Qantas 2016 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

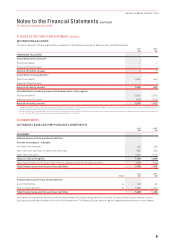

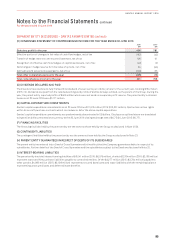

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

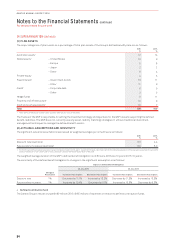

iii. Equity Accounted Investments

Associates are those entities in which the Group has significant influence, but not control or joint control, over the financial and

operating policies. Interests in associates are accounted for under the equity accounting method and initially recognised at cost,

including transaction costs.

Subsequent to initial recognition, the Consolidated Financial Statements include the Group’s share of profit or loss and other

comprehensive income of equity accounted investees, until the date on which significant influence ceases.

Dividends reduce the carrying amount of the equity accounted investment.

When the Group’s share of losses exceeds the equity accounted carrying value of an associate, the Group’s carrying amount is

reduced to nil and recognition of further losses is discontinued, except to the extent that the Group has incurred legal or constructive

obligations to fund the associates’ operations or has made payments on behalf of an associate.

iv. Transactions Eliminated on Consolidation

Intra-group transactions, balances and unrealised gains and losses on transactions between controlled entities are eliminated in the

Consolidated Financial Statements. Unrealised gains and losses arising from transactions with investments accounted for under

the

equity method are eliminated to the extent of the Group’s interest in the associate.

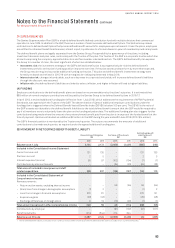

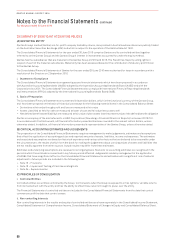

(D) FOREIGN CURRENCY

i. Foreign Currency Transactions

Transactions in foreign currencies are translated into the respective functional currencies of the Group’s companies at the exchange

rates at the date of the transactions.

Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rate

at the reporting date. Non-monetary assets and liabilities that are measured at fair value in a foreign currency are translated into

the functional currency at the exchange rate when the fair value was determined. Non-monetary items that are measured based on

historical cost in a foreign currency are translated at the exchange rate at the date of the transactions. Foreign currency differences

are generally recognised in the Consolidated Income Statement.

ii. Foreign Operations

The assets and liabilities of foreign operations, including goodwill and fair value adjustments arising on acquisition, are translated

into Australian Dollars at the exchange rates at the reporting date. The income and expenses of foreign operations are translated into

Australian Dollars at the exchange rates at the date of the transactions.

Foreign currency differences are recognised in the Consolidated Statement of Comprehensive Income and accumulated in the

Foreign Currency Translation Reserve, except to the extent that the translation difference is allocated to Non-controlling Interests.

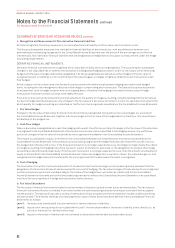

When a foreign operation is disposed of in its entirety or partially such that control, significant influence or joint control is lost, the

cumulative amount in the Foreign Currency Translation Reserve related to that foreign operation is reclassified to the Consolidated

Income Statement as part of the gain or loss on disposal. If the Group disposes of part of its interests in a subsidiary but retains

control, then the relevant proportion of the cumulative amount is reattributed to non-controlling Interests. When the Group disposes

of only part of an associate or joint venture while retaining significant influence or joint control, the relevant proportion of the

cumulative amount is reclassified to the Consolidated Income Statement.

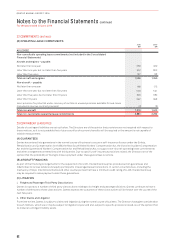

(E) FINANCIAL INSTRUMENTS

NON-DERIVATIVE FINANCIAL INSTRUMENTS

i. Recognition and Measurement of Non-derivative Financial Assets

At initial recognition, the Group measures a financial asset at its fair value plus, in the case of a financial asset not at fair value through

profit or loss, transaction costs. Transaction costs of financial assets carried at fair value through profit or loss are expensed.

The Group subsequently classifies its financial assets in the following measurement categories:

–Those to be measured subsequently at fair value (either through the Consolidated Income Statement or the Consolidated

Statement of Comprehensive Income)

–Those to be measured at amortised cost

91

QANTAS ANNUAL REPORT 2016