Qantas 2016 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

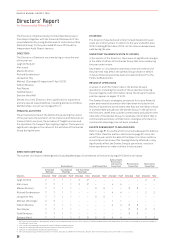

Directors’ Report continued

For the year ended 30 June 2016

COVER LETTER TO THE REMUNERATION REPORT

Dear Shareholder,

The Remuneration Report sets out remuneration information for the Chief Executive Officer (CEO), direct reports to the CEO

(Executive Management) and Non-Executive Directors.

In addition to the detailed Remuneration Report, we have provided an introduction to the Report which contains a summary of:

–The Remuneration Framework and how it was applied for the 2015/2016 financial year

–The remuneration outcomes for the CEO

Qantas’ Remuneration Policy

Qantas is committed to having remuneration outcomes that are aligned with performance and the creation of shareholder value.

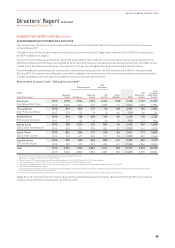

The commitment and practice is demonstrated in 2015/2016 and also in the five years prior where:

–Annual incentives were not paid to the CEO in two years (2011/2012 and 2013/2014), partial awards were paid in two years

(2010/2011 and 2012/2013), and above ‘At Target’ was paid once (2014/2015)

–Long Term Incentive Plan (LTIP) awards partially vested once (2014/2015) and did not vest at all in the four previous years

The Remuneration Report includes further details of the history of incentive plan outcomes on page 33.

Qantas’ Performance in 2015/2016

2015/2016 was an outstanding year for Qantas. Over the financial year, Qantas continued to improve the customer experience,

exceeded its commitments under the Qantas Transformation program, and has delivered a record financial result and returned

over $1 billion to shareholders.

All employees can be very proud of their contribution to these results.

Remuneration Outcomes in 2015/2016

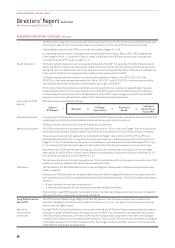

Fixed Remuneration – During 2015/2016 our restrained approach to fixed remuneration increases continued.

Variable Remuneration – The 2015/2016 remuneration outcomes for the CEO and Executive Management align with Qantas’

performance and the creation of shareholder value.

Annual Incentive Outcomes:

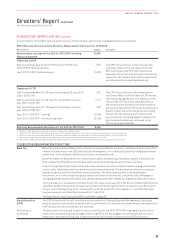

Annual incentives were paid to the CEO and Executive Management based on their contribution to the achievement of the 2015/16

Short Term Incentive Plan’s (STIP) ‘scorecard’ of financial and non-financial performance targets. The Board reviewed the performance

of the CEO and Executive Management, and concluded that their actions were instrumental in the achievement of these targets.

Management achieved $357 million growth of passenger revenue largely driven by increased utilisation of existing Group aircraft,

continued growth of non-cyclical earnings through delivery of Qantas Loyalty’s diversification strategy, and delivered a strong

improvement from Jetstar Group Airlines in Asia (Singapore, Japan and Vietnam) which reported a healthy combined profit.

Management also achieved the objectives of the Group’s Financial Framework:

–Achieving optimal capital structure with investment grade level credit ratings restored by Moody’s Investor Services and

Standard and Poor’s

–Achieving Return on Invested Capital (ROIC) of 23 per cent

–Being disciplined in the allocation of capital and were able to return $1 billion to shareholders through both a share buy-back

and a return of capital

The Board assessed performance against the ‘scorecard’ at 160 per cent of target. The Remuneration Report includes further

detail of the Board’s assessment of the CEO and Executive Management’s contribution to these results.

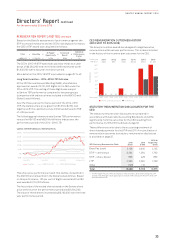

Long Term Incentive Outcomes:

Under the 2014–2016 LTIP, a fixed number of Rights were awarded to the CEO and Executive Management in 2013. Based on Qantas’

Total Shareholder Return (of +109 per cent) over the three year performance period, the Rights all converted to Qantas shares.

The value of this fixed number of shares increases or decreases depending on the share price at the time of vesting. Over the

three year performance period of the 2014–2016 LTIP, Qantas’ share price increased from $1.35 to $2.82. In the remuneration

outcomes table, we have disclosed the value of these shares at the start of the performance period and have also disclosed the

increase in the value of these shares that has been driven by share price growth over the performance period.

The Board remains committed to a Remuneration Framework that is aligned to the Qantas Group strategy, is performance-

based, attracts, motivates and appropriately rewards Management, meets shareholders’ requirements and encourages

decision-making that is focused on the longer-term.

Paul Rayner

Chair, Remuneration Committee

REMUNERATION REPORT (AUDITED)

30

QANTAS ANNUAL REPORT 2016