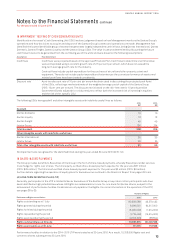

Qantas 2016 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

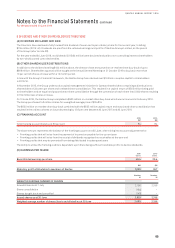

Notes to the Financial Statements continued

For the year ended 30 June 2016

2016

$M

2015

$M

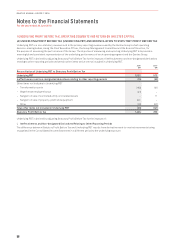

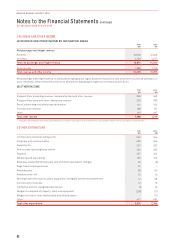

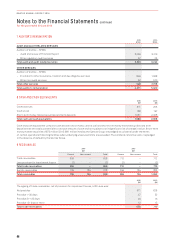

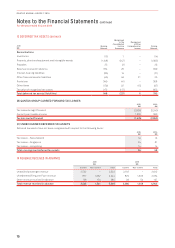

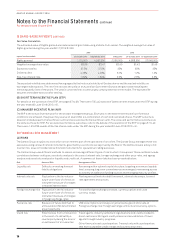

RECONCILIATION BETWEEN INCOME TAX EXPENSE AND STATUTORY PROFIT BEFORE INCOME TAX

Statutory profit before income tax expense 1,424 789

Income tax expense using the domestic corporate tax rate of 30 per cent (427) (237)

Adjusted for:

Non-assessable dividends from controlled entities 110

Non-deductible share of net loss for investments accounted for under the equity method –(14)

Non-deductible losses for foreign branches and controlled entities (6) (7)

Utilisation of previously unrecognised foreign branch and controlled entity losses 6 5

Utilisation of previously unrecognised capital losses 8 –

Non-assessable gain on disposal of property, plant and equipment 30 –

Write-down of investments –(2)

Other net non-assessable/(non-deductible) items 7(4)

(Under)/over provision from prior periods (14) 20

Income tax expense (395) (229)

RECOGNISED IN THE CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Cash flow hedges (2) 21

Defined benefit actuarial (losses)/gains 89 (15)

Income tax benefit recognised directly in the Consolidated Statement of Comprehensive Income 87 6

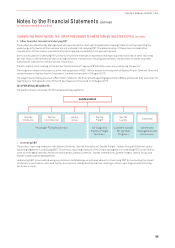

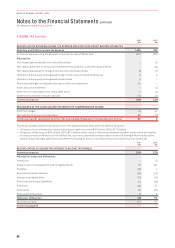

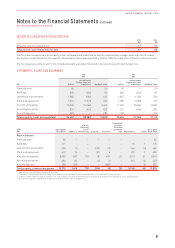

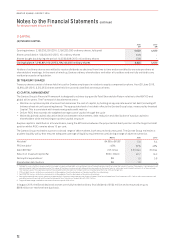

Income tax payable was less than 30 per cent of the Qantas Group’s Statutory Profit Before Tax due to:

–Utilisation of carry forward tax losses that reduce taxable income of $413 million (2015: $117 million)

–Temporary differences of ($18 million) (2015: $112 million) which result in differences between taxable income which will reverse

in future periods and Statutory Profit Before Tax, such as accelerated tax depreciation on aircraft (timing difference due to the

Qantas Group making a significant investment in renewing its fleet in recent years that will reverse in future tax periods)

2016

$M

2015

$M

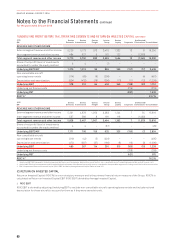

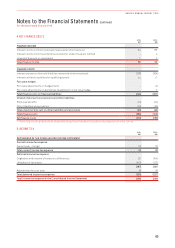

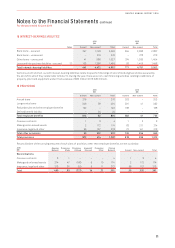

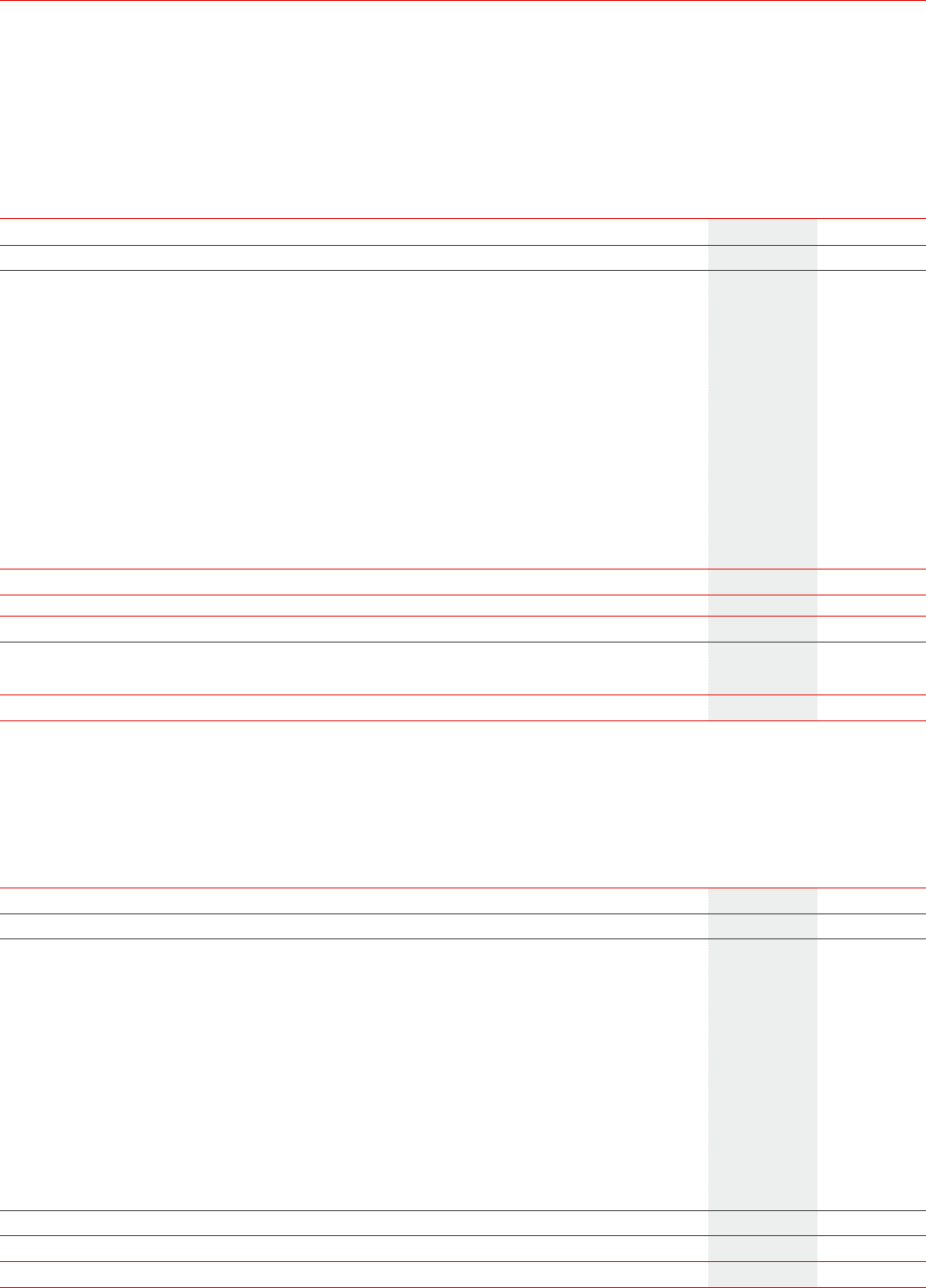

RECONCILIATION OF INCOME TAX EXPENSE TO INCOME TAX PAYABLE

Income tax expense (395) (229)

Adjusted for temporary differences

Inventories 1(1)

Property, plant and equipment and intangible assets 18 247

Payables (28) 2

Revenue received in advance (64) (25)

Interest-bearing liabilities (16) (14)

Other financial assets/(liabilities) 40 (49)

Provisions (26) 41

Other items 49 (97)

Prior period differences 8 8

Temporary differences (18) 112

Tax losses utilised 413 117

Income tax payable – –

5 INCOME TAX CONTINUED

64

QANTAS ANNUAL REPORT 2016