Qantas 2016 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

For the year ended 30 June 2016

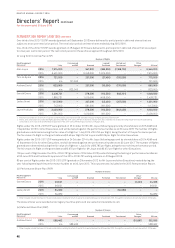

Review of Allocation

Methodology

During 2015/2016, the Remuneration Committee reviewed the approach used to determine the number

of Rights granted to the CEO and each Executive under the LTIP. While the Committee decided to retain

the current allocation methodology (a ‘fair value’ methodology) it also decided to provide additional ‘face

value’ information in both the 2016 Remuneration Report and Notice of Meeting. This will ensure absolute

transparency around the value of Rights awarded under the LTIP.

Allocation

Methodology

At each year’s AGM, Qantas seeks shareholder approval for any award of Rights to the CEO.

Qantas seeks approval for the specific number of Rights to be awarded and discloses the allocation

methodology.

These awards are calculated as follows:

Number of Rights

awarded =Base Pay x ‘At Target’ Opportunity1

=Base Pay x ‘At Target’ Opportunity2

Fair Value of each Right Face Value (Share Price) as at 30 June

1 On a fair value basis

2 On a face value basis

The ‘At Target’ opportunity for the CEO for the 2015 grant was:

–80 per cent of Base Pay on a fair value basis

–141 per cent of Base Pay on a face value basis

That is, the 2015 grant to the CEO of 947,000 Rights was calculated by applying an ‘At Target’ opportunity of

80 per cent of Base Pay on a fair value basis. The award of 947,000 Rights can also be calculated by applying

an ‘At Target’ opportunity of 141 per cent of Base Pay on a face value basis.

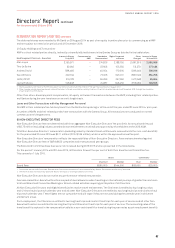

The ‘At Target’ LTIP opportunity for the CEO and KMP is provided on both a fair value basis and a face value

basis in the Summary of Key Contract Terms on page 43.

Change of Control In the event of a change of control, and to the extent that Rights have not already lapsed, the Board

determines whether the LTIP Rights vest or otherwise.

Disclosure The ‘LTIP vesting’ amount shown in the remuneration outcomes tables is equal to the number of Rights

vested multiplied by the Qantas share price at the start of the performance period.

The ‘LTIP share price growth’ amount is equal to the number of Rights vested multiplied by the increase in the

Qantas share price over the three year performance period (rather than amortising the accounting value over

the relevant performance and service period as per the accounting standards).

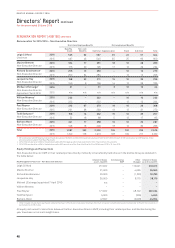

Other Benefits

Non-cash Benefits Non-cash benefits, as disclosed in the remuneration tables, include travel entitlements while employed

and other minor benefits.

Travel Travel concessions are provided to permanent Qantas employees, consistent with practice in the airline

industry. Travel at concessionary prices is on a sub-load basis, that is, subject to considerable restrictions

and limits on availability. It includes specified direct family members or a nominated travel companion.

In addition to this and consistent with practice in the airline industry, Directors and KMP and their eligible

beneficiaries are entitled to a number of trips for personal purposes at no cost to the individual.

Post-employment travel concessions are also available to all permanent Qantas employees who qualify

through retirement or redundancy. The CEO and KMP and their eligible beneficiaries are also entitled to a

number of free trips for personal purposes after ceasing employment. An estimated present value of these

entitlements is accrued over the service period of the individual and is disclosed as a post-employment

benefit.

Superannuation Superannuation includes statutory and salary sacrifice superannuation contributions and is disclosed as a

post-employment benefit.

Other Long-term

Benefits

The movement in accrual of annual leave and long service leave is included in other long-term benefits. The

accounting value of other long-term benefits may be negative, for example where an Executive’s annual leave

balance decreases as a result of taking more than the 20 days annual leave they accrued during the year.

REMUNERATION REPORT (AUDITED) CONTINUED

40

QANTAS ANNUAL REPORT 2016