118

SINGAPORE AIRLINES 116 notes to the financial statements 31 march 2010 4 Segment Information (in $ million) (continued) Business segments The Group's businesses are organised and managed separately according to the nature of the services provided. The following tables present revenue and profit ... -

Page 119

ANNUAL REPORT 2009/10 117 Airport terminal and food operations 2009-10 Engineering services 2009-10 Cargo operations 2009-10 Others 2009-10 Total of segments 2009-10 Elimination* 2009-10 Consolidated 2009-10 370.4 226.5 596.9 70.5 (3.3) 0.4 0.8 16.7 (18.2) 66.9 370.0 636.4 1,006.4 110.4 1.0 15.5... -

Page 120

SINGAPORE AIRLINES 118 notes to the financial statements 31 march 2010 4 Segment Information (in $ million) (continued) Business segments (continued) Airline operations 2008-09 TOTAL REVENUE External revenue Inter-segment revenue RESULTS Segment result Finance charges Interest income Surplus on ... -

Page 121

ANNUAL REPORT 2009/10 119 Airport terminal and food operations 2008-09 Engineering services 2008-09 Cargo operations 2008-09 Others 2008-09 Total of segments 2008-09 Elimination* 2008-09 Consolidated 2008-09 451.2 610.9 1,062.1 358.5 686.8 1,045.3 2,965.7 8.3 2,974.0 60.5 133.4 193.9 15,996.3... -

Page 122

SINGAPORE AIRLINES 120 notes to the financial statements 31 march 2010 4 Segment Information (in $ million) (continued) Business segments (continued) Airline operations 2010 OTHER INFORMATION AT 31 MARCH Segment assets Investments in and loans to associated and joint venture companies Long-term ... -

Page 123

ANNUAL REPORT 2009/10 121 Airport terminal and food operations 2010 Engineering services 2010 Cargo operations 2010 Others 2010 Total of segments 2010 Elimination* 2010 Consolidated 2010 14.9 28.3 10.0 (1.2) 1,075.6 470.8 14.6 1,561.0 217.2 52.1 269.3 39.6 14.3 34.4 4.2 6.0 2,637.8 16.8 2,654.6... -

Page 124

SINGAPORE AIRLINES 122 notes to the financial statements 31 march 2010 4 Segment Information (in $ million) (continued) Business segments (continued) Airline operations 2009 OTHER INFORMATION AT 31 MARCH Segment assets Investments in and loans to associated and joint venture companies Goodwill on... -

Page 125

ANNUAL REPORT 2009/10 123 Airport terminal and food operations 2009 Engineering services 2009 Cargo operations 2009 Others 2009 Total of segments 2009 Elimination* 2009 Consolidated 2009 1,459.6 335.2 242.3 7.9 0.2 2,045.2 226.6 20.9 232.7 0.5 148.2 628.9 25.3 2.8 58.5 9.7 6.1 (7.7) 957.2 530.4 ... -

Page 126

... presents revenue information on airline operations by geographical areas for the financial years ended 31 March 2010 and 2009. By area of original sale 2009-10 2008-09 East Asia Europe South West Pacific Americas West Asia and Africa Systemwide Non-scheduled services and incidental revenue 3,791... -

Page 127

...5 Staff Costs (in $ million) (continued) Share-based compensation expense The Company has in place the Singapore Airlines Limited Employee Share Option Plan ("ESOP"), Restricted Share Plan ("RSP") and Performance Share Plan ("PSP') and the amounts recognised in the profit and loss account for share... -

Page 128

SINGAPORE AIRLINES 126 notes to the financial statements 31 march 2010 5 Staff Costs (in $ million) (continued) Share-based compensation expense (continued) Share option plans (continued) Movement of share options during the financial year The following table illustrates the number and weighted ... -

Page 129

... (years) Exercise price ($) Share price at date of grant ($) * Management's forecast in line with dividend policy 22.58 - 28.24 2.66 - 3.12 5.5 - 7.0 13.12* 14.60 Following approval by the Company's shareholders of the dividend in specie of SATS shares on 31 July 2009, the Board Compensation... -

Page 130

SINGAPORE AIRLINES 128 notes to the financial statements 31 march 2010 5 Staff Costs (in $ million) (continued) Share-based compensation expense (continued) Share option plans (continued) Terms of share options outstanding as at 31 March 2010: Exercisable period Excercise price Number ... -

Page 131

ANNUAL REPORT 2009/10 129 5 Staff Costs (in $ million) (continued) Share-based compensation expense (continued) Share option plans (continued) Exercisable period Excercise price Number outstanding Number exercisable 2.7.2009 - 1.7.2017 2.7.2010 - 1.7.2017 2.7.2011 - 1.7.2017 1.7.2009 - 30.6.2018... -

Page 132

SINGAPORE AIRLINES 130 notes to the financial statements 31 march 2010 5 Staff Costs (in $ million) (continued) Share-based compensation expense (continued) Share-based incentive plans The RSP and PSP are share-based incentive plans for senior executives and key senior management, which were ... -

Page 133

... of three-year performance period upon meeting stated performance targets. Following approval by the Company's shareholders of the dividend in specie of SATS shares on 31 July 2009, the Board Compensation & Industrial Relations Committee approved an increase in all performance shares outstanding on... -

Page 134

SINGAPORE AIRLINES 132 notes to the financial statements 31 march 2010 5 Staff Costs (in $ million) (continued) Share-based compensation expense (continued) Share-based incentive plans (continued) Fair values of share awards granted The fair value of services received in return for shares awarded ... -

Page 135

...plans (continued) Fair values of share awards granted (continued) For performance share grants with non-market conditions, the Group revises its estimates of the number of share grants expected to vest and corresponding adjustments are made to the profit and loss account and share-based compensation... -

Page 136

SINGAPORE AIRLINES 134 notes to the financial statements 31 march 2010 7 Finance Charges (in $ million) The Group 2009-10 2008-09 Notes payable Loans Finance lease commitments Other receivables measured at amortised cost Realised loss on interest rate swap contracts accounted as cash flow hedges ... -

Page 137

...tax for reduction in Singapore statutory corporate tax rate Deferred taxation related to other comprehensive income: The Group 2009-10 2008-09 Available-for-sale financial assets Cash flow hedges Share of comprehensive expense of associated and joint venture companies 2.0 110.6 0.2 112.8 1.0 153... -

Page 138

SINGAPORE AIRLINES 136 notes to the financial statements 31 march 2010 10 Taxation (in $ million) (continued) A reconciliation between taxation expense and the product of accounting profit multiplied by the applicable tax rate for the years ended 31 March is as follows: The Group 2009-10 2008-09 ... -

Page 139

ANNUAL REPORT 2009/10 137 11 Earnings Per Share (continued) Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Company by the weighted average number of ordinary shares in issue during the financial year. For purposes of calculating diluted ... -

Page 140

SINGAPORE AIRLINES 138 notes to the financial statements 31 march 2010 13 Share Capital (in $ million) The Group and the Company 2010 2009 Number of shares 2010 Amount 2009 Issued and fully paid share capital Ordinary shares Balance at 1 April Share options exercised during the year Balance at 31... -

Page 141

... of fulfilling the Company's obligations under the equity compensation plans. In the previous financial year, the Company purchased 5,177,000 of its ordinary shares by way of on-market purchases at share prices ranging from $9.48 to $16.07. The total amount paid to purchase the shares was $64... -

Page 142

...of the cumulative value of services received from employees recorded on grant of equity-settled share options and awards. (d) Fair value reserve Fair value reserve records the cumulative fair value changes of available-for-sale financial assets and the portion of the fair value changes (net of tax... -

Page 143

...changes Share of associated companies' net gain/(loss) on fair value reserve Recognised in the carrying value of non-financial assets on occurrence of capital expenditure commitments Recognised in the profit and loss account on occurrence of: Fuel hedging contracts recognised in "Fuel costs" Foreign... -

Page 144

SINGAPORE AIRLINES 142 notes to the financial statements 31 march 2010 17 Deferred Taxation (in $ million) The Group Statement of financial position 31 March Profit and loss The Company Statement of financial position 31 March 2010 The deferred taxation arises as a result of: Deferred tax ... -

Page 145

...). Loans During the financial year, the Group repaid an unsecured loan of $0.8 million which was a revolving credit facility denominated in USD taken by a subsidiary company bearing interest of 1.20% per annum over the bank prevailing Singapore Interbank Offered Rate. The Group also repaid unsecured... -

Page 146

... interest rates ranged from 4.20% to 4.50% per annum. The Group 31 March 2010 2009 Not later than one year Later than one year but not later than five years Later than five years - 32.7 9.2 2.1 44.0 Finance leases commitments Singapore Airlines Cargo Pte Ltd ("SIA Cargo") holds four B747... -

Page 147

... made for upgrade costs and return costs for aircraft under sales and leaseback arrangement. It is expected that the return costs will be incurred by the end of the lease terms. An analysis of the provisions is as follows: The Group 31 March 2010 2009 The Company 31 March 2010 2009 Balance... -

Page 148

SINGAPORE AIRLINES 146 notes to the financial statements 31 march 2010 19 Property, Plant and Equipment (in $ million) The Group Aircraft Aircraft Aircraft spares spare engines Cost At 1 April 2008 Additions Acquisition of subsidiary companies Transfer to investment properties Transfers Disposals ... -

Page 149

ANNUAL REPORT 2009/10 147 Leasehold Freehold land Freehold buildings land and buildings Plant and equipment Office and computer equipment Advance and progress payments Total 15.7 1.4 17.1 (1.4) 15.7 151.1 0.7 14.0 165.8 (14.7) (0.4) 150.7 1,329.1 10.3 81.7 (16.3) (11.3) 1,393.5 11.1 (807.1) ... -

Page 150

SINGAPORE AIRLINES 148 notes to the financial statements 31 march 2010 19 Property, Plant and Equipment (in $ million) (continued) The Company Aircraft Aircraft Aircraft spares spare engines Cost At 1 April 2008 Additions Transfers Disposals At 31 March 2009 Additions Transfers Disposals At 31 ... -

Page 151

ANNUAL REPORT 2009/10 149 Leasehold Freehold land Freehold buildings land and buildings Plant and equipment Office and computer equipment Advance and progress payments Total 15.7 15.7 15.7 151.1 151.1 (0.4) 150.7 351.7 (10.0) 341.7 341.7 408.3 18.4 (3.1) 423.6 2.1 11.6 (9.8) 427.5 307.4 40... -

Page 152

...The Group 31 March 2010 2009 Net book value of: - plant and equipment - freehold land - freehold buildings - leasehold buildings - 21.6 1.4 12.8 10.2 46.0 The property, plant and equipment mortgaged under bank loans were related to a subsidiary company that was disposed during the financial year... -

Page 153

ANNUAL REPORT 2009/10 151 20 Intangible Assets (in $ million) The Group Deferred engine development cost Advance and progress payments Goodwill arising on consolidation Computer software Brands Customer relationships Licences Total Cost At 1 April 2008 Additions: - Internal development - ... -

Page 154

SINGAPORE AIRLINES 152 notes to the financial statements 31 march 2010 20 Intangible Assets (in $ million) (continued) The Group (continued) Goodwill arising on consolidation In 2002-03, SATS acquired 66.7% equity interest in Country Foods Pte Ltd at a cost of $6.0 million. Goodwill on acquisition ... -

Page 155

... and equipment Disposal of a subsidiary company Depreciation Balance at 31 March Cost Accumulated depreciation Net book value 7.0 (6.8) (0.2) - 7.3 (0.3) 7.0 16.3 (9.3) 7.0 The property rental income earned by the Group for the year ended 31 March 2010 from its investment properties which are... -

Page 156

... Amounts owing by subsidiary companies Market value of quoted equity investments # ## The value is $1. The value is $2. During the financial year: 1. SIAEC injected an additional $1.9 million in SIA Engineering Philippines ("SIAE(PH)"). There was no change in SIAEC's 65.0% equity stake in SIAE(PH... -

Page 157

... per annum for AUD funds. As at 31 March 2010, the composition of funds from subsidiary companies held in foreign currencies by the Company is as follows: USD - 21.0% (2009: 9.4%) and AUD - 0.7% (2009: 0.4%). Amounts owing to/by subsidiary companies are unsecured, trade-related, non-interest bearing... -

Page 158

... Percentage of equity held by the Group 2010 2009 Principal activities Country of incorporation and place of business SIA Engineering Company Limited Aircraft Maintenance Services Australia Pty Ltd* NexGen Network (1) Holding Pte Ltd@ NexGen Network (2) Holding Pte Ltd@ SIA Engineering (USA), Inc... -

Page 159

... Marketing of Abacus Computer reservations systems Pilot recruitment Singapore - do - do - do Mauritius 100.0 100.0 76.0 61.0 100.0 100.0 100.0 95.3 61.0 100.0 The following companies are part of SATS Group which was disposed during the financial year: Singapore Airport Terminal Services Limited... -

Page 160

SINGAPORE AIRLINES 158 notes to the financial statements 31 march 2010 22 Subsidiary Companies (in $ million) (continued) Percentage of equity held by the Group 2010 2009 Principal activities Country of incorporation and place of business Brash Brothers Limited## Daniels Chilled Foods Limited##... -

Page 161

... the share of post-acquisition capital reserve. SIAEC acquired a 49.0% stake in SAFRAN Electronics Asia Pte Ltd. Tiger Airways Holdings Limited ("TIG") was listed on the SGX-ST in January 2010 and pursuant to the listing, the Group's shareholdings in TIG decreased from 49.0% to 34.0%. As a result... -

Page 162

SINGAPORE AIRLINES 160 notes to the financial statements 31 march 2010 23 Associated Companies (in $ million) (continued) The customer-related intangible assets arose from SATS' acquisition of associated companies. SATS had engaged an independent third party to perform a fair valuation of these ... -

Page 163

... Sri Persada Great Wall Airlines Company Limited++ Quality service training Singapore Air transportation United Kingdom Investment holding Singapore Hotel ownership and management - do Repair and overhaul of aircraft engine - do combustion chambers, guides, fuel nozzles and related parts Repair and... -

Page 164

...and place of business The following companies are part of SATS Group which was disposed during the financial year: PT Jasa Angkasa Semesta Tbk#++ Asia Airfreight Terminal Co Ltd* Aviserv Ltd**++ Servair-SATS Holding Company Pte Ltd##++ Taj SATS Air Catering Limited# Beijing Airport Inflight Kitchen... -

Page 165

... cost) Share of post-acquisition reserves - general reserve - foreign currency translation reserve 56.6 66.6 (14.6) 108.6 56.9 74.7 (4.1) 127.5 The Group's share of the consolidated assets and liabilities, and results of joint venture companies are as follows: The Group 31 March 2010 2009 Assets... -

Page 166

SINGAPORE AIRLINES 164 notes to the financial statements 31 march 2010 24 Joint Venture Companies (in $ million) (continued) The joint venture companies at 31 March are: Percentage of equity held by the Group 2010 2009 Principal activities Country of incorporation and place of business ... -

Page 167

...as at 31 March 2009. 27 Inventories (in $ million) The Group 31 March 2010 2009 The Company 31 March 2010 2009 Technical stocks and stores Catering and general stocks Work-in-progress Total inventories at lower of cost and net realisable value 368.5 17.1 43.9 429.5 383.4 70.8 49.0 503.2 297.7 12... -

Page 168

SINGAPORE AIRLINES 166 notes to the financial statements 31 march 2010 28 Trade Debtors (in $ million) The table below is an analysis of trade debtors as at 31 March: The Group 31 March 2010 2009 The Company 31 March 2010 2009 Not past due and not impaired Past due but not impaired 1,236.0 110.5 ... -

Page 169

... written off directly to profit and loss account, net of debts recovered 35.8 (2.7) (7.1) 26.0 17.1 12.3 (0.6) 7.0 35.8 11.6 (1.7) (1.3) 8.6 4.4 7.2 11.6 0.8 2.4 0.7 1.2 As at 31 March 2010, the composition of trade debtors held in foreign currencies by the Group is as follows: USD - 40... -

Page 170

SINGAPORE AIRLINES 168 notes to the financial statements 31 march 2010 30 Investments (in $ million) The Group 31 March 2010 2009 The Company 31 March 2010 2009 Available-for-sale investments Quoted investments Government securities Equity investments Non-equity investments Unquoted investments ... -

Page 171

... 31 March 2010. Included in the Group's bank overdrafts as at 31 March 2009, was a secured banking facility of $1.8 million offered to certain subsidiary companies. It was secured on the property, plant and equipment and other assets of these subsidiary companies with a total carrying value of $141... -

Page 172

SINGAPORE AIRLINES 170 notes to the financial statements 31 march 2010 35 Capital and Other Commitments (in $ million) (continued) (b) Operating lease commitments As lessee Aircraft The Company has 2 B747-400, 4 B777-200, 3 B777-200ER, 7 B777-300, 11 A330-300 and 5 A380-800 aircraft under operating... -

Page 173

... for office and computer equipment, leasehold land and buildings. These non-cancellable leases have lease terms of between 1 to 30 years. Future lease payments under non-cancellable operating leases are as follows: The Group 31 March 2010 2009 The Company 31 March 2010 2009 Not later than one year... -

Page 174

..., Australia, Canada, New Zealand, South Africa, South Korea, and Switzerland on whether surcharges, rates or other competitive aspects of air cargo service were lawfully determined ("the air cargo issues"). These investigations remain ongoing. SIA Cargo and the Company are cooperating in relation to... -

Page 175

... the financial statements. (c) Passengers: Civil Class Actions and Investigations by Competition Authorities The Company and several airlines have been named in civil class action damages lawsuits in the US and Canada alleging an unlawful agreement to fix surcharges and rates on transpacific flights... -

Page 176

... basis: Derivatives at fair value through profit and loss Loans and receivables Availablefor-sale financial assets Derivatives used for hedging Financial liabilities at amortised cost Total 2010 The Group Assets Long-term investments Other non-current assets Trade debtors Deposits and other... -

Page 177

...-sale financial assets Financial liabilities at amortised cost Loans and receivables Derivatives used for hedging Total The Company Assets Long-term investments Other non-current assets Trade debtors Deposits and other debtors Amounts owing by subsidiary companies Investments Cash and bank... -

Page 178

SINGAPORE AIRLINES 176 notes to the financial statements 31 march 2010 37 Financial Instruments (in $ million) (continued) (a) Classification of financial instruments (continued) Derivatives at fair value through profit and loss Loans and receivables Availablefor-sale financial assets ... -

Page 179

...-sale financial assets Financial liabilities at amortised cost Loans and receivables Derivatives used for hedging Total The Company Assets Long-term investments Other non-current assets Trade debtors Deposits and other debtors Amounts owing by subsidiary companies Investments Cash and bank... -

Page 180

... (continued) Derivative financial instruments included in the statements of financial position are as follows: The Group 31 March 2010 2009 The Company 31 March 2010 2009 Assets* Currency hedging contracts Fuel hedging contracts Cross currency swap contracts Interest rate cap contracts Liabilities... -

Page 181

... by level of fair value hierarchy: The Group 31 March 2010 Quoted prices in active markets for identical instruments (Level 1) Significant other observable inputs (Level 2) Total Financial assets: Available-for-sale financial assets (Note 30) Quoted investments - Government securities - Equity... -

Page 182

...daily MOPS price. The continuously compounded risk-free rate estimated as average of the past 12 months Singapore Government Securities benchmark issues' one-year yield (2009-10: 0.41%, 2008-09: 0.88%) was also applied to each individual jet fuel option contract to derive their estimated fair values... -

Page 183

... risks, including the effects of changes in jet fuel prices, foreign currency exchange rates, interest rates and the market value of its investments. The Group's overall risk management approach is to moderate the effects of such volatility on its financial performance. The Group's policy is to use... -

Page 184

SINGAPORE AIRLINES 182 notes to the financial statements 31 march 2010 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (a) Jet fuel price risk (continued) Jet fuel price sensitivity analysis (continued) The fuel hedging sensitivity analysis is based on contracts that... -

Page 185

ANNUAL REPORT 2009/10 183 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (b) Foreign currency risk (continued) Fair value through profit and loss In addition, there are cross currency swap contracts in place where the Group pays SGD and receives USD with exchange ... -

Page 186

SINGAPORE AIRLINES 184 notes to the financial statements 31 march 2010 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (c) Interest rate risk The Group's earnings are also affected by changes in interest rates due to the impact such changes have on interest income ... -

Page 187

ANNUAL REPORT 2009/10 185 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (c) Interest rate risk (continued) Interest rate sensitivity analysis (continued) Under these assumptions, an increase or decrease in market interest rates of one basis point for all ... -

Page 188

SINGAPORE AIRLINES 186 notes to the financial statements 31 march 2010 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (d) Market price risk The Group and the Company owned $140.6 million (2009: $655.6 million) and $80.0 million (2009: $587.6 million) in available-... -

Page 189

... 1-2 years 2-3 years 3-4 years 4-5 years Total 2010 The Group Notes payable Finance lease commitments Trade and other creditors Amounts owing to associated companies Derivative financial instruments: Currency hedging contracts Fuel hedging contracts Cross currency swap contracts Interest rate... -

Page 190

SINGAPORE AIRLINES 188 notes to the financial statements 31 march 2010 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (e) Liquidity risk (continued) More than 5 years Within 1 year 1-2 years 2-3 years 3-4 years 4-5 years Total 2009 The Group Notes payable ... -

Page 191

ANNUAL REPORT 2009/10 189 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (f) Credit risk The Group has an independent Group Debts Review Committee to review the follow up actions on outstanding receivables monthly. On a day-to-day basis, the respective Finance ... -

Page 192

SINGAPORE AIRLINES 190 notes to the financial statements 31 march 2010 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (g) Counterparty risk Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments. ... -

Page 193

... liquidity to mitigate the effect of unforeseen events on cash flows. The Directors regularly review the Company's capital structure and make adjustments to reflect economic conditions, business strategies and future commitments. The Group monitors capital using a gearing ratio, which is total debt... -

Page 194

...the financial statements, these were the following significant related party transactions which were carried out in the normal course of business on terms that prevail in arm's length transactions during the financial year: The Group 2009-10 2008-09 The Company 2009-10 2008-09 Purchases of services... -

Page 195

... to end of financial year under review Name of participant Balance as at 1 April 2009 Base Awards granted during the financial year Base Awards vested during the financial year Adjustment arising from dividend in specie* Balance as at 31 March 2010 Chew Choon Seng Bey Soo Khiang Huang Cheng... -

Page 196

... the financial year# Final Awards released during the financial year Adjustment arising from dividend in specie* Balance as at 31 March 2010 Aggregate ordinary shares released to participant since commencement of RSP to end of financial year under review Chew Choon Seng Bey Soo Khiang Huang... -

Page 197

...Limited Singapore Airport Terminal Services Limited Taj Madras Flight Kitchen Pvt Limited Taj SATS Air Catering Ltd Tan Son Nhat Cargo Services Ltd (TCS) Temasek Holdings (Private) Limited Group Asprecise Pte Ltd Certis CISCO Security Pte Ltd Great Wall Airlines Company Ltd MediaCorp Pte Ltd PT Bank... -

Page 198

SINGAPORE AIRLINES 196 quarterly results of the group 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total TOTAL REVENUE 2009-10 2008-09 ($ million) ($ million) 2,871.4 4,131.7 3,082.1 4,379.3 3,418.0 4,164.0 3,335.8 3,321.3 12,707.3 15,996.3 TOTAL EXPENDITURE 2009-10 2008-09 ($ million) ($ ... -

Page 199

...Singapore Aircraft Leasing Enterprise Pte Ltd Profit before taxation Profit attributable to equity holders of the Company STATEMENT OF FINANCIAL POSITION ($ million) Share capital Treasury shares Capital reserve Foreign currency translation reserve Share-based compensation reserve Fair value reserve... -

Page 200

...) Dividend cover (times) PROFITABILITY RATIOS (%) Return on equity holders' funds R4 Return on total assets R5 Return on turnover R6 PRODUCTIVITY AND EMPLOYEE DATA Value added ($ million) Value added per employee ($) R7 Revenue per employee ($) R7 Average employee strength S$ per US$ exchange rate... -

Page 201

...-01 SINGAPORE AIRLINES FINANCIAL R1 Total revenue Total expenditure Operating (loss)/profit Profit before taxation Profit after taxation Capital disbursements R2 Passenger - yield - unit cost - breakeven load factor OPERATING PASSENGER FLEET Aircraft Average age Industry-wide average age PASSENGER... -

Page 202

... Group operating fleet consisted of 136 aircraft - 125 passenger aircraft and 11 freighters. 108 and 18 of the passenger aircraft were operated by Singapore Airlines and SilkAir respectively. Average age in years (y) and months (m) Aircraft type Owned Finance Lease Operating Lease Total Seats... -

Page 203

ANNUAL REPORT 2009/10 201 group corporate structure at 31 march 2010 SINGAPORE AIRLINES LIMITED 80.5% SIA Engineering Company Limited 100% SilkAir (Singapore) Private Limited 56% Abacus Travel Systems Pte Ltd 5% 100% Singapore Aviation and General Insurance Company (Pte) Limited 100% SIA ... -

Page 204

SINGAPORE AIRLINES 202 information on shareholdings as at 7 June 2010 No. of Issued Shares: No. of Issued Shares (excluding Treasury Shares): No./Percentage of Treasury Shares: Class of Shares: 1,192,105,292 1,192,038,808 66,484 (0.01%) Ordinary shares One Special share held by the Minister for ... -

Page 205

... REPORT 2009/10 203 Twenty largest shareholders Name Number of shares %* 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Temasek Holdings (Private) Limited Citibank Nominees Singapore Pte Ltd DBS Nominees Pte Ltd DBSN Services Pte Ltd HSBC (Singapore) Nominees Pte Ltd United Overseas Bank... -

Page 206

SINGAPORE AIRLINES 204 share price and turnover For the financial year ended 31 March 2010 2009-10 2008-09 Share Price ($) Highest closing price Lowest closing price 31 March closing price Market Value Ratios R1 Price/Earnings Price/Book value Price/Cash earnings R2 R1 R2 15.94 10.12 15.20 16.... -

Page 207

...Square, Singapore 039594 on Tuesday, 27 July 2010 at 10.00 a.m. to transact the following business: Ordinary Business 1. 2. 3. To receive and adopt the Directors' Report and Audited Financial Statements for the year ended 31 March 2010 and the Auditors' Report thereon. To declare a final dividend of... -

Page 208

...the capital of the Company as may be required to be issued pursuant to the exercise of options under the SIA Employee Share Option Plan ("Share Option Plan") and/or such number of fully paid shares as may be required to be issued pursuant to the vesting of awards under the Performance Share Plan and... -

Page 209

..., continue to serve as a member of the Board Nominating Committee and Board Safety and Risk Committee. Mr Gonski, Mr Koh and Mrs Ong are considered independent Directors. Please refer to the sections on Board of Directors and Corporate Governance in the Annual Report for further details on Mr Gonski... -

Page 210

SINGAPORE AIRLINES 208 number of Board and Committee meetings for Financial Year 2010-11, assuming full attendance by all of the current eight non-executive Directors, at the fee rates shown in the Annual Report. The amount also caters for unforeseen circumstances, for example, the appointment of ... -

Page 211

This page is intentionally left blank -

Page 212

This page is intentionally left blank -

Page 213

-

Page 214

Registered Address Airline House, 25 Airline Road Singapore 819829 Company Secretary Ethel Tan Tel: 6541 4030 Fax: 6546 7469 Email: [email protected] Investor Relations Tel: 6541 4885 Fax: 6542 9605 Email: [email protected] Public Affairs Tel: 6541 5880 Fax: 6545 ...