Kroger 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

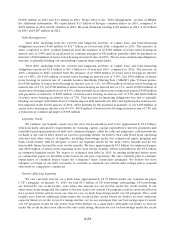

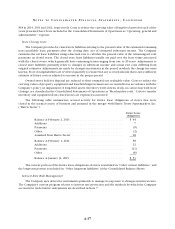

A-30

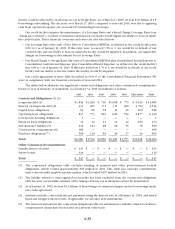

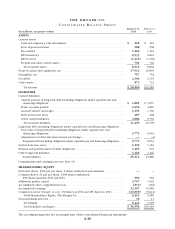

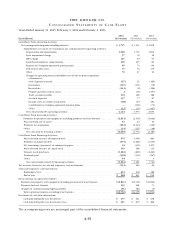

THE KROGER CO.

CO N S O L I D A T E D B A L A N C E S H E E T S

(In millions, except par values)

January 31,

2015

February 1,

2014

ASSETS

Current assets

Cash and temporary cash investments ....................................... $ 268 $ 401

Store deposits in-transit................................................... 988 958

Receivables ............................................................ 1,266 1,116

FIFO inventory ......................................................... 6,933 6,801

LIFO reserve ........................................................... (1,245) (1,150)

Prepaid and other current assets ........................................... 701 704

Total current assets .................................................... 8,911 8,830

Property, plant and equipment, net .......................................... 17,912 16,893

Intangibles, net .......................................................... 757 702

Goodwill ............................................................... 2,304 2,135

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 672 721

Total Assets .......................................................... $ 30,556 $ 29,281

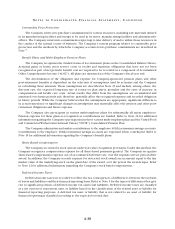

LIABILITIES

Current liabilities

Current portion of long-term debt including obligations under capital leases and

financing obligations ................................................... $ 1,885 $ 1,657

Trade accounts payable................................................... 5,052 4,881

Accrued salaries and wages ............................................... 1,291 1,150

Deferred income taxes ................................................... 287 248

Other current liabilities................................................... 2,888 2,769

Total current liabilities.................................................. 11,403 10,705

Long-term debt including obligations under capital leases and financing obligations

Face-value of long-term debt including obligations under capital leases and

financing obligations ................................................... 9,771 9,654

Adjustment to reflect fair-value interest rate hedges ............................ —(1)

Long-term debt including obligations under capital leases and financing obligations ... 9,771 9,653

Deferred income taxes..................................................... 1,209 1,381

Pension and postretirement benefit obligations ................................. 1,463 901

Other long-term liabilities .................................................. 1,268 1,246

Total Liabilities ........................................................ 25,114 23,886

Commitments and contingencies (see Note 13)

SHAREHOLDERS’ EQUITY

Preferred shares, $100 par per share, 5 shares authorized and unissued.............. ——

Common shares, $1 par per share, 1,000 shares authorized;

959 shares issued in 2014 and 2013 ........................................ 959 959

Additional paid-in capital................................................... 3,707 3,549

Accumulated other comprehensive loss ....................................... (812) (464)

Accumulated earnings ..................................................... 12,367 10,981

Common stock in treasury, at cost, 472 shares in 2014 and 451 shares in 2013 ........ (10,809) (9,641)

Total Shareholders’ Equity - The Kroger Co................................. 5,412 5,384

Noncontrolling interests ................................................... 30 11

Total Equity .......................................................... 5,442 5,395

Total Liabilities and Equity............................................... $ 30,556 $ 29,281

The accompanying notes are an integral part of the consolidated financial statements.