Qantas 2016 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

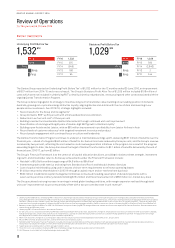

Domestic Australia experienced a stable operating environment in non-resources sectors:

–Lower AUD and increased inbound visitor arrivals supporting domestic traffic growth

–Resource related traffic and revenue down compared to 2014/15

–Fourth quarter 2015/16 general demand weakness

The Group’s international operating environment was more competitive, with competitor capacity growth and sharper pricing activity

seen on key routes:

–Increased industry capacity growth on the back of higher operating margins

–Industry-wide pricing activity passing on a portion of fuel benefit

–Geopolitical uncertainty impacting northern hemisphere travel

–Qantas and Jetstar capacity growth focused on higher demand markets in Asia

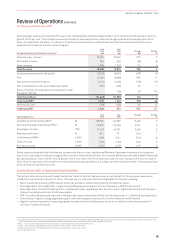

FINANCIAL FRAMEWORK ALIGNED WITH SHAREHOLDER OBJECTIVES

Qantas’ Financial Framework aligns our objectives with those of our shareholders. With the aim of generating maintainable Earnings

per share growth over the cycle, which in turn should translate into Total Shareholder Returns (TSR) in the top quartile of the ASX100

and a basket of global airlines11, the Financial Framework has three clear priorities and associated long-term targets:

MAINTAINABLE EPS13 GROWTH OVER THE CYCLE

TOTAL SHAREHOLDER RETURNS IN THE TOP QUARTILE

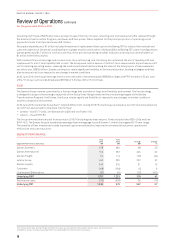

1. Maintaining an Optimal Capital

Structure

2. ROIC > WACC12 Through the Cycle 3. Disciplined Allocation of Capital

Minimise cost of capital by targeting a

net debt range of $4.8 billion to $6billion

Deliver ROIC > 10 per cent through

the cycle

Grow Invested Capital with disciplined

investment, return surplus capital

Maintaining an Optimal Capital Structure

Surplus Capital No Surplus Capital

OPTIMAL CAPITAL

STRUCTURE

Debt reduction

focus

Increased

distributions, grow

invested capital

10% ROIC

Net Debt ($B)

$4.8 $6.0

ROIC (%)

–The Group’s Financial Framework targets an optimal

capital structure with a net debt range of between

$4.8billion and $6 billion, based on the current Average

Invested Capital of approximately $9 billion. This capital

structure lowers the Group’s cost of capital, preserves

financial strength, and therefore enhances long-term

shareholder value.

–Capital allocation decisions, including distributions to

shareholders, are sized to remain within the target net debt

range on a forward basis.

–The Group’s optimal capital structure is consistent with

investment grade credit metrics from Standard and Poor’s

and Moody’s Investor Services.

11 Target Total Shareholder Returns within the top quartile of the ASX100 and global listed airline peer group as stated in the 2015 Annual Report, with reference to the 2015-2017 Long Term

Incentive Plan (LTIP).

12 Weighted Average Cost of Capital (WACC) is calculated on a pre-tax basis.

13 Earnings per share.

Review of Operations continued

For the year ended 30 June 2016

13

QANTAS ANNUAL REPORT 2016