Qantas 2016 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

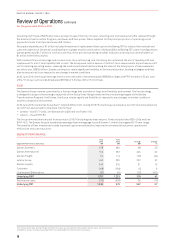

Review of Operations continued

For the year ended 30 June 2016

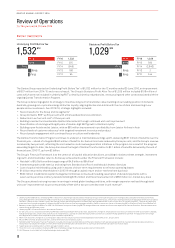

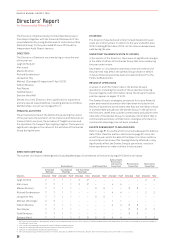

QANTAS LOYALTY

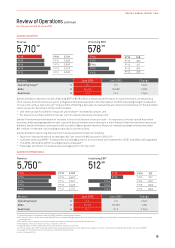

Metrics June 2016 June 2015 Change

Operating margin %23.8 23.1 0.7pts

Deferred revenue growth M56 108 (48)%

QFF members M11.4 10.8 5.4%

Qantas Loyalty reported a record Underlying EBIT of $346 million, the eighth consecutive year of double-digit earnings growth52.

Diversifying the Group’s non-cyclical earnings at Qantas Loyalty remains a key pillar of the Group’s long-term strategy. Highlights in

2015/16 included:

–Revenue up 6.7 per cent; strong margins maintained

–3.8 per cent growth in Qantas Frequent Flyer co-branded credit cards, outpacing industry53

–Continued growth of core Qantas Frequent Flyer coalition

–44 per cent of revenue growth coming from Loyalty businesses other than Qantas Frequent Flyer

–Record customer advocacy after program enhancements

The Qantas Frequent Flyer and Aquire programs continued to attract new partners or extensions with existing ones. Significantly for

Qantas Frequent Flyer, a new Woolworths proposition was announced that includes better member earn rates than under previous

proposition. Core to the Loyalty strategy is diversification into new businesses that leverage the assets of the 11.4 million member

base, in-house marketing expertise and digital capability. New ventures announced in the year were:

–Qantas Assure health insurance on target to deliver two to three per cent market share with a differentiated offering

–Investment in Data Republic – Australia’s first secure public data exchange platform

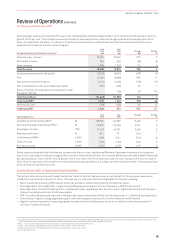

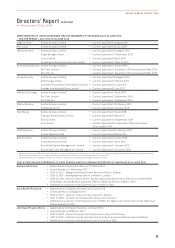

QANTAS FREIGHT

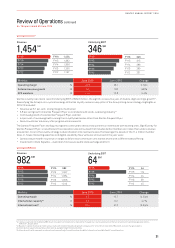

Metrics June 2016 June 2015 Change

Operating margin %6.5 10.7 (4.2)pts

International capacity54 B3.3 3.2 4.7%

International load55 %53.4 5 7.0 (3.6)pts

FY16

FY15

FY14

FY13

FY12

Revenue

982

$M

FY16 982

FY15 1,067

FY14 1,084

FY13 1,056

F Y12 1,013

FY16

FY15

FY14

FY13

FY12

Underlying EBIT

64

$M

FY16 64

FY15 114

FY14 24

FY13 36

F Y12 45

FY16

FY15

FY14

FY13

FY12

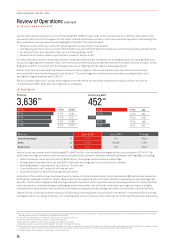

Revenue

1,454

$M

FY16 1,454

FY15 1,362

FY14 1,306

FY13 1,205

F Y12 1,157

FY16

FY15

FY14

FY13

FY12

Underlying EBIT

346

$M

FY16 346

FY15 315

FY14 286

FY13 260

F Y12 231

52 Qantas Loyalty record Underlying EBIT result compared to prior periods normalised for changes in accounting estimates of the fair value of points and breakage expectations

effective 1 January 2009.

53 Based on number of personal credit card accounts with interest free periods; growth comparison for 12 months to June 2016; RBA credit and card charges statistics.

54 International capacity measured as international available freight tonne kilometres.

55 International load is measured as international revenue freight tonne kilometres divided by International available freight tonne kilometres.

21

QANTAS ANNUAL REPORT 2016