Qantas 2016 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

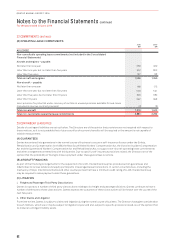

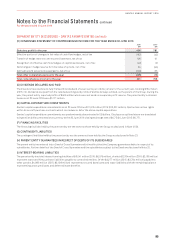

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

ii. Recognition and Measurement of Non-derivative Financial Liabilities

At initial recognition, the Group measures a non-derivative financial liability at its fair value, less transaction costs.

The Group subsequently measures non-derivative financial liabilities at amortised cost, with any difference between cost

and

redemption value being recognised in the Consolidated Income Statement over the period of the borrowings on an effective

interest basis. Non-derivative financial liabilities that are designated as hedged items are subject to measurement under the hedge

accounting requirements.

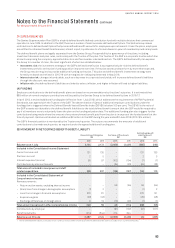

DERIVATIVE FINANCIAL INSTRUMENTS

Derivative financial instruments are recognised at fair value both initially and on an ongoing basis. The accounting for subsequent

changes in fair value depends on whether the derivative is a designated hedging instrument, and if so, the nature of the item being

hedged and the type of hedge relationship designated. The Group designates derivatives as either hedges of the fair value of

recognised assets or liabilities or a firm commitment (fair value hedges), or hedges of highly probable forecast transactions (cash

flow hedges).

At the inception of the transactions, the Qantas Group documents the relationship between hedging instruments and hedged

items, including the risk management objective and strategy for undertaking each transaction. The Qantas Group also documents

its assessment, both at hedge inception and on an ongoing basis, of whether the hedging instruments that are used in hedge

transactions have been and will continue to be highly effective.

From time to time certain derivative financial instruments do not qualify for hedge accounting, notwithstanding that the derivatives

are held to hedge identified exposures. Any changes in the fair value of a derivative instrument, or part of a derivative instrument that

do not qualify for hedge accounting are classified as ‘ineffective’ and recognised immediately in the Consolidated Income Statement.

i. Fair Value Hedges

Changes in the fair value of derivative financial instruments that are designated and qualify as fair value hedges are recorded in

the Consolidated Income Statement, together with any changes in the fair value of the hedged asset or liability or firm commitment

attributable to the hedged risk.

ii. Cash Flow Hedges

Where a derivative is designated as a cash flow hedging instrument, the effective portion of changes in the fair value of the derivative

is recognised in the Consolidated Statement of Comprehensive Income and accumulated in the hedging reserve. Any ineffective

portion of changes in the fair value of the derivative are recognised immediately in the Consolidated Income Statement.

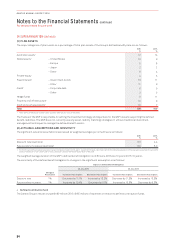

The amount accumulated in equity is retained in the Consolidated Statement of Comprehensive Income and reclassified to the

Consolidated Income Statement in the same period or periods during which the hedged forecast cash flows affect profit or loss or

the hedged item affects profit or loss. If the forecast transaction is no longer expected to occur, the hedge no longer meets the criteria

for hedge accounting, the hedging instrument expires or is sold, terminated or exercised, or the designation is revoked, then hedge

accounting is discontinued prospectively. If the forecast transaction is no longer expected to occur, then the amount accumulated in

equity is reclassified to the Consolidated Income Statement. Where the hedged item is capital in nature, the cumulative gain or loss

recognised in the hedge reserve is transferred to the carrying amount of the asset when the asset is recognised.

iii. Cost of Hedging

The time value of an option, the forward element of a forward contract and any foreign currency basis spread is excluded from the

designation of a financial instrument and accounted for as a cost of hedging. The fair value changes of these elements are recognised

in other comprehensive income and depending on the nature of the hedged item, will either be transferred to the Consolidated

Income Statement in the same period that the underlying transaction affects the Consolidated Income Statement or be capitalised

into the initial carrying value of a hedge and reported as ineffectiveness.

iv. Fair Value Calculations

The fair value of financial instruments traded in active markets is based on quoted market prices at balance date. The fair value of

financial instruments that are not traded in an active market are estimated using valuation techniques consistent with accepted

market practice. The Qantas Group uses a variety of methods and input assumptions that are based on market conditions existing

at balance date. The different methods of estimating the fair value of these items have been defined in the Consolidated Financial

Statements as follows:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices)

Level 3: Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

92

QANTAS ANNUAL REPORT 2016