Qantas 2016 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

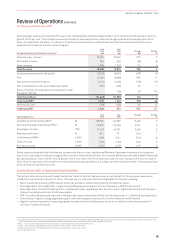

Review of Operations continued

For the year ended 30 June 2016

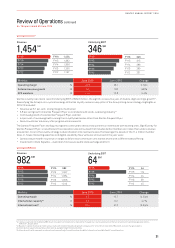

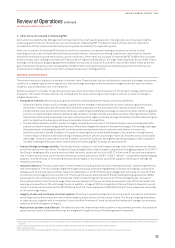

ROIC > WACC Through the Cycle

Return on Invested Capital (ROIC) of 22.7 per cent, up

from 16.2per cent in the prior year, was achieved

through

generating higher returns from existing assets. Average

Invested Capital in 2015/16 of $8.9billion was slightly

below Average Invested Capital of $9.1 billion in 2014/15

with disciplined

capital expenditure. With increased

fleet utilisation, cost reduction through the Qantas

Transformation Program and lower fuel prices, returns were

well above the Group’s threshold target of ROIC greater than

10percent.

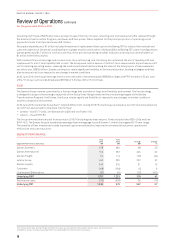

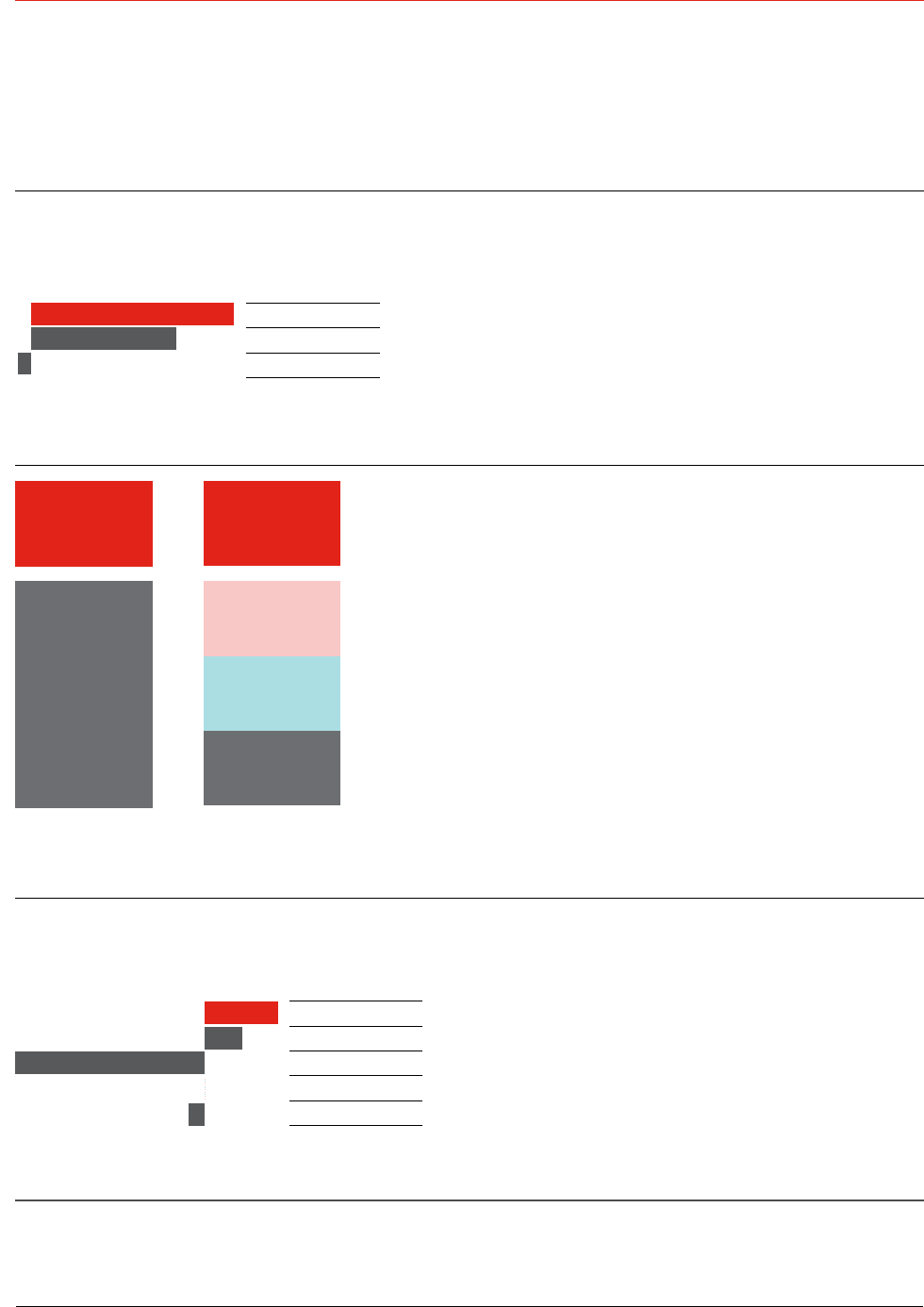

Disciplined Allocation of Capital

Funds from

Operations

$3.1b

Debt reduction

$1.1b

Net capex

$1.0b

Shareholder

distributions

$1.0b

Reduction in cash

balance

$0.9b

Refinancing of

operating leases

$0.8b

Sources Uses

Funds from Operations (FFO)14 increased to $3.1billion in

2015/16. FFO were applied to:

–$1.1 billion of debt repayments15

–$1 billion of net capital expenditure16 in line withguidance

–$1 billion distributed to shareholders in 2015/16 through

a share buy-back and capitalreturn

$778 million cash in excess of short-term liquidity

requirements was used to refinance 29 aircraft out of

maturing operating leases. Using the Group’s existing cash

balance in this way achieved the following benefits:

–Reduced gross debt and cost of carry, minimal impact to

net debt

–Greater fleet and maintenance planning flexibility

–Reduced exposure to USD lease rentals

–Increased value of unencumbered assets to over

US$3.9billion17

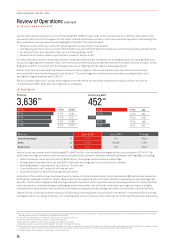

Maintainable EPS Growth over the Cycle

Earnings per share almost doubled to 49.4 cents, with an

84percent improvement in Statutory Profit After Tax and a

12.6per cent reduction in shares on issue.

Shares on issue

were reduced through the $505 million

capital return and

related share consolidation as well as the $500million on-

market share buy-back, both ofwhich were completed in

2015/16.

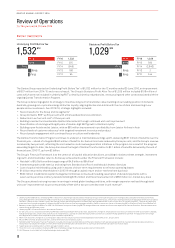

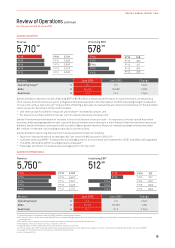

UNDERLYING PBT

The Qantas Group’s full-year 2015/16 Underlying PBT increased to $1,532 million, compared to an Underlying PBT of $975 million

in 2014/15. The significant improvement in earnings was driven by the delivery of a reduction in ex-fuel unit cost, fuel efficiency

initiatives, and revenue benefits from the Qantas Transformation Program and the benefits of lower fuel prices captured by the

Group’s disciplined hedging program.

FY16

FY15

FY14

Return on Invested Capital

23

%

FY16 22.7%

FY15 16.2%

FY14 (1.5%)

FY16

FY15

FY14

FY13

FY12

Earnings Per Share

49.4

cents

FY16 49.4

FY15 25.4

FY14 (128.5)

FY13 0.0

F Y12 (10.8)

14 Funds from Operations of $3.1 billion is equal to operating cash flows in the Consolidated Cash Flow Statement adjusted for the principal portion of operating leased aircraft rental

payments. The principal portion of aircraft operating lease rentals are considered a debt repayment in the Group’s financial framework. After this adjustment, the interest portion of

lease rental payments continues to be recognised as an outflow in Funds from Operations.

15 Debt repayments of $1.1 billion refers to repayment of on balance sheet borrowings and capitalised operating lease liability repayments (excluding cash flows relating to aircraft

operating lease refinancing). Debt reduction is equal to the total of financing cash flows in the statement of cash flows excluding shareholder distributions and payments for treasury

shares, principal portion of operating leased aircraft rental payments and reduction of capitalised operating leases from the return of leased aircraft.

16 Net capital expenditure of $1 billion is equal to net investing cash flows included in the Consolidated Cash Flow Statement (excluding aircraft operating lease refinancing) less the

impact to invested capital of returning operating lease aircraft.

17 Based on AVAC market values.

14

QANTAS ANNUAL REPORT 2016