Kroger 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-54

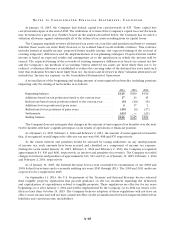

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

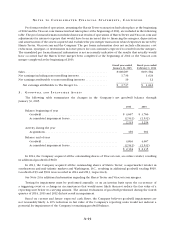

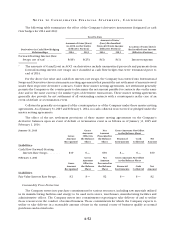

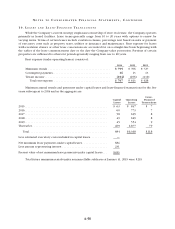

further discussion related to the Company’s carrying value of goodwill. Long-lived assets and store lease exit

costs were measured at fair value on a nonrecurring basis using Level 3 inputs as defined in the fair value

hierarchy. See Note 1 for further discussion of the Company’s policies and recorded amounts for impairments

of long-lived assets and valuation of store lease exit costs. In 2014, long-lived assets with a carrying amount of

$59 were written down to their fair value of $22, resulting in an impairment charge of $37. In 2013, long-lived

assets with a carrying amount of $68 were written down to their fair value of $29, resulting in an impairment

charge of $39.

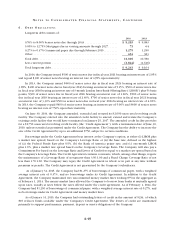

Mergers are accounted for using the acquisition method of accounting, which requires that the purchase

price paid for an acquisition be allocated to the assets and liabilities acquired based on their estimated fair

values as of the effective date of the acquisition, with the excess of the purchase price over the net assets being

recorded as goodwill. Harris Teeter assets and liabilities were valued as of January 28, 2014 and Vitacost.com

assets and liabilities were valued as of August 18, 2014. Harris Teeter was excluded in the above table for

February 1, 2014 due to all acquired assets and assumed liabilities in the Harris Teeter merger being recorded

at fair value as of January 28, 2014. See Note 2 for further discussion related to the mergers with Harris Teeter

and Vitacost.com.

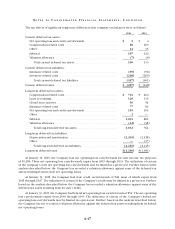

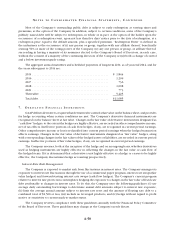

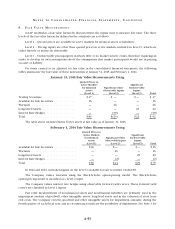

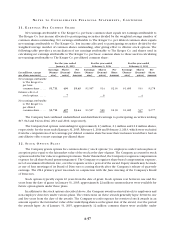

FA I R VA L U E O F O T H E R F I N A N C I A L I N S T R U M E N T S

Current and Long-term Debt

The fair value of the Company’s long-term debt, including current maturities, was estimated based on the

quoted market prices for the same or similar issues adjusted for illiquidity based on available market evidence.

If quoted market prices were not available, the fair value was based upon the net present value of the future

cash flow using the forward interest rate yield curve in effect at respective year-ends. At January 31, 2015, the

fair value of total debt was $12,378 compared to a carrying value of $11,085. At February 1, 2014, the fair value

of total debt was $11,547 compared to a carrying value of $10,780.

Cash and Temporary Cash Investments, Store Deposits In-Transit, Receivables, Prepaid and Other

Current Assets, Trade Accounts Payable, Accrued Salaries and Wages and Other Current Liabilities

The carrying amounts of these items approximated fair value.

Other Assets

The fair values of these investments were estimated based on quoted market prices for those or similar

investments, or estimated cash flows, if appropriate. At January 31, 2015 and February 1, 2014, the carrying

and fair value of long-term investments for which fair value is determinable was $133 and $51, respectively.

The increase in fair value of long-term investments for which fair value is determinable is mainly due to the

Company’s merger with Harris Teeter. At January 31, 2015 and February 1, 2014, the carrying value of notes

receivable for which fair value is determinable was $98 and $87, respectively.