Qantas 2016 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

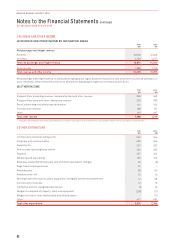

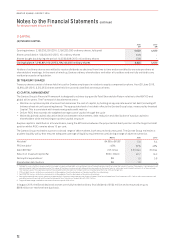

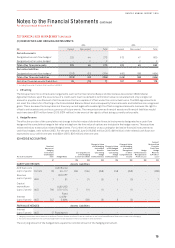

17 CAPITAL

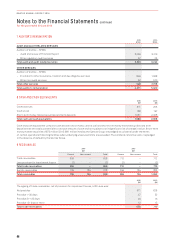

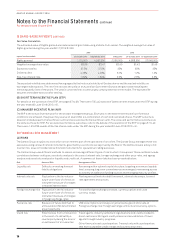

(A) ISSUED CAPITAL

2016

$M

2015

$M

Opening balance: 2,196,330,250 (2015: 2,196,330,250) ordinary shares, fully paid 4,630 4,630

Share consolidation: 133,929,900 (2015: nil) ordinary shares (505) –

Shares bought back during the period: 143,599,336 (2015: nil) ordinary shares (500) –

Closing balance: 1,918,801,014 (2015:2,196,330,250) ordinary shares 3,625 4,630

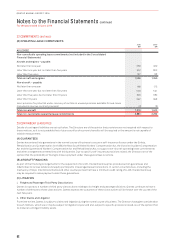

Holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at

shareholders’ meetings. In the event of wind-up, Qantas ordinary shareholders rank after all creditors and are fully entitled to any

residual proceeds on liquidation.

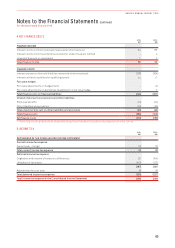

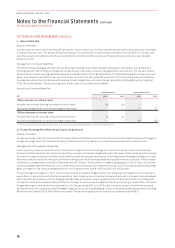

(B) TREASURY SHARES

Treasury shares consist of shares held in trust for Qantas employees in relation to equity compensation plans. As at 30 June 2016,

13,864,426 (2015: 3,512,952) shares were held in trust and classified as treasury shares.

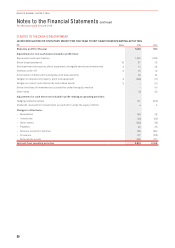

(C) CAPITAL MANAGEMENT

The Qantas Group’s Financial Framework is designed to achieve top quartile Total Shareholder Return relative to the ASX100 and

global airline peers. The Framework’s key elements are to:

–Maintain an optimal capital structure that minimises the cost of capital, by holding an appropriate level of net debt (including off

balance sheet aircraft operating leases). The appropriate level of net debt reflects the Qantas Group’s size, measured by Invested

Capital. This is consistent with investment grade credit metrics

–Deliver ROIC that exceeds the weighted average cost of capital through the cycle

–Make disciplined capital allocation decisions between reinvestment, debt reduction and distribution of surplus capital to

shareholders while maintaining an optimal capital structure

Surplus capital is identified on a forward basis, being the difference between the projected net debt position and the target net debt

position whilst ROIC remains above 10 per cent.

The Qantas Group maintains access to a broad range of debt markets, both secured and unsecured. The Qantas Group maintains a

prudent liquidity policy that ensures adequate coverage of liquidity requirements considering a range of adverse scenarios.

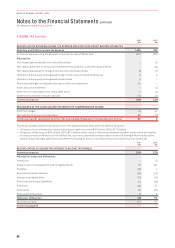

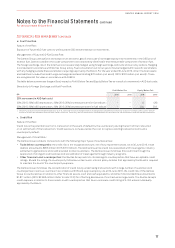

Metric 2016 2015

Net debt1 $4.8B to $6.0B55.6 6.4

FFO/net debt2>45% 52% 45%

Debt/EBITDA3<3.5 times 2.5 times 3 times

Return on Invested Capital (%) ROIC > WACC 22.7 16.2

Net capital expenditure4$B 1.0 0.8

Shareholder distributions $B 1.0 –

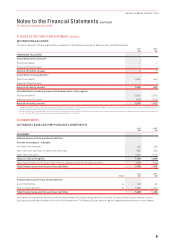

1 Net debt is a non-statutory measure which includes on balance sheet debt and capitalised aircraft operating lease liabilities under the Group’s Financial Framework. Capitalised aircraft

operating lease liabilities are measured at fair value at the lease commencement date and remeasured over the lease term on a principal and interest basis akin to a finance lease.

The residual value of the capitalised aircraft lease liability denominated in a foreign currency is translated at the long-term exchange rate.

2 FFO/net debt is a non-statutory measure which is Management’s estimate based on Standard and Poor’s methodology.

3 Debt/EBITDA is a non-statutory measure which is Management’s estimate based on Moody’s methodology.

4 Net capital expenditure is a non-statutory measure which is equal to net investing cash flows included in the Consolidated Cash Flow Statement of $1.1 billion (which excludes aircraft

operating lease refinancing) less the implied proceeds from the return of leased aircraft of $0.1 billion.

5 Target net debt range is based on the current invested capital of $9 billion.

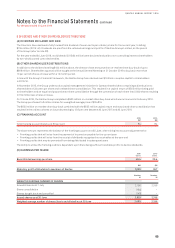

In August 2016, the Board declared a seven cent fully franked ordinary final dividend of $134 million and announced an up to

$366million on-market share buy-back.

72

QANTAS ANNUAL REPORT 2016