Qantas 2016 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of Operations continued

For the year ended 30 June 2016

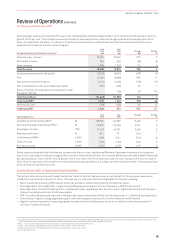

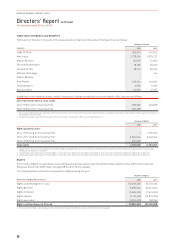

ii. Other items not included in Underlying PBT

Items which are identified by Management and reported to the chief operating decision-making bodies as not representing the

underlying performance of the business are not included in Underlying PBT. The determination of these items is made after

consideration of their nature and materiality and is applied consistently from period to period.

Items not included in Underlying PBT primarily result from revenues or expenses relating to business activities in other

reporting

periods, major transformational/restructuring initiatives, transactions involving investments, impairments of assets

and other transactions outside the ordinary course of business. Other items not included in Underlying PBT of $93 million includes

transformation costs relating to the Qantas Transformation Program of $183 million, the wage freeze employee bonus of $91 million

relating to the Enterprise Bargaining Agreements (EBAs) announced on 3 July 2015 and other costs of $20 million offset by the net

gain on disposal of property, plant and equipment of $201 million relating to the disposal of Sydney Airport Terminal Three and

related assets to Sydney Airport Corporation Limited announced on 18 August 2015.

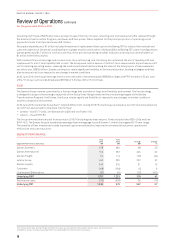

MATERIAL BUSINESS RISKS

The aviation industry is subject to a number of inherent risks. These include, but are not limited to, exposure to changes in economic

conditions, changes in government regulations, fuel and foreign exchange volatility and other exogenous events such as aviation

incidents, natural disasters, war or an epidemic.

Qantas is subject to a number of specific business risks which may impact the achievement of the Group’s strategy and financial

prospects. The nature of these risks has not changed with the focus remaining on improving the controls in place to manage or

mitigate these risks.

–Competitive intensity: Market capacity growth ahead of underlying demand impacts industry profitability.

• Australia’s liberal aviation policy settings coupled with the strength of the Australian economy relative to global economic

weakness in recent years has attracted more offshore competitors to the Australian international aviation market,

predominantly state-sponsored airlines. Qantas is responding by building key strategic airline partnerships with strong global

partners and optimising its network. Qantas brings domestic strength and the unrivalled customer offering of Qantas Loyalty.

Qantas International has embarked on a major restructure of its legacy cost base through the Qantas Transformation Program

with the objective of achieving a cost base comparable to direct competitors.

• The Australian domestic aviation market is a highly competitive environment. The Qantas Group’s market-leading domestic

position and dual-brand strategy allow Qantas to effectively mitigate the impact of any market changes. This strategy leverages

Qantas Domestic (including QantasLink) to serve business and premium leisure customers and Jetstar to serve price-

sensitive

customers. Qantas Domestic is focused on removing the cost base disadvantage to its competitor through Qantas

Transformation initiatives while maintaining a revenue premium. Jetstar is working to maintain its lowest seat cost and yield

advantage. These priorities deliver Qantas Domestic and Jetstar Domestic the highest operating margins in their respective

markets enabling the Group to retain market share of Underlying EBIT in excess of capacity share.

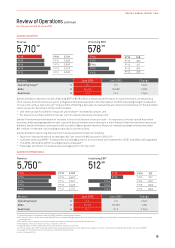

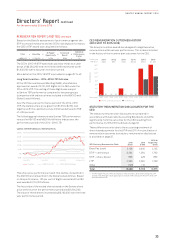

–Fuel and foreign exchange volatility: The Qantas Group is subject to fuel and foreign exchange risks. These risks are an inherent

part of the operations of an airline. The Qantas Group manages these risks through a comprehensive hedging program. For 2016/17

the Group’s hedging profile is positioned such that the worst case total fuel cost is $3.2

56

billion with 87 per cent participation

rate in lower fuel prices (at current forward market price total fuel cost for 2016/17 is $3.157 billion)58. Complementing the hedging

program, increased focus on forecasting and operational agility of our aviation operations supports the Group to manage the

residual uncertainty.

–Industrial relations: The associated risks of transformation including industrial action relating to Qantas’ collective agreements

with its employees. The risk is being mitigated through continuous employee engagement initiatives and ongoing, constructive

dialogue with all union groups and other relevant stakeholders. In 2015/16 the Group’s engagement score was at a record 79 per

cent up four percentage points since 2014/15. The Group has successfully closed 30 Enterprise Bargaining Agreements (EBAs)

subsequent to the commencement of the Qantas Transformation Program inclusive of an 18 month wage freeze. To support

the implementation of the 18 month wage freeze a bonus payment of five per cent was announced in July 2015 to be made to all

employees covered by an 18 month wage freeze. In addition, in August 2016 in recognition of the contribution towards a record

result, the Group announced a further $3,000 bonus to all full-time employees and $2,500 to all part-time employees covered by

an 18 month wage freeze.

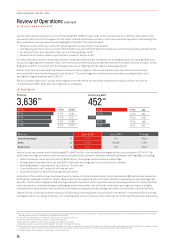

–Integrity of data and continuity of critical systems: The Group’s operations depend on the continuity of a number of information

technology and communication services and the integrity and protection of the privacy of data. The Group’s ongoing investment

in cybersecurity, together with its extensive Control and Risk Framework59 work to reduce the likelihood of outages, ensure early

detection and the mitigation of impact.

–Key business partners and alliances: The Qantas Group has relationships with a number of key business partners. Any potential

exposures as a result of these partnerships are mitigated through the Group Risk Management Framework.

56 The worst case total fuel cost is based on a two standard deviation correlated move in the Brent forward market prices to US$56/bbl with the AUD/USD rate at 0.78 for the remainder of

2016/17.

57 The current forward market price total fuel cost is based on a Brent forward market price of A$67/bbl for the remainder of 2016/17.

58 As at 23 August 2016.

59 An overview of the Group Risk Management Framework is available through the Qantas Group Business Practices Document on www.qantas.com.au.

23

QANTAS ANNUAL REPORT 2016