Qantas 2016 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

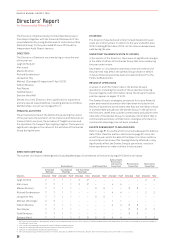

Corporate Governance Statement continued

For the year ended 30 June 2016

THE BOARD SAFEGUARDS THE INTEGRITY OF CORPORATE

FINANCIAL REPORTING

The Board and Audit Committee closely monitor the

independence of the external auditor. Regular reviews occur

of the independence safeguards put in place by the external

auditor. Qantas rotates the lead external audit partner every

fiveyears and imposes restrictions on the employment of

personnel previously employed by the external auditor.

Policies are in place to restrict the type of non-audit services

which can be provided by the external auditor and a detailed

review of non-audit fees paid to the external auditor is

undertaken on a half-yearly basis.

At each meeting, the Audit Committee meets privately with

Executive Management without the external auditor, and with

the internal and external auditors with Executive Management.

THE BOARD MAKES TIMELY AND BALANCED DISCLOSURE

Qantas is committed to ensuring that trading in its shares takes

place in an orderly and informed market, with transparent

and consistent communication with all shareholders. Qantas

has an established process to ensure that it complies with its

continuous disclosure obligations at all times, including a bi-

annual confirmation by all Executive Management that the areas

for which they are responsible have complied with the Group’s

Continuous Disclosure Policy.

Qantas proactively communicates with its shareholders via the

ASX and its web-based Newsroom, with all materials released

by the Group made available to all shareholders at the same

time. Additionally, Qantas actively conveys its publicly-disclosed

information and seeks the views of its shareholders, large and

small, in a number of forums, including at the Annual General

Meeting (AGM), the Qantas Investor Day and, as is common

practice among its major listed peers, through periodic

meetings with current and potential institutional shareholders.

THE BOARD RESPECTS THE RIGHTS OF SHAREHOLDERS

Qantas has a Shareholder Communications Policy which promotes

effective two-way communication with shareholders and the

wider investment community, and encourages participation at

general meetings.

Shareholders also have the option to receive communications

from, and send communications to, Qantas and its Share

Registry electronically, including email notification of significant

market announcements.

The external auditor attends the AGM and is available to answer

shareholder questions that are relevant to the audit.

THE BOARD RECOGNISES AND MANAGES RISK

Qantas is committed to embedding risk management practices

to support the achievement of business objectives and fulfil

corporate governance obligations. The Board is responsible

for reviewing and overseeing the risk management strategy for

the Qantas Group and for ensuring the Qantas Group has an

appropriate corporate governance structure. Within that overall

strategy, Management has designed and implemented a risk

management and internal control system to manage Qantas’

material businessrisks.

During 2015/2016, the two Board committees responsible for

oversight of risk-related matters, the Audit Committee and

the Safety, Health, Environment and Security Committee,

undertook their annual review of the effectiveness of Qantas’

implementation of its risk management system and internal

control framework.

The internal audit function is carried out by Group Audit and

Risk and is independent of the external auditor. Group Audit and

Risk provides independent, objective assurance and consulting

services on Qantas’ system of risk management, internal control

and governance.

The Audit Committee approves the Group Audit and Risk Internal

Audit Charter, which provides Group Audit and Risk with full

access to Qantas Group functions, records, property and

personnel, and establishes independence requirements. The

Audit Committee also approves the appointment, replacement

and remuneration of the internal auditor. The internal auditor

has a direct reporting line to the Audit Committee and also

provides reporting to the Safety, Health, Environment and

Security Committee.

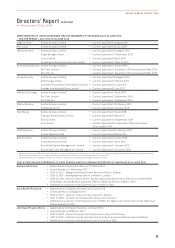

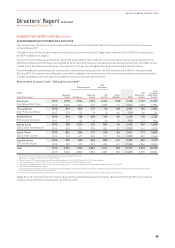

THE BOARD REMUNERATES FAIRLY AND RESPONSIBLY

The Qantas executive remuneration objectives and approach are

set out in full below.

Information about remuneration of Executive Management is

disclosed to the extent required, together with the process for

evaluating performance, in the Remuneration Report from page

30 of the 2016 Annual Report.

Qantas Non-Executive Directors are entitled to statutory

superannuation and certain travel entitlements (accrued

during service) that are reasonable and standard practice in

the aviation industry. Non-Executive Directors do not receive

any performance-based remuneration (see pages 47 to 48 of

the Qantas Annual Report 2016).

25

QANTAS ANNUAL REPORT 2016