Qantas 2016 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

(I) PROPERTY, PLANT AND EQUIPMENT

i. Recognition and Measurement

Items of property, plant and equipment are stated at cost less accumulated depreciation and impairment losses. Items of property,

plant and equipment are initially recorded at cost, being the fair value of the consideration provided plus incidental costs directly

attributable to the acquisition.

The cost of acquired assets includes the initial estimate at the time of installation of the costs of dismantling and removing the items

and restoring the site on which they are located, and changes in the measurement of existing liabilities recognised for these costs

resulting from changes in the timing or outflow of resources required to settle the obligation or from changes in the discount rate.

Theunwinding of the discount is treated as a finance charge.

The cost also may include transfers from hedge reserve of any gain or loss on qualifying cash flow hedges of foreign currency

purchases of property, plant and equipment in accordance with Note 29(E). Borrowing costs associated with the acquisition,

construction or production of qualifying assets are recognised as part of the cost of the asset to which they relate.

ii. Subsequent Expenditure

Subsequent expenditure is capitalised only if it is probable that the future economic benefits associated with the expenditure will

flow to the Group.

iii. Depreciation

Depreciation is provided on a straight-line basis on all items of property, plant and equipment except for freehold land, which is

not depreciated. The depreciation rates of owned assets are calculated so as to allocate the cost or valuation of an asset, less

any estimated residual value, over the asset’s estimated useful life to the Qantas Group. Assets are depreciated from the date of

acquisition or, with respect to internally constructed assets, from the time an asset is completed and available for use. The costs of

improvements to assets are depreciated over the remaining useful life of the asset or the estimated useful life of the improvement,

whichever is the shorter. Assets under finance lease are depreciated over the term of the relevant lease or, where it is likely the

Qantas Group will obtain ownership of the asset, the life of the asset.

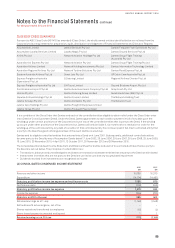

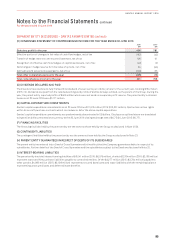

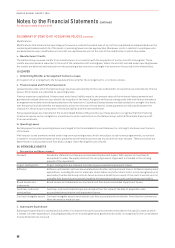

The principal asset depreciation periods and estimated residual value percentages are:

Years Residual Value (%)

Buildings and leasehold improvements 10 – 40 01

Plant and equipment 3 – 20 0

Passenger aircraft and engines 2.5 – 20 0 – 10

Freighter aircraft and engines 2.5 – 20 0 – 20

Aircraft spare parts 15 – 20 0 – 20

1 Certain leases allow for the sale of leasehold improvements for fair value. In these instances, the expected fair value is used as the estimated residual value.

Useful lives and residual values are reviewed annually and reassessed having regard to commercial and technological developments,

the estimated useful life of assets to the Qantas Group and the long-term fleet plan.

iv. Maintenance and Overhaul Costs

Embedded Maintenance

An element of the cost of an acquired aircraft (owned or finance-leased) is attributed to its service potential, reflecting the

maintenance condition of its engines and airframe. This cost is depreciated over the shorter of the period to the next major

inspection event or the remaining life of the asset or remaining lease term.

Subsequent Maintenance Expenditure

The costs of subsequent major cyclical maintenance checks for owned and leased aircraft (including operating leases) are recognised

and depreciated over the shorter of the scheduled usage period to the next major inspection event or the remaining life of the aircraft

or lease term (as appropriate). Maintenance checks which are covered by third party maintenance agreements where there is a

transfer of risk and legal obligation are expensed on the basis of hours flown. All other maintenance costs are expensed as incurred.

95

QANTAS ANNUAL REPORT 2016