Qantas 2016 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

For the year ended 30 June 2016

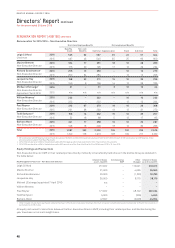

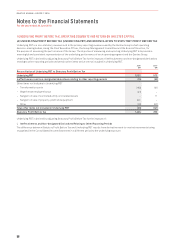

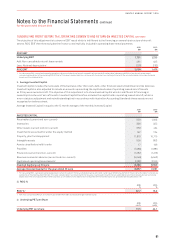

1 UNDERLYING PROFIT BEFORE TAX, OPERATING SEGMENTS AND RETURN ON INVESTED CAPITAL

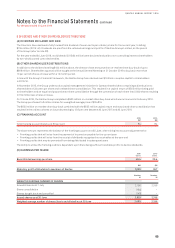

(A) UNDERLYING PROFIT BEFORE TAX (UNDERLYING PBT) AND RECONCILIATION TO STATUTORY PROFIT BEFORE TAX

Underlying PBT is a non-statutory measure and is the primary reporting measure used by the Qantas Group’s chief operating

decision-making bodies, being the Chief Executive Officer, the Group Management Committee and the Board of Directors, for

the purpose of assessing the performance of the Group. The objective of measuring and reporting Underlying PBT is to provide a

meaningful and consistent representation of the underlying performance of each operating segment and the Qantas Group.

Underlying PBT is derived by adjusting Statutory Profit Before Tax for the impacts of ineffectiveness and non-designated derivatives

relating to other reporting periods and certain other items which are not included in Underlying PBT.

2016

$M

2015

$M

Reconciliation of Underlying PBT to Statutory Profit Before Tax

Underlying PBT 1,532 975

Ineffectiveness and non-designated derivatives relating to other reporting periods (15) (39)

Other items not included in Underlying PBT

– Transformation costs (183) (91)

– Wage freeze employee bonus (91) –

– Net gain on sale of controlled entity and related assets –11

– Net gain on sale of property, plant and equipment 201 –

– Other (20) (67)

Total other items not included in Underlying PBT (93) (147)

Statutory Profit Before Tax 1,424 789

Underlying PBT is derived by adjusting Statutory Profit Before Tax for the impacts of:

i. Ineffectiveness and Non-designated Derivatives Relating to Other Reporting Periods

The difference between Statutory Profit Before Tax and Underlying PBT results from derivative mark-to-market movements being

recognised in the Consolidated Income Statement in a different period to the underlying exposure.

58

QANTAS ANNUAL REPORT 2016