Qantas 2016 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

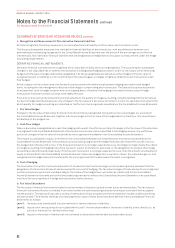

Defined benefit

superannuation

plans cont.

as a result of contributions and benefit payments. Net interest expense and other expenses related to

defined benefit plans are recognised in the Consolidated Income Statement.

The discount rate used is the corporate bond rate which has a maturity date that approximates the terms

of Qantas obligations. When the benefits of a plan are changed or when a plan is curtailed, the resulting

change in benefit that relates to past service or the gain or loss on curtailment is recognised immediately

in profit or loss. The Group recognises gains and losses on the settlement of a defined benefit plan when

the settlement occurs.

Employee termination

benefits

Termination benefits are expensed at the earlier of when the Group can no longer withdraw the offer of

those benefits and when the Group recognises costs for a restructuring. If benefits are not expected to

be settled wholly within 12 months of the end of the reporting period, then they are discounted.

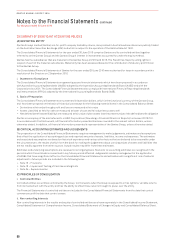

(M) PROVISIONS

A provision is recognised if, as a result of a past event, there is a present legal or constructive obligation that can be measured

reliably, and it is probable that an outflow of economic benefits will be required to settle the obligation.

If the effect is material, a provision is determined by discounting the expected future cash flows required to settle the obligation at a

pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding

of the discount is treated as a finance charge.

Onerous contracts An onerous contract is a contract in which the unavoidable cost of meeting the obligations under the

contract exceeds the economic benefit expected to be received. The Qantas Group has raised this

provision in respect of operating leases on premises and onerous customer contracts.

A provision for onerous contracts is measured at present value of the lower of the expected cost of

terminating the contract and the expected net cost of continuing with the contract. Before a provision

isestablished, the Group recognises any impairment loss on the assets associated with that contract.

Make good on leased

assets

Aircraft: a provision for return costs to meet contractual return aircraft minimum conditions, at the end

of the lease terms for the aircraft under operating leases, are recognised over the lease term.

Property and environment: where the occupation of property or land gives rise to an obligation for site

closure or rehabilitation, the Group recognises a provision for the costs associated with restoration.

Insurance, legal and other Insurance: The Qantas Group self-insures for risks associated with workers’ compensation in certain

jurisdictions. Qantas has made provision for all notified assessed workers’ compensation liabilities,

together with an estimate of liabilities incurred but not reported, based on an independent actuarial

assessment. The provision is discounted using pre-tax rates that reflect current market assessments of

the time value of money and the risks specific to the liabilities and have maturity dates approximating the

terms of Qantas’ obligations. Workers’ compensation for all remaining employees is commercially insured.

Legal and other provisions: these are recognised where they are incurred as a result of a past event, there

is legal or constructive obligation that can be measured reliably and it is probable that an outflow of

economic benefits will be required to settle the obligation.

(N) NET FINANCE COSTS

Net finance costs comprise interest payable on borrowings calculated using the effective interest method, unwinding of the

discount on provisions and receivables, interest receivable on funds invested and gains and losses on mark-to-market movement

infair value hedges.

Finance income is recognised in the Consolidated Income Statement as it accrues, using the effective interest method.

Finance costs are recognised in the Consolidated Income Statement as incurred, except where interest costs relate to qualifying

assets in which case they are capitalised to the cost of the assets. Qualifying assets are assets that necessarily take a substantial

period of time to be made ready for intended use. Where funds are borrowed generally, borrowing costs are capitalised using the

average interest rate applicable to the Qantas Group’s debt facilities.

(O) CAPITAL AND RESERVES

i. Ordinary Shares

Ordinary shares are classified as equity. Incremental costs directly attributable to issue of ordinary shares are recognised as a

deduction from equity, net of any related income tax benefit.

29 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES CONTINUED

98

QANTAS ANNUAL REPORT 2016