Kroger 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-7

MA N A G E M E N T ’S D I S C U S S I O N A N D A N A L Y S I S O F

FI N A N C I A L C O N D I T I O N A N D R E S U L T S O F O P E R A T I O N S

OU R B U S I N E S S

The Kroger Co. was founded in 1883 and incorporated in 1902. Kroger is one of the nation’s largest

retailers, as measured by revenue, operating 2,625 supermarket and multi-department stores under two dozen

banners including Kroger, City Market, Dillons, Food 4 Less, Fred Meyer, Fry’s, Harris Teeter, Jay C, King

Soopers, QFC, Ralphs and Smith’s. Of these stores, 1,330 have fuel centers. We also operate 782 convenience

stores, either directly or through franchisees, 326 fine jewelry stores and an online retailer.

We operate 37 manufacturing plants, primarily bakeries and dairies, which supply approximately 40% of

the corporate brand units sold in our supermarkets.

Our revenues are earned and cash is generated as consumer products are sold to customers in our

stores. We earn income predominately by selling products at price levels that produce revenues in excess of

the costs we incur to make these products available to our customers. Such costs include procurement and

distribution costs, facility occupancy and operational costs, and overhead expenses. Our retail operations,

which represent over 99% of our consolidated sales and EBITDA, is our only reportable segment.

On January 28, 2014, we closed our merger with Harris Teeter by purchasing 100% of the Harris Teeter

outstanding common stock for approximately $2.4 billion. The merger allows us to expand into the fast-

growing southeastern and mid-Atlantic markets and into Washington, D.C. Harris Teeter is included in our

ending Consolidated Balance Sheets for 2013 and 2014 and in our Consolidated Statements of Operations

for 2014. Due to the timing of the merger closing late in fiscal year 2013, its results of operations were not

material to our consolidated results of operations for 2013. Year-over-year comparisons will be affected as a

result. See Note 2 to the Consolidated Financial Statements for more information related to our merger with

Harris Teeter.

On August 18, 2014, we closed our merger with Vitacost.com by purchasing 100% of the Vitacost.com

outstanding common stock for $8.00 per share or $287 million. Vitacost.com is a leading online retailer in

health and wellness products, which are sold directly to consumers through the website vitacost.com. The

merger affords us access to Vitacost.com’s extensive e-commerce platform, which can be combined with our

customer insights and loyal customer base, to create new levels of personalization and convenience for our

customers. Vitacost.com is included in our ending Consolidated Balance Sheets and Consolidated Statements

of Operations for 2014. See Note 2 to the Consolidated Financial Statements for more information related to

our merger with Vitacost.com.

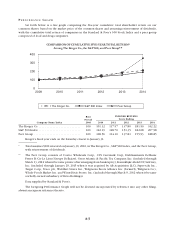

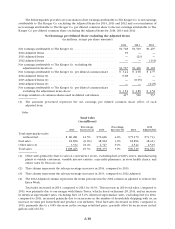

OU R 2 0 1 4 P E R F O R M A N C E

We achieved outstanding results in 2014. Our business strategy continues to resonate with a full range

of customers and our results reflect the balance we seek to achieve across our business including positive

identical sales growth, increases in loyal household count, and good cost control, as well as growth in net

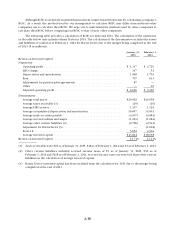

earnings and net earnings per diluted share. Our 2014 net earnings were $1.7 billion or $3.44 per diluted

share, compared to $1.5 billion, or $2.90 per diluted share for the same period of 2013.

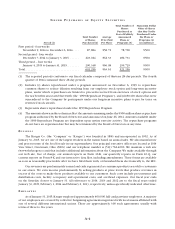

Our net earnings for 2014 include a net $39 million after-tax charge for an $87 million ($56 million

after-tax) charge to operating, general and administrative (“OG&A”) expenses due to the commitments

and withdrawal liabilities arising from restructuring of certain pension plan agreements to help stabilize

associates’ future pension benefits, offset partially by the benefits from certain tax items ($17 million) (“2014

Adjusted Items”). In addition, our net earnings for 2014 included unusually high fuel margins, partially offset

by a last-in, first-out (“LIFO”) charge that was significantly higher than 2013 and $140 million in contributions

charged to OG&A expenses for the United Food and Commercial Workers International Union (“UFCW”)

Consolidated Pension Plan ($55 million) and our charitable foundation ($85 million) (“2014 Contributions”).

Fuel margin per gallon was $0.19 per gallon in 2014, compared to $0.14 per gallon in 2013. The $55 million

contribution to the UFCW Consolidated Pension Plan was to further fund the plan. The $85 million contribution