Kroger 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-65

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

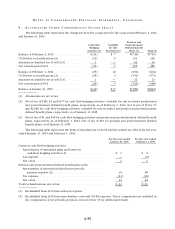

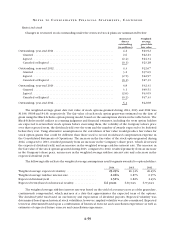

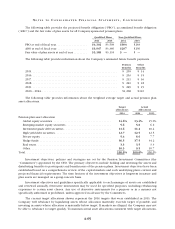

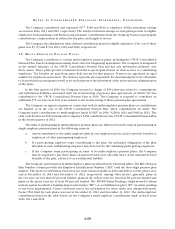

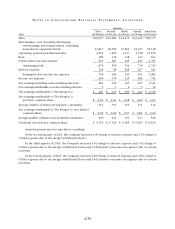

The following table provides the projected benefit obligation (“PBO”), accumulated benefit obligation

(“ABO”) and the fair value of plan assets for all Company-sponsored pension plans.

Qualified Plans Non-Qualified Plans

2014 2013 2014 2013

PBO at end of fiscal year . . . . . . . . . . . . . . . . . . . . $4,102 $3,509 $304 $263

ABO at end of fiscal year . . . . . . . . . . . . . . . . . . . . $3,947 $3,360 $297 $256

Fair value of plan assets at end of year . . . . . . . . . $3,189 $3,135 $ — $ —

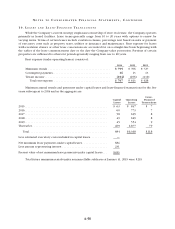

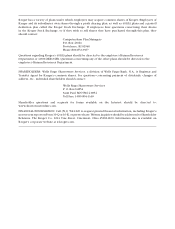

The following table provides information about the Company’s estimated future benefit payments.

Pension

Benefits

Other

Benefits

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 205 $ 14

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 203 $ 15

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 211 $ 16

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 221 $ 18

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 229 $ 19

2020 – 2024 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,268 $110

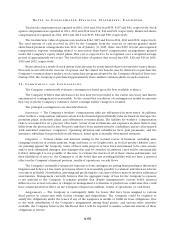

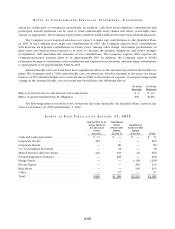

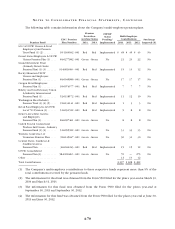

The following table provides information about the weighted average target and actual pension plan

asset allocations.

Target

allocations

Actual

Allocations

2014 2014 2013

Pension plan asset allocation

Global equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.6% 13.4% 15.0%

Emerging market equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.6 5.8 6.2

Investment grade debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.6 11.2 10.4

High yield debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.7 12.5 12.5

Private equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.4 6.6 7.7

Hedge funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36.5 37.5 34.2

Real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.3 3.5 3.3

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.3 9.5 10.7

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.0% 100.0% 100.0%

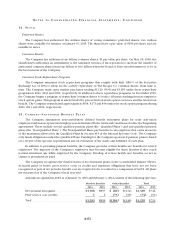

Investment objectives, policies and strategies are set by the Pension Investment Committees (the

“Committees”) appointed by the CEO. The primary objectives include holding and investing the assets and

distributing benefits to participants and beneficiaries of the pension plans. Investment objectives have been

established based on a comprehensive review of the capital markets and each underlying plan’s current and

projected financial requirements. The time horizon of the investment objectives is long-term in nature and

plan assets are managed on a going-concern basis.

Investment objectives and guidelines specifically applicable to each manager of assets are established

and reviewed annually. Derivative instruments may be used for specified purposes, including rebalancing

exposures to certain asset classes. Any use of derivative instruments for a purpose or in a manner not

specifically authorized is prohibited, unless approved in advance by the Committees.

The current target allocations shown represent the 2014 targets that were established in 2013. The

Company will rebalance by liquidating assets whose allocation materially exceeds target, if possible, and

investing in assets whose allocation is materially below target. If markets are illiquid, the Company may not

be able to rebalance to target quickly. To maintain actual asset allocations consistent with target allocations,