Qantas 2016 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Review of Operations continued

For the year ended 30 June 2016

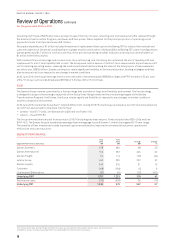

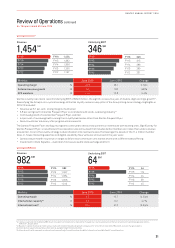

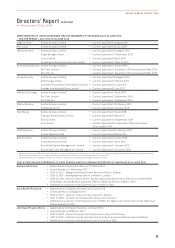

BUILDING ON THE GROUP’S LONG-TERM COMPETITIVE ADVANTAGES

The Qantas Group’s integrated portfolio strategy is designed to diversify earnings and mitigate risk, with the dual brands of Qantas

and Jetstar and their presence in attractive markets across the Asia Pacific providing long-term growth opportunities. The starting

point for the Group’s strategy is understanding the global forces that will impact Qantas over the long-term – the megatrends that

present both risk and opportunity – and ensuring the Group is well positioned to respond.

Qantas has engaged with stakeholders including shareholders, sustainability thought leaders, industry partners and suppliers to

identify and prioritise the global forces of most relevance to the Group. With this long-term context in mind, the Group’s strategic

priorities allow us to navigate the right path, building on our long-term competitive advantages while recognising and responding to

the risks and opportunities arising from emerging global forces.

New Centres

of Customer

Demand &

Geopolitical

Influence

Rapid Digitisation

& the Rise of Big

Data

Shifting

Customer

& Workforce

Preferences

Resource

Constraints &

Climate Change

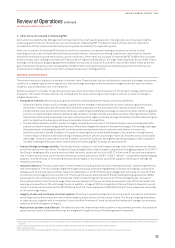

CLEAR STRATEGIC PRIORITIES

Maximising

Leading Domestic

Position through

Dual Brand

Strategy

Investing in

Customer, Brand,

Data & Digital

Focus on People,

Culture &

Leadership

Building a

Resilient &

Sustainable

Qantas

International,

Growing Efficiently

with Partnerships

Aligning Qantas

& Jetstar with

Asia’s Growth

Diversification &

Growth at Qantas

Loyalty

Embedding Sustainability Across Qantas Group

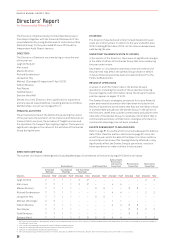

RAPIDLY IMPROVED CASH GENERATION

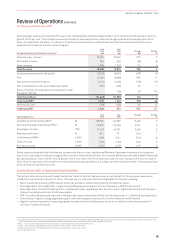

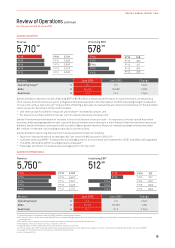

Cash Flow Summary

June

2016

$M

June

2015

$M

Change

$M

Change

%

Operating cash flows 2,819 2,048 771 38

Investing cash flows (excluding aircraft

operating lease refinancing) (1,145) (944) (201) 21

Net free cash flow 1,674 1,104 570 52

Aircraft operating lease refinancing (778) –(778) >100

Financing cash flows (1,825) (1,218) (607) 50

Cash at beginning of year 2,908 3,001 (93) (3)

Effect of foreign exchange on cash 121 (20) (95)

Cash at end of year 1,980 2,908 (928) (32)

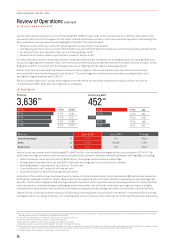

Debt Analysis

June

2016

$M

June

2015

$M

Change Change

%

Net on balance sheet debt32 2,880 2,594 286 11

Capitalised operating lease liabilities33 2,766 3,806 (1,040) (27)

Net debt34 5,646 6,400 (754) (12)

FFO/net debt %52 45 7pts

Debt/EBITDA times 2.5 3.0 (0.5) times

32 Net on balance sheet debt includes interest-bearing liabilities and the fair value of hedges related to debt reduced by cash and cash equivalents.

33 Capitalised operating lease liabilities are measured at fair value at the lease commencement date and remeasured over the lease term on a principal and interest basis akin to a finance

lease. Residual value of capitalised aircraft operating lease liability denominated in foreign currency is translated at the long-term exchange rate.

34 Net debt includes on balance sheet debt and capitalised aircraft operating lease liabilities under the Group’s Financial Framework.

17

QANTAS ANNUAL REPORT 2016