Qantas 2016 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2016 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

For the year ended 30 June 2016

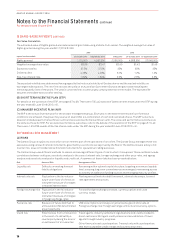

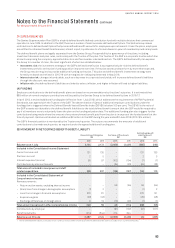

24 SUPERANNUATION

The Qantas Superannuation Plan (QSP) is a hybrid defined benefit/defined contribution fund with multiple divisions that commenced

operation in June 1939. In addition to the QSP, there are a number of small overseas defined benefit plans. The Qantas Group makes

contributions to defined benefit plans that provide defined benefit amounts for employees upon retirement. Under the plans, employees

are entitled to retirement benefits determined, at least in part, by reference to a formula based on years of membership and salary levels.

The defined benefit plans are legally separated from the Qantas Group. Responsibility for governance of the plans, including

investment decisions and plan rules, rests solely with the Trustee of the plan. The Trustee of the QSP is a corporate trustee which has

a board comprising five company-appointed directors and five member-elected directors. The QSP’s defined benefit plan exposes

the Group to a number of risks, the most significant of which are detailed below:

–Investment risk: the investment strategy of the QSP’s defined benefit plan is to progressively de-risk the defined benefit

investment portfolio as the plan’s funding position improves over time. If the plan assets underperform by more than expected,

the Group may be required to provide additional funding to the plan. This plan and defined benefit investment strategy were

formally reviewed and refined in 2015/16 with a marginal de-risking implemented in May 2016.

–Interest rate risk: changes in bond yields, such as a decrease in corporate bond yields, will increase defined benefit liabilities

through the discount rate assumed.

–Inflation risk: the defined benefit liabilities are linked to salary inflation, and higher inflation will lead to higher liabilities.

(A) FUNDING

Employer contributions to the defined benefit plans are based on recommendations by the plans’ actuaries. It is estimated that

$89million of normal employer contributions will be paid by the Qantas Group to its defined benefit plans in 2016/17.

In April 2013, a revised additional funding plan (effective from 1 July 2013), which addresses the requirements of APRA Prudential

Standards, was agreed with the Trustee of the QSP. The determination of Qantas’ additional employer contributions under the

funding plan is triggered where the Defined Benefit Vested Benefits Index (DB VBI) is below 100 per cent. The DB VBI is the ratio of

the QSP’s assets attributable to the defined benefit liabilities to the total defined benefit amount that the QSP would be required to

pay if all members were to voluntarily leave the plan on the funding valuation date. The additional funding plan also triggers further

contributions being made where the amount of any retrenchment benefit paid from the plan is in excess of the funded benefit at the

time of payment. Qantas contributed an additional $2 million to the QSP during the year ended 30 June 2016 (2015: $14 million).

The QSP’s financial position is monitored by the Trustee each quarter. The actuary recommends the amounts of additional

contributions to be made each quarter, as required under the agreed additional funding plan.

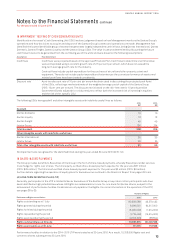

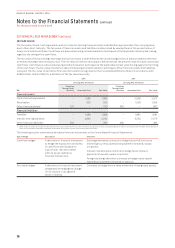

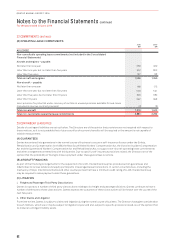

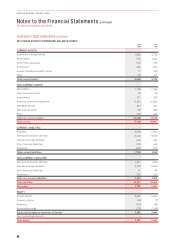

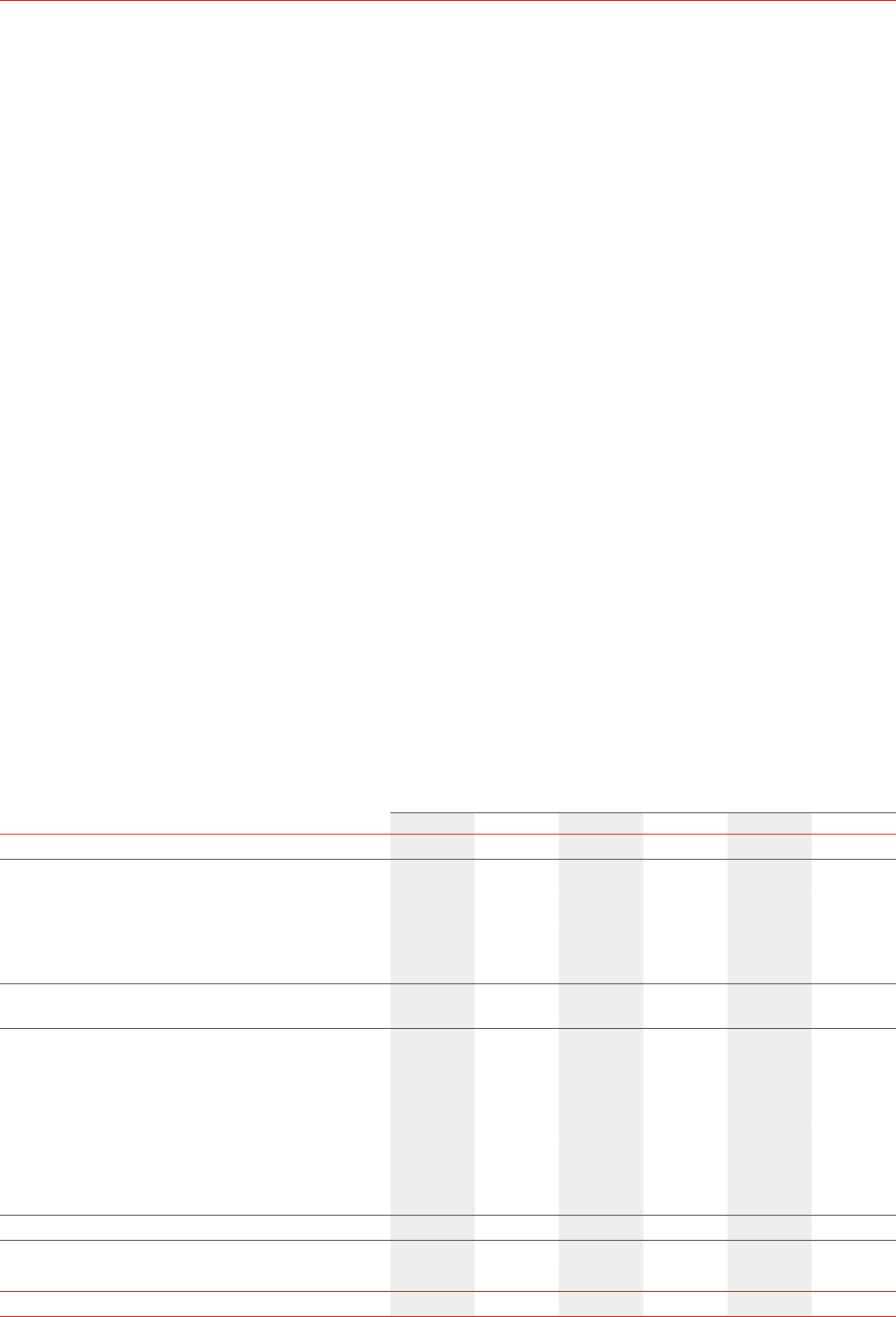

(B) MOVEMENT IN NET DEFINED BENEFIT (ASSET)/LIABILITY

Present Value of Obligation

$M

Fair Value of Plan Assets

$M

Net Defined Benefit

Liability/(Asset)1

$M

2016 2015 2016 2015 2016 2015

Balance as at 1 July 2,124 2,172 (2,409) (2,405) (285) (233)

Included in the Consolidated Income Statement

Current service cost 131 135 – – 131 135

Past service cost 2 5 – – 2 5

Interest expense/(income) 95 97 (102) (104) (7) (7)

Contributions by plan participants – – (24) (23) (24) (23)

Total amount included in manpower and staff

related expenditure 228 237 (126) (127) 102 110

Included in the Consolidated Statement of

Comprehensive Income

Remeasurements:

− Return on plan assets, excluding interest income – – 59 (94) 59 (94)

− (Gain)/Loss from change in demographic assumptions (1) 2 – – (1) 2

− Loss from change in financial assumptions 270 81 – – 270 81

− Experience gains (29) (43) – – (29) (43)

− Exchange differences on foreign plans 919 (10) (20) (1) (1)

Total amount recognised in other comprehensive income 249 59 49 (114) 298 (55)

Contributions by employer – – (91) (107) (91) (107)

Benefit payments (214) (344) 214 344 – –

Balance as at 30 June 2,387 2,124 (2,363) (2,409) 24 (285)

1 The net defined benefit liability is included in non-current provisions (refer to Note 16) and the net defined benefit asset is included in non-current other assets.

83

QANTAS ANNUAL REPORT 2016