Kroger 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

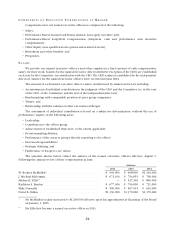

34

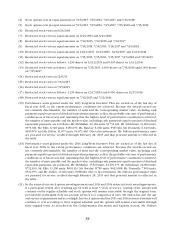

deferralaccountiscreatedeachyearandtheinterestrateestablishedforthatyearisappliedtothatdeferral

accountuntilthedeferredcompensationispaidout.IftheinterestrateestablishedbytheCompanyfor

aparticularyearexceeds120%oftheapplicablefederallong-terminterestratethatcorrespondsmost

closelytotheplanrate,theamountbywhichtheplanrateexceeds120%ofthecorrespondingfederal

rateisdeemedtobeabove-marketorpreferential.Inthirteenofthetwenty-oneyearsinwhichatleast

onenamedexecutiveofficerdeferredcompensation,theratesetundertheplanforthatyearexceeds

120% of the corresponding federal rate. For each of the deferral accounts in which the plan rate is

deemedtobeabove-market,theCompanycalculatestheamountbywhichtheactualannualearningson

theaccountexceedwhattheannualearningswouldhavebeeniftheaccountearnedinterestat120%of

the corresponding federal rate, and discloses those amounts as preferential earnings. Amounts deferred

in2014earninterestataratehigherthan120%ofthecorrespondingfederalrate,accordinglythereare

preferential earnings on these amounts.

TheamountreportedforMr.McMullenincludesachangeinpensionvalueintheamountof$3,426,477

andpreferentialearningsonnonqualifieddeferredcompensationintheamountof$71,919.Theamount

reportedforMr.Schlotmanincludesonlyachangeinpensionvalue.TheamountreportedforMr.Ellis

includesachangeinpensionvalueintheamountof$23,444andpreferentialearningsonnonqualified

deferred compensation in the amount of $3,933. The amount reported for Mr. Donnelly includes a

changeinpensionvalueintheamountof$337,634andpreferentialearningsonnonqualifieddeferred

compensationintheamountof$4,141.TheamountreportedforMr.Dillonincludesonlypreferential

earningsonnonqualified deferredcompensationbecause theactuarial present valueofaccumulated

pensionbenefitsunderhispensionplansdecreasedby$264,282.

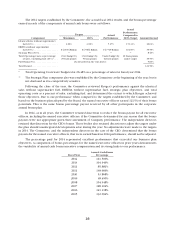

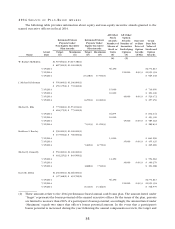

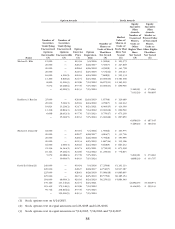

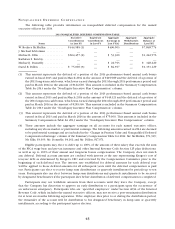

(6) Thefollowingtableprovidestheitemsandamountsincludedinthe“AllOtherCompensation”column

for2014.

Life Insurance

Premium

Accidental Death

and Dismemberment

Insurance Premium

Long-Term

Disability

Insurance

Premium

Payment of

Dividend

Equivalents

on Earned

Performance Units

Dividends

Paid on

Unvested

Restricted

Stock Other

Mr. McMullen $ 55,221 $228 $3,489 $29,215 $144,449 —

Mr.Schlotman $ 49,172 $ 228 — $16,382 $ 48,140 —

Mr.Ellis $ 43,002 $ 228 $3,489 $ 6,596 $ 45,615 $18,375

Ms.Barclay $ 67,581 $ 228 — $ 9,906 $ 31,082 $10,897

Mr.Donnelly $ 55,879 $ 228 $3,481 $ 7,604 $ 33,113 —

Mr.Dillon $242,691 $228 — $89,521 $196,253 $ 325

Theamountsreportedin“Other”columnforMr.EllisandMs.BarclayrepresenttheCompany’smatching

contributiontothetheir401(k)savingsplanaccounts.Theamountreportedinthe“Other”columnfor

Mr.Dillonrepresentsthevalueofaretirementgift.