Qantas 2016 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

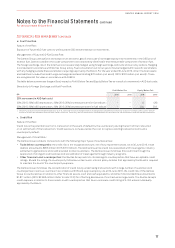

20 FINANCIAL RISK MANAGEMENT CONTINUED

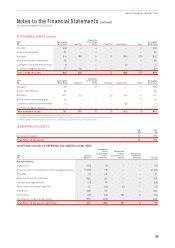

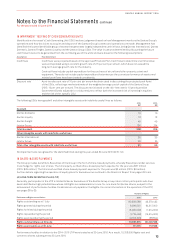

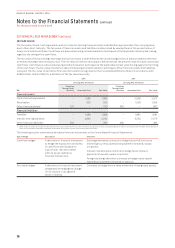

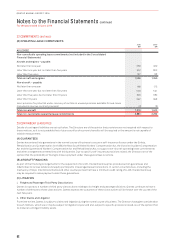

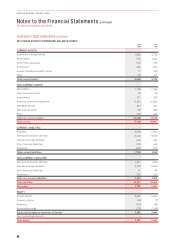

(C) DERIVATIVES AND HEDGING INSTRUMENTS

2016 2015

$M Current Non-current Total Current Non-current Total

Derivative assets

Designated as cash flow hedges1229 44 273 613 47 660

Designated as fair value hedges1–22–22

Total other financial assets 229 46 275 613 49 662

Derivative liabilities

Designated as cash flow hedges1(203) (61) (264) (416) (68) (484)

Total other financial liabilities (203) (61) (264) (416) (68) (484)

Net other financial assets/(liabilities) 26 (15) 11 197 (19) 178

1 Including time value of options after transition to AASB 9.

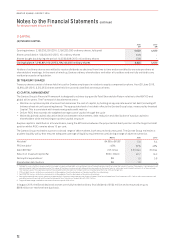

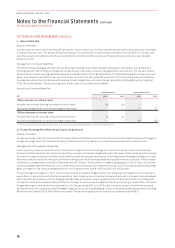

i. Offsetting

The Group enters into contractual arrangements such as the International Swaps and Derivatives Association (ISDA) Master

Agreement where, upon the occurrence of a credit event (such as default) a termination value is calculated and only a single net

amount is payable in settlement of all transactions that are capable of offset under the contractual terms. The ISDA agreements do

not meet the criteria for offsetting in the Consolidated Balance Sheet and consequently financial assets and liabilities are recognised

gross. This is because the Group does not have any current legal enforceable right to offset recognised amounts, because the right to

offset is enforceable only on the occurrence of future events. The amounts shown as financial assets and financial liabilities would

each have been $181 million lower (2015: $374 million) in the event of the right to offset being currently enforceable.

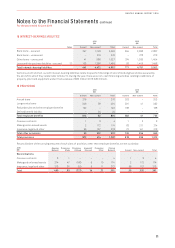

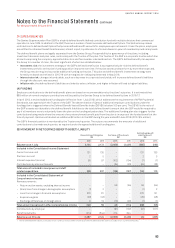

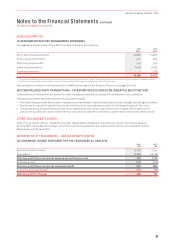

ii. Hedge Reserve

The effective portion of the cumulative net change in the fair value of derivative financial instruments designated as a cash flow

hedge and the cumulative change in fair value arising from the time value of options are included in the hedge reserve. These options

relate entirely to transaction related hedged items. For further information on accounting for derivative financial instruments as

cash flow hedges, refer to Note 29(E). For the year ended 30 June 2016, $95 million (2015: $96 million) of the related cash flows are

expected to occur within one year and $24m (2015: $26 million) after one year.

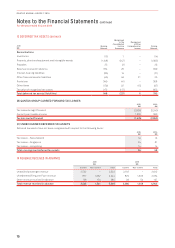

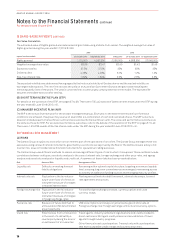

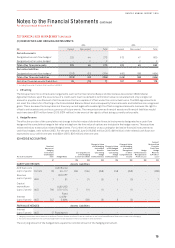

(D) HEDGE ACCOUNTING

As at 30 June 2016

Nominal

Amount of

Hedging

Instrument

and Hedged

Item Hedge Rates

Carrying Amount

of the Hedging

Instrument (AUD)1

Change in Value

of the Hedging

Instrument

Used for

Calculating

Hedge

Ineffectiveness

Change in Value

of the Hedged

Item Used for

Calculating

Hedge

Ineffectiveness

Change in Value

of the Hedging

Instrument

Recognised

in Other

Comprehensive

Income

Hedge

Ineffectiveness

Recognised in

Profit or Loss

Amount

Reclassified

From the

Cash Flow

Hedge

Reserve

to Profit or

Loss2

M$M $M $M $M $M $M $M

CASH FLOW HEDGES Assets Liabilities

AUD fuel costs

(up to 2 years) barrels 33

AUD/Barrel

50–117 266 (195) (258) 258 (258) –(288)

Revenue

(up to 2 years) AUD 7

AUD/JPY

81 –(7) (5) 5(5) – 7

Capital

expenditure

(up to 2 years) AUD 766

AUD/USD

0.70–0.74 7(11) (1) 1(1) – –

Interest

(up to 6 years) AUD 547

Fixed

4.40%–

5.99% –(58) (3) 3(3) – –

FAIR VALUE HEDGES Assets Liabilities

Interest

(up to 5 years) AUD 17 Floating n/a 2 – – – – – –

1 Hedging instruments are located within the Other Financial Assets and Other Financial Liabilities on the Consolidated Balance Sheet and include costs of hedging.

2 Amounts reclassified from the cash flow hedge reserve to fuel expense in the Consolidated Income Statement.

The carrying amount of the hedged item equals the nominal amount of the hedging instrument.

79

QANTAS ANNUAL REPORT 2016