Kroger 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-66

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

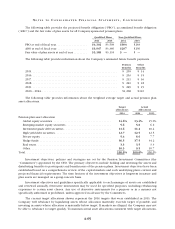

assets are reallocated or rebalanced periodically. In addition, cash flow from employer contributions and

participant benefit payments can be used to fund underweight asset classes and divest overweight asset

classes, as appropriate. The Company expects that cash flow will be sufficient to meet most rebalancing needs.

The Company is not required and does not expect to make any contributions to the Qualified Plans

in 2015. If the Company does make any contributions in 2015, the Company expects these contributions

will decrease its required contributions in future years. Among other things, investment performance of

plan assets, the interest rates required to be used to calculate the pension obligations, and future changes

in legislation, will determine the amounts of any contributions. The Company expects 2015 expense for

Company-sponsored pension plans to be approximately $90. In addition, the Company expects 401(k)

retirement savings account plans cash contributions and expense from automatic and matching contributions

to participants to be approximately $180 in 2015.

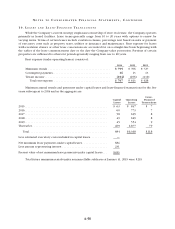

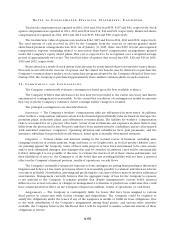

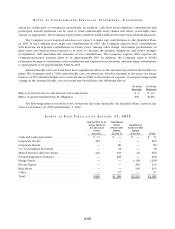

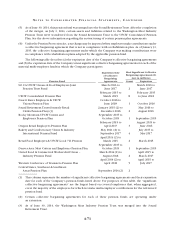

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care

plans. The Company used a 7.00% initial health care cost trend rate, which is assumed to decrease on a linear

basis to a 4.50% ultimate health care cost trend rate in 2028, to determine its expense. A one-percentage-point

change in the assumed health care cost trend rates would have the following effects:

1% Point

Increase

1% Point

Decrease

Effect on total of service and interest cost components ......................... $ 3 $ (3)

Effect on postretirement benefit obligation ................................... $30 $(26)

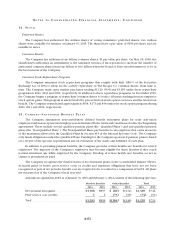

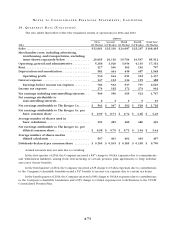

The following tables set forth by level, within the fair value hierarchy, the Qualified Plans’ assets at fair

value as of January 31, 2015 and February 1, 2014:

AS S E T S A T F A I R VA L U E A S O F J A N U A R Y 3 1 , 2 0 15

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . $ 73 $ — $ — $ 73

Corporate Stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . 294 — — 294

Corporate Bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . — 80 — 80

U.S. Government Securities . . . . . . . . . . . . . . . . . . — 78 — 78

Mutual Funds/Collective Trusts . . . . . . . . . . . . . . . 123 503 40 666

Partnerships/Joint Ventures . . . . . . . . . . . . . . . . . . — 468 — 468

Hedge Funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,158 1,158

Private Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 210 210

Real Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 105 105

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 57 — 57

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $490 $1,186 $1,513 $3,189