Qantas 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

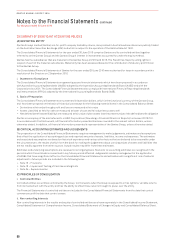

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

v. Financial Guarantee Contracts

Financial guarantee contracts are recognised as a financial liability at the time the guarantee is issued. The liability is initially

measured at fair value and subsequently at the higher of the amount determined in accordance with AASB 137: Provisions,

Contingent Liabilities and Contingent Assets, and the amount initially recognised less cumulative amortisation, where appropriate.

The fair value of financial guarantees is determined as the present value of the difference in net cash flows between the contractual

payments under the debt instrument and the payments that would be required without the guarantee, or the estimated amount that

would be payable to a third party for assuming the obligations.

Where guarantees in relation to loans or payables of associates and jointly controlled entities are provided for no compensation,

thefair values are accounted for as contributions and recognised as part of the cost of the investment.

(F) REVENUE RECOGNITION

i. Passenger and Freight Revenue

Passenger and freight revenue is measured at the fair value of the consideration received, net of sales discount, passenger and

freight interline/IATA commission and Goods and Services Tax. Other sales commissions paid by the Qantas Group are included

inexpenditure.

Passenger revenue and freight revenue is recognised when passengers or freight are uplifted. Unused tickets are recognised as

revenue using estimates based on the terms and conditions of the ticket, historic trends and experience.

Passenger recoveries (including fuel surcharge on passenger tickets) are included in net passenger revenue. Freight fuel surcharge

isincluded in net freight revenue.

Revenue from ancillary passenger revenue, passenger services fees, lease capacity revenue and air charter revenue is recognised

asrevenue when the services are provided.

Receipts for advanced passenger ticket sales or freight sales which have not yet been availed or recognised as revenue are deferred

on the balance sheet as revenue received in advance.

ii. Frequent Flyer Marketing Revenue

Marketing revenue associated with the issuance of Frequent Flyer points is recognised when the service is performed (typically on

the issuance of the point). Marketing revenue is measured as the difference between the cash received on issuance of a point and the

amount deferred as unrecognised redemption revenue.

iii. Frequent Flyer Redemption Revenue

Revenue received for the issuance of points is deferred as a liability (revenue received in advance) until the points are redeemed or,

in the case of Qantas Group flight redemption, the passenger is uplifted. Redemption revenue is measured based on Management’s

estimate of the fair value of the expected awards for which the points will be redeemed. The fair value of the awards is reduced to

take into account the proportion of points that are expected to expire (breakage). Redemption revenue arising from Qantas Group

flight redemptions is recognised in passenger revenue. Redemptions on other airlines are recognised in other revenue.

iv. Frequent Flyer Membership Fee Revenue

Membership fee revenue results from the initial joining fee charged to members. Revenue is recognised on expiry of any refund period.

(G) TAXES

i. Tax Compliance

The Qantas Group is committed to embedding risk management practices to support the achievement of compliance objectives and

fulfil corporate governance obligations. Tax risk management is governed by both the Qantas Group Risk Management Policy and the

Qantas Group Tax Risk Management Policy, ensuring corporate governance obligations with respect to tax risks are met.

The Qantas Group has paid all taxes that it owes and all tax compliance obligations are up to date. The Australian Taxation Office

(ATO) has advised that the Qantas Group is a key taxpayer continuing to have a ‘low’ likelihood of non-compliance. The ATO also

acknowledged Qantas’ continued commitment to engage cooperatively and transparently to mitigate tax risks, including obtaining

tax certainty on key transactions through the use of binding Private Rulings and entering into a multi-tax Annual Compliance

Arrangement (ACA).

Tax Treaties

Due to the operation of income tax treaties and specific rules dealing with airlines, the Qantas Group appropriately reports the majority

of its income in Australia with only a small component being reported in foreign jurisdictions (for the purpose of determining liability to

company tax). This effectively results in more than 99 per cent of the Qantas Group’s profit being subject to taxation in Australia.

93

QANTAS ANNUAL REPORT 2016