Qantas 2016 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

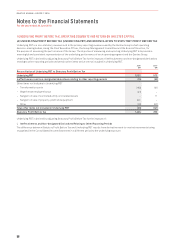

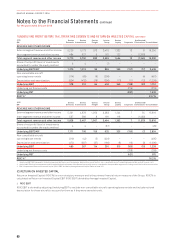

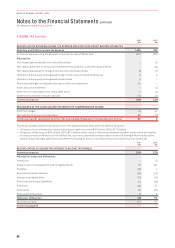

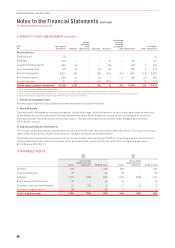

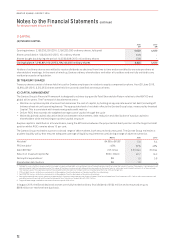

7 AUDITOR’S REMUNERATION

2016

$’000

2015

$’000

AUDIT AND AUDIT RELATED SERVICES

Auditors of Qantas – KPMG

– Audit and review of Financial Report 3,266 3,219

– Other regulatory audit services 57 23

Total audit and audit related services 3,323 3,242

OTHER SERVICES

Auditors of Qantas – KPMG

– In relation to other assurance, taxation and due diligence services 896 1,588

– Other non-audit services 52 570

Total other services 948 2,158

Total auditor’s remuneration 4,271 5,400

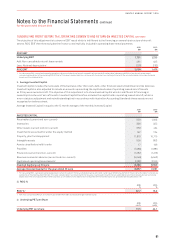

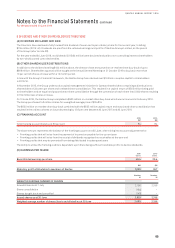

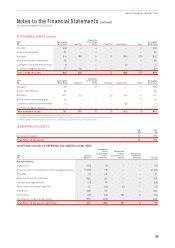

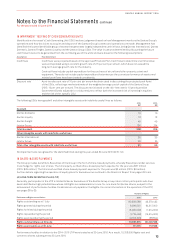

8 CASH AND CASH EQUIVALENTS

2016

$M

2015

$M

Cash balances 311 253

Cash at call 138 197

Short-term money market securities and term deposits 1,531 2,458

Total cash and cash equivalents 1,980 2,908

Cash and cash equivalents comprise cash at bank and on hand, cash at call and short-term money market securities and term

deposits that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value. Short-term

money market securities of $72 million (2015: $81 million) held by the Qantas Group are pledged as collateral under the terms

of certain operational financing facilities when underlying unsecured limits are exceeded. The collateral cannot be sold or repledged

inthe absence of default by the Qantas Group.

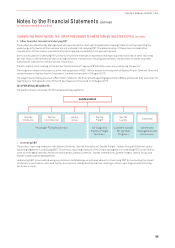

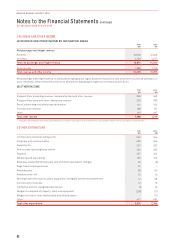

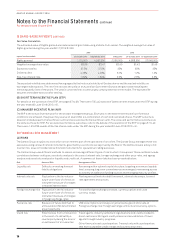

9 RECEIVABLES

2016

$M

2015

$M

Current Non-current Total Current Non-current Total

Trade receivables 658 –658 712 –712

Less provision for impairment losses (2) –(2) (2) –(2)

Total trade receivables 656 –656 710 –710

Sundry receivables 139 134 273 249 134 383

Total receivables 795 134 929 959 134 1,093

2016

$M

2015

$M

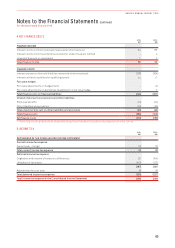

The ageing of trade receivables, net of provision for impairment losses, at 30 June was:

Not past due 571 628

Past due 1–30 days 47 52

Past due 31–120 days 26 15

Past due 121 days or more 12 15

Total trade receivables 656 710

66

QANTAS ANNUAL REPORT 2016