Qantas 2016 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

20 FINANCIAL RISK MANAGEMENT CONTINUED

(B) FAIR VALUE

The fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value

due to their short maturity. The fair value of financial assets and liabilities is determined by valuing them at the present value of

future contracted cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having

regard to the timing of the cash flows.

The fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by reference

to market exchange rates and fuel prices. The fair value of interest rate swaps is determined as the present value of future contracted

cash flows. Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the timing

of the cash flows. The fair value of options is determined using standard valuation techniques. Other financial assets and liabilities

represent the fair value of derivative financial instruments recognised on the Consolidated Balance Sheet in accordance with

AASB9. Refer to Note 29(E) for a definition of the fair value hierarchy.

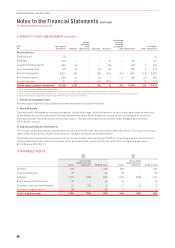

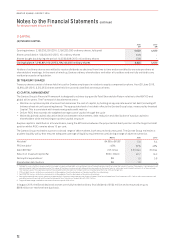

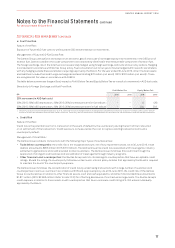

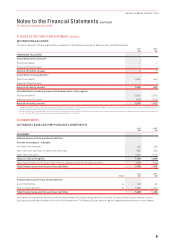

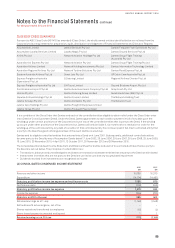

2016 2015

Carrying Amount Held at Carrying Amount Held at

$M

Fair Value

Through Profit

and Loss Amortised Cost Fair Value

Fair Value

Through Profit

and Loss Amortised Cost Fair Value

Financial assets

Cash and cash equivalents –1,980 1,986 –2,908 2,917

Receivables –929 929 –1,093 1,093

Other financial assets1275 –275 662 –662

Financial liabilities

Payables –1,986 1,986 –1,881 1,881

Interest-bearing liabilities –4,862 4,952 –5,562 5,575

Other financial liabilities1264 –264 484 –484

1 Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on the Consolidated Balance Sheet in accordance with AASB 9. These derivative

financial instruments have been measured at fair value using Level 2 inputs in estimating their fair values.

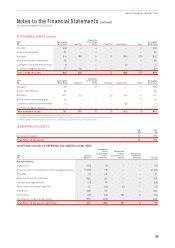

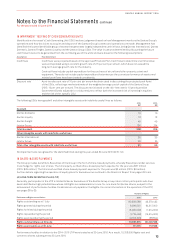

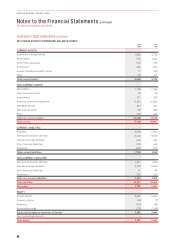

The following section summarises derivative financial instruments in the Consolidated Financial Statements:

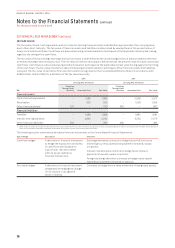

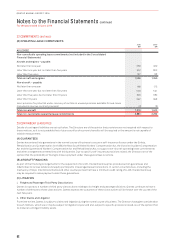

Type of Hedge Description Derivative

Cash flow hedges A derivative or financial instrument

to hedge the exposure to variability

i

n cash flows attributable to

a particular risk associated

with an asset, liability or

forecasttransaction.

Exchange derivative contracts to hedge future AUD fuel costs

and foreign currency operational payments (forwards, swaps

oroptions).

Interest rate derivative contracts to hedge future interest

payments (forwards, swaps or options).

Foreign exchange derivative contracts to hedge future capital

expenditure payments (forwards or options).

Fair value hedges A derivative or financial instrument

designated as hedging the change

in fair value of a recognised

assetorliability.

Contracts to hedge the fair value movement of designated assets.

78

QANTAS ANNUAL REPORT 2016