Qantas 2016 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

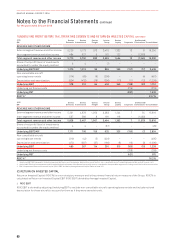

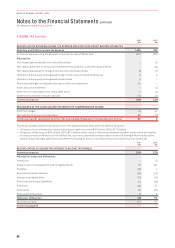

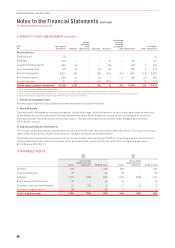

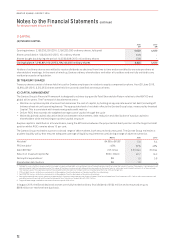

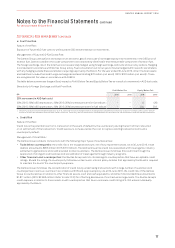

13 DEFERRED TAX ASSETS CONTINUED

2015

$M

Opening

Balance

Recognised

in the

Consolidated

Income

Statement

Recognised

in Other

Comprehensive

Income

Closing

Balance

Reconciliations

Inventories (15) 1 – (14)

Property, plant and equipment and intangible assets (1,148) (247) –(1,395)

Payables 25 (2) –23

Revenue received in advance 674 25 –699

Interest-bearing liabilities (85) 14 –(71)

Other financial assets/liabilities (45) 49 21 25

Provisions 349 (41) – 308

Other items (179) 97 (15) (97)

Tax value of recognised tax losses 972 (117) –855

Total deferred tax assets/(liabilities) 548 (221) 6333

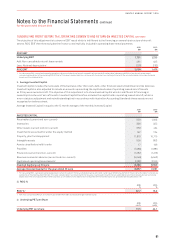

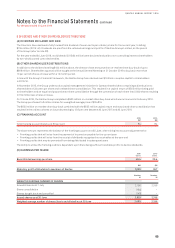

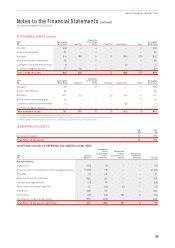

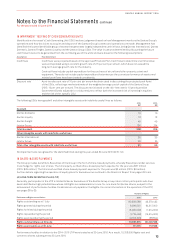

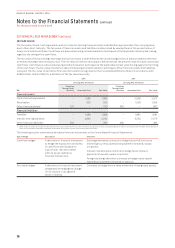

(B) QANTAS GROUP CARRIED FORWARD TAX LOSSES

2016

$M

2015

$M

Tax losses brought forward (2,850) (3,240)

Current year taxable income 1,376 390

Tax loss carried forward (1,474) (2,850)

(C) UNRECOGNISED DEFERRED TAX ASSETS

Deferred tax assets have not been recognised with respect to the following items:

2016

$M

2015

$M

Tax losses – New Zealand 16 13

Tax losses – Singapore 24 31

Tax losses – Hong Kong 14 14

Total unrecognised deferred tax assets 54 58

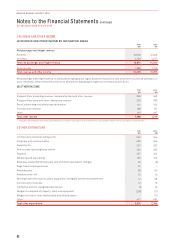

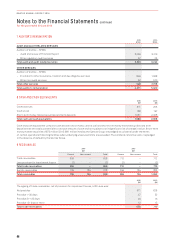

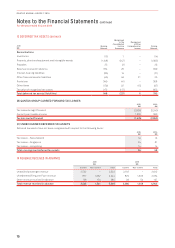

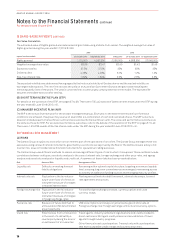

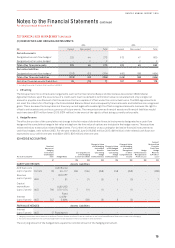

14 REVENUE RECEIVED IN ADVANCE

2016

$M

2015

$M

Current Non-current Total Current Non-current Total

Unavailed passenger revenue 2,522 –2,522 2,612 –2,612

Unredeemed Frequent Flyer revenue 877 1,367 2,244 879 1,305 2,184

Other revenue received in advance 126 154 280 93 54 147

Total revenue received in advance 3,525 1,521 5,046 3,584 1,359 4,943

70

QANTAS ANNUAL REPORT 2016