Qantas 2016 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

ii. Repurchase of Share Capital

When share capital recognised as equity is repurchased, the amount of the consideration paid, including directly attributable costs

isrecognised as a deduction from equity.

iii. Treasury Shares

Shares held by the Qantas sponsored Employee Share Plan Trust are recognised as treasury shares and deducted from equity.

iv. Employee Compensation Reserve

The fair value of equity plans granted is recognised in the employee compensation reserve over the vesting period. This reserve will

be reversed against treasury shares when the underlying shares vest and transfer to the employee. No gain or loss is recognised in

the Consolidated Income Statement on the purchase, sale, issue or cancellation of Qantas’ own equity instruments.

v. Hedge Reserve

The hedge reserve is comprised of the effective portion of the cumulative net change in the fair value of cash flow hedging

instruments and the cumulative change in fair value arising from the time value of options related to future forecast transactions.

vi. Foreign Currency Translation Reserve

The foreign currency translation reserve comprises all foreign exchange differences arising from the translation of the financial

statements of foreign controlled entities and investments accounted for under the equity method.

vii. Defined Benefit Reserve

The defined benefit reserve comprises the remeasurements of the net defined benefit asset/(liability) which are recognised in other

comprehensive income in accordance with AASB 119 Employee Benefits (2011).

(P) COMPARATIVES

Where applicable, various comparative balances have been reclassified to align with current period presentation.

(Q) SEGMENT REPORTING

Underlying EBIT of the Qantas Group’s operating segments is prepared and presented on the basis that it reflects the revenue earned

and the expenses incurred by each operating segment. The significant accounting policies applied in implementing this basis of

preparation are set out below. These accounting policies have been consistently applied to all periods presented in the Consolidated

Financial Statements.

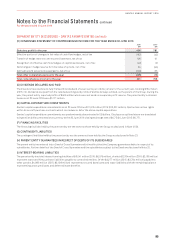

Segment Performance Measure Basis of Preparation

External segment

revenue

External segment revenue is reported by operating segments as follows:

− Net passenger revenue is reported by the operating segment which operated the relevant flight or

provided the relevant service. For Qantas Airlines, where a multi-sector ticket covering international

and domestic travel is sold, the revenue is reported by Qantas Domestic and Qantas International on

a pro-rata basis using an industry standard allocation process

− Other revenue is reported by the operating segment that earned the revenue

Inter-segment revenue Inter-segment revenue for Qantas Domestic, Qantas International and Jetstar Group operating segments

primarily represents:

− Net passenger revenue arising from the redemption of Frequent Flyer points for Qantas Group flights

by Qantas Loyalty

− Net freight revenue from the utilisation of Qantas Domestic, Qantas International and Jetstar Group’s

aircraft bellyspace by Qantas Freight

Inter-segment revenue for Qantas Loyalty primarily represents marketing revenue arising from the

issuance of Frequent Flyer points to Qantas Domestic, Qantas International and Jetstar Group.

Inter-segment revenue transactions, which are eliminated on consolidation, occur in the ordinary course

of business at prices that approximate market prices.

Qantas Loyalty does not derive net profit from inter-segment transactions relating to Frequent Flyer

point issuances and redemptions.

99

QANTAS ANNUAL REPORT 2016