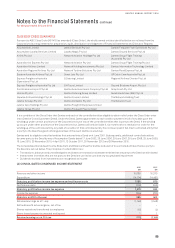

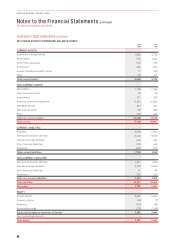

Qantas 2016 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

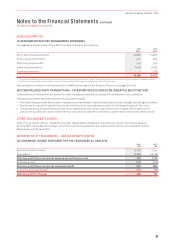

24 SUPERANNUATION CONTINUED

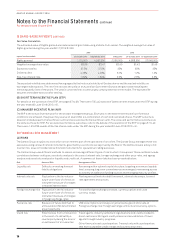

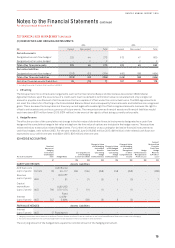

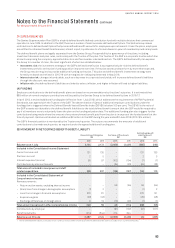

(C) PLAN ASSETS

The major categories of plan assets as a percentage of total plan assets of the Group’s defined benefit plans are as follows:

2016

%

2015

%

Australian equity112 14

Global equity1− United States 10 9

− Europe 5 8

− Japan 2 2

− Other 6 4

Private equity 4 5

Fixed interest1− Government bonds 13 11

− Other 11 9

Credit1− Corporate debt 6 9

− Other 2 2

Hedge funds 911

Property and infrastructure 10 9

Cash and cash equivalents110 7

Total 100 100

1 The majority of these plan assets have a quoted market price in an active market.

The Trustee of the QSP is responsible for setting the investment strategy and objectives for the QSP’s assets supporting the define

d

benefit liabilities. The QSP does not currently use any asset-liability matching strategies. It utilises traditional investment

management techniques to manage the defined benefit assets.

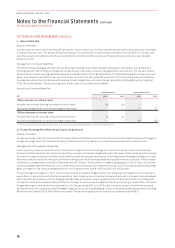

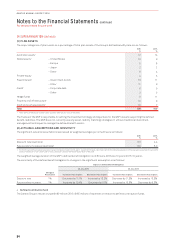

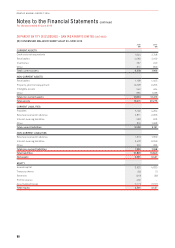

(D) ACTUARIAL ASSUMPTIONS AND SENSITIVITY

The significant actuarial assumptions (expressed as weighted averages per annum) were as follows:

2016

%

2015

%

Discount rate (Australia) 3.3 4.4

Future salary increases (Australia)13.0 3.0

1 For the 30 June 2016 actuarial calculation, salary increases of 2 per cent in year 1, 2.4 per cent in year 2 and 3 per cent for the remaining duration of the plan were assumed (30 June 2015:

salary increases of 2.1 per cent in years 1 and 2 and 3 per cent for the remaining duration of the plan).

The weighted average duration of the QSP’s defined benefit obligation as at 30 June 2016 was 10 years (2015: 10 years).

The sensitivity of the defined benefit obligation to changes in the significant assumption is as follows:

Impact on Defined Benefit Obligation

30 June 2016 30 June 2015

Change in

Assumption Increase in Assumption Decrease in Assumption Increase in Assumption Decrease in Assumption

Discount rate 1% Decrease by 11.1% Increase by 13.2% Decrease by 11.3% Increase by 13.3%

Future salary increase 1% Increase by 10.4% Decrease by 9.1% Increase by 10.6% Decrease by 9.3%

i. Defined contribution fund

The Qantas Group’s results include $180 million (2015: $165 million) of expenses in relation to defined contribution funds.

84

QANTAS ANNUAL REPORT 2016