Qantas 2016 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

For the year ended 30 June 2016

REMUNERATION REPORT (AUDITED) CONTINUED

Based on the Board’s assessment of performance against the

STIP scorecard measures and the CEO’s individual performance,

the CEO’s STIP award was calculated as follows:

Total =Base Pay x‘At Target’

Opportunity xScorecard

Result x

Individual

Performance

Factor

4,896,000 =2,125,000 x120% x160% x1.2

The CEO’s 2015/16 STIP award was paid two-thirds as a cash

bonus of $3,264,000 and one-third as deferred shares worth

$1,632,000 with a two year restriction period.

More detail on the 2015/16 STIP is provided on pages 37 to 42.

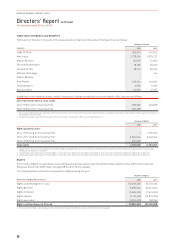

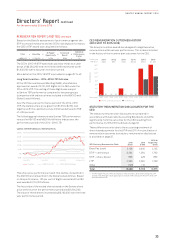

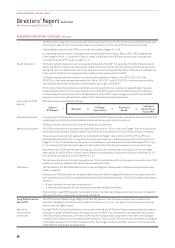

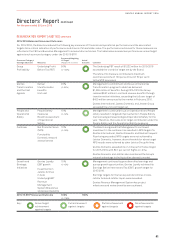

Long Term Incentive – 2014–2016 LTIP Outcome

At the 2013 Annual General Meeting (AGM), shareholders

approved an award of 2,151,000 Rights to the CEO under the

2014–2016 LTIP. The vesting of these Rights was subject

to Qantas TSR performance compared to two peer groups

(companies with ordinary shares included in the ASX100 and

Global Listed Airlines).

Over the three year performance period of the 2014–2016

LTIP, the Qantas share price grew from $1.35 to $2.82, and

together with the capital structure initiatives delivered a TSR

of+109percent.

The following graph demonstrates Qantas TSR performance

versus the ASX100 and MSCI World Airline Indices over the

performance period of the 2014–2016 LTIP.

-50%

0%

50%

100%

150%

200%

250%

QANTAS TSR PERFORMANCE v PEER GROUPS (%)

Qantas S&P / ASX 100 MSCI World Airlines

1 July 2013 1 July 2014 1 July 2015 30 June 2016

This share price performance meant that Qantas ranked 2nd in

the ASX100 and ranked 2nd in the Global Listed Airlines. Based

on this performance, 100 per cent of Rights vested and the CEO

was awarded 2,151,000 shares.

The face value of the vested shares based on the Qantas share

price at the start of the performance period was $2,904,000.

The value of these shares increased by $3,162,000 over the three

year performance period.

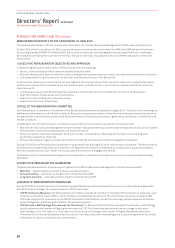

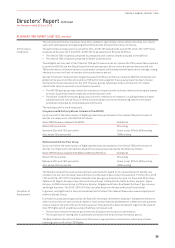

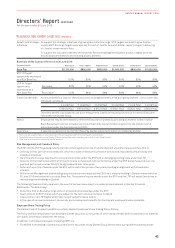

CEO REMUNERATION OUTCOMES HISTORY

(2010/2011 TO 2015/2016)

The Group’s incentive awards are designed to align Executive

remuneration with business performance. This is demonstrated

in the history of the incentive plan outcomes for the CEO.

20%

40%

60%

80%

100%

120%

140%

160%

2011

$552

2012

$95

2013

$186

2014

($646)

2015

$975

2016

$1,532

65%

0%0%0%0%0%0%

STIP LTIP STIP LTIP STIP LTIP STIP LTIP STIP LTIP STIP LTIP

OUTCOME %

LTIP Vesting

STIP Scorecard Outcome

Outcomes:

Underlying

PBT ($m):

100%

160%

85%

140%

38%

65%

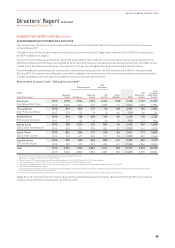

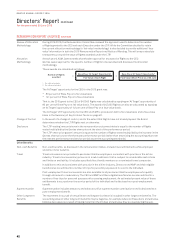

STATUTORY REMUNERATION DISCLOSURES FOR THE

CEO

The statutory remuneration disclosures are prepared in

accordance with Australian Accounting Standards and differ

significantly from the outcomes for the CEO resulting from

performance in 2015/2016 outlined on page 32.

These differences arise due to the accounting treatment of

share-based payments for the STIP and LTIP. A reconciliation of

remuneration outcomes to statutory remuneration disclosures

is provided on page 37.

CEO Statutory Remuneration Table

2016

$’000

2015

$’000

2016 ‘At

Target’ Pay

$’000

Base Pay (cash) 2,106 2,000 2,125

STIP – cash bonus 3,264 1,904 1,700

STIP – share-based 836 423 850

LTIP 2,330 2,261 1,7001

Other (108) 112 –

Total 8,428 6,700 6,375

1 The ‘At Target’ Pay for LTIP is set based on a fair value allocation methodology for LTIP

awards. The ‘At Target’ value applying a face value methodology for the 2014–2016 LTIP

would be $2,904,000.

33

QANTAS ANNUAL REPORT 2016