Qantas 2016 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

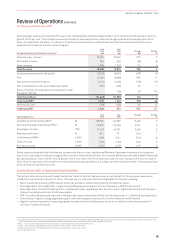

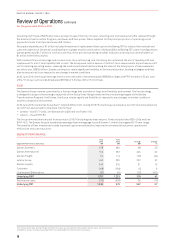

Review of Operations continued

For the year ended 30 June 2016

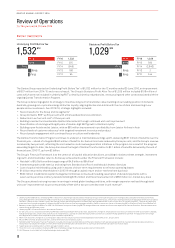

QANTAS DOMESTIC

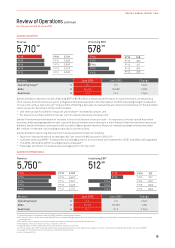

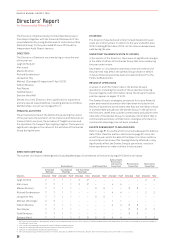

Metrics June 2016 June 2015 Change

Operating margin37 %10.1 8.2 1.9pts

ASKs M36,260 36,638 (1.0)%

Seat factor %75.2 74.2 1.0pts

Qantas Domestic reported a record Underlying EBIT of $578 million, a stand out performance in a year that saw a continued drop

off in revenue from the resources sector and general demand weakness in the final quarter 2015/16. Operating margin increased to

10.1per cent, with ex-fuel unit cost38 improvement offsetting a decrease in revenue that was driven by the downturn in the Australian

resources sector. Key drivers of the result included:

–Unit revenue was flat while ex-resources unit revenue39 increased by one per cent

–Ex-fuel unit cost improvement of one per cent on capacity decrease of one per cent

Qantas Transformation delivered an increase in aircraft utilisation of two per cent40. In response to the two-speed Australian

economy, with passenger growth on east coast and leisure markets and contraction in intra-Western Australia and other resources

markets, Qantas Domestic continued to shift aircraft to higher-growth markets. Resource-related passenger revenue was down

$121million41 in the year, not including a reduction in charter activity.

Qantas Domestic saw strong improvement in all key operational metrics including:

–Record on-time performance increasing to 89.7 per cent from 88.3 per cent in 2014/1542

–Customer advocacy (NPS)43 increased five percentage points to a record result with investment in B737 and A330 cabin upgrades

–15 x A330–200 and 54 x B737 reconfigurations completed44

–Passenger seat factor increased one percentage point to 75.2 per cent

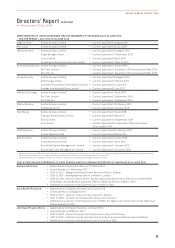

QANTAS INTERNATIONAL

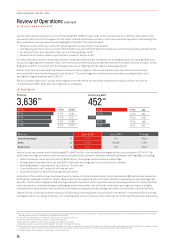

Metrics June 2016 June 2015 Change

Operating margin %8.9 4.9 4.0pts

ASKs M63,599 59,263 7.3%

Seat factor %81.7 81.5 0.2pts

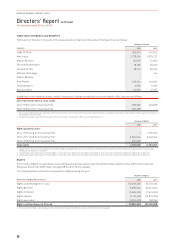

FY16

FY15

FY14

FY13

FY12

Underlying EBIT

512

$M

FY16 512

FY15 267

FY14 (497)

FY13 (246)

F Y12 (484)

FY16

FY15

FY14

FY13

FY12

Revenue

5,750

$M

FY16 5,750

FY15 5,467

FY14 5,297

FY13 5,496

F Y12 5,770

FY16

FY15

FY14

FY13

FY12

Underlying EBIT

578

$M

FY16 578

FY15 480

FY14 30

FY13 365

F Y12 463

FY16

FY15

FY14

FY13

FY12

Revenue

5,710

$M

FY16 5,710

FY15 5,828

FY14 5,848

FY13 6,218

F Y12 6,063

37 Operating margin calculated as Underlying EBIT divided by total segment revenue.

38 Ex-fuel unit cost is calculated as Underlying PBT less ticketed passenger revenue and fuel, adjusted for changes in: employee discount rates and other assumptions, and foreign

exchange rates.

39 Ex-resources unit revenue is unit revenue other than specific routes that are classified as resources.

40 Average block hours per aircraft per day compared to 2014/15.

41 Regular Public Transport (RPT) resources routes revenue compared to 2014/15.

42 On time performance (OTP) of Qantas Mainline (excluding QantasLink) operations. Measured as departures within 15 minutes of scheduled departure time. Source: BITRE.

43 Average 2015/16 net promotor score based on internal Qantas reporting.

44 As at 24 August 2016.

19

QANTAS ANNUAL REPORT 2016